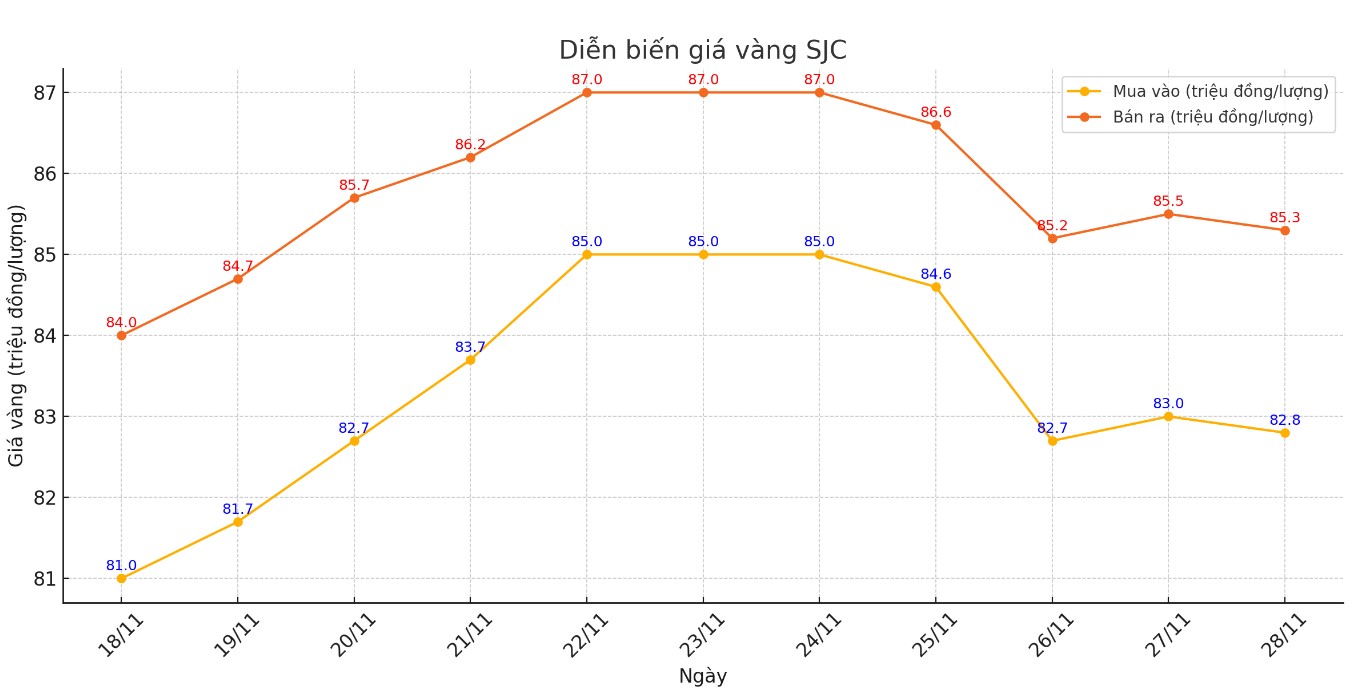

Update SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 82.8-85.3 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, DOJI adjusted the price of SJC gold bars down by VND 200,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82.8-85.3 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the price of SJC gold bars was adjusted down by 200,000 VND/tael for both buying and selling by Saigon Jewelry Company.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83-85.5 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

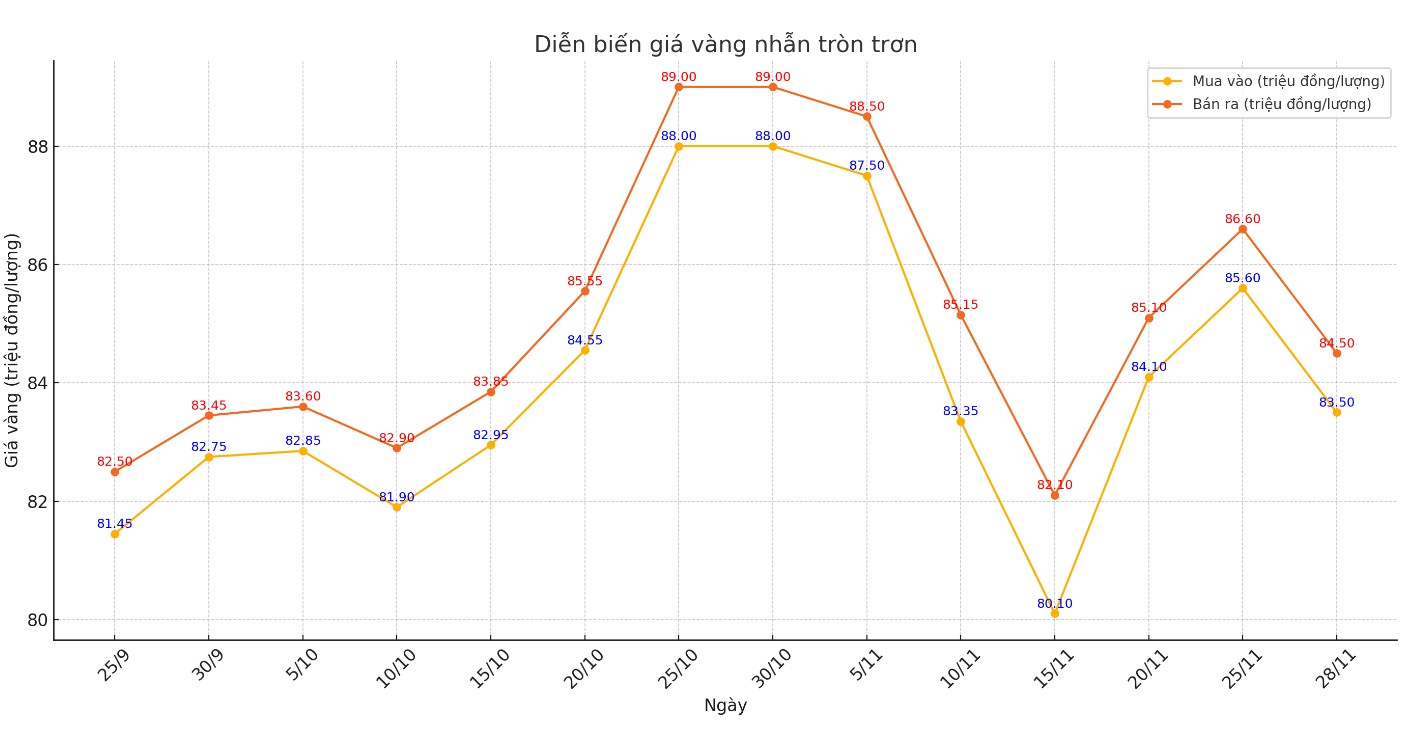

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.5-84.5 million VND/tael (buy - sell); an increase of 100,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 82.58-84.58 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and 100,000 VND/tael for selling compared to early this morning.

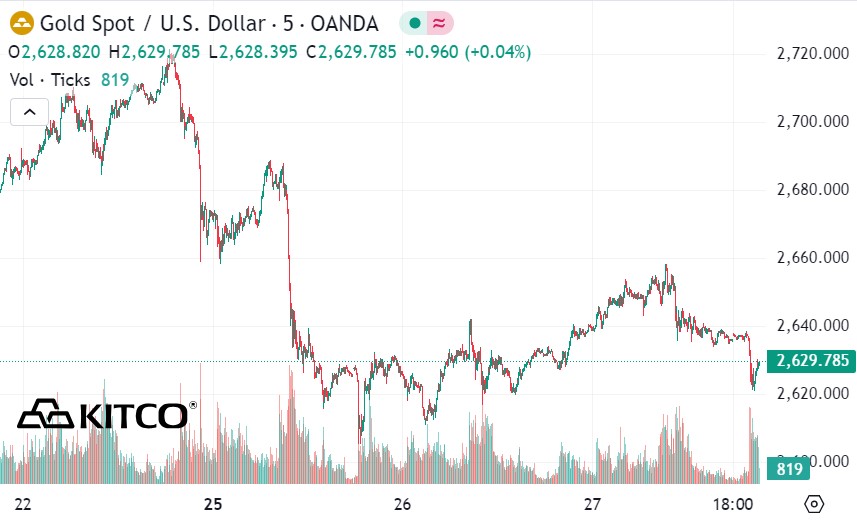

World gold price

As of 9:13 a.m., the world gold price listed on Kitco was at 2,629.7 USD/ounce, down 8.6 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell amid the rise of the US dollar. Recorded at 9:15 a.m. on November 28, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.120 points (up 0.09%).

Gold prices are being strongly affected by geopolitical developments and new moves from the US Federal Reserve (FED). The minutes of the FED's November meeting were just released, providing important information about the US economic outlook.

Fed officials expressed growing confidence in the direction of the economy, particularly inflation and the labor market. The minutes showed policymakers believed inflation was moving closer to the Fed's 2 percent target and assessed the current labor market as strong.

These observations have important implications for monetary policy. The minutes of the US Federal Reserve (FED) released on the night of November 26 (Vietnam time) increased market expectations for a December interest rate cut after the minutes were released.

The Federal Open Market Committee (FOMC) unanimously voted to cut its benchmark interest rate by another 0.25 percentage point, bringing the target range down to 4.5%-4.75%.

Market analyst Han Tan of Exinity Group said that the greenback's correction is helping gold extend its slight recovery after the precious metal's sharp decline earlier this week.

The market is also returning to expectations that the US Federal Reserve will cut interest rates in December, which will boost bullion prices, the expert said.

Gold prices could hit $3,000 an ounce in the first two quarters of 2025 unless a spike in inflation forces the Fed to raise interest rates, which could hurt the bull market, predicts Phillip Streible, chief market strategist at Blue Line Futures.

Neils Christensen - analyst at Kitco News - commented that the precious metal is reacting to geopolitical uncertainties related to the upcoming administration of President-elect Donald Trump.

In a recent interview with Kitco News, WisdomTree's head of commodity and macroeconomic research, Nitesh Shah, also predicted that gold prices will rise in 2025 and reach $2,850 an ounce by the fourth quarter of next year.

See more news related to gold prices HERE...