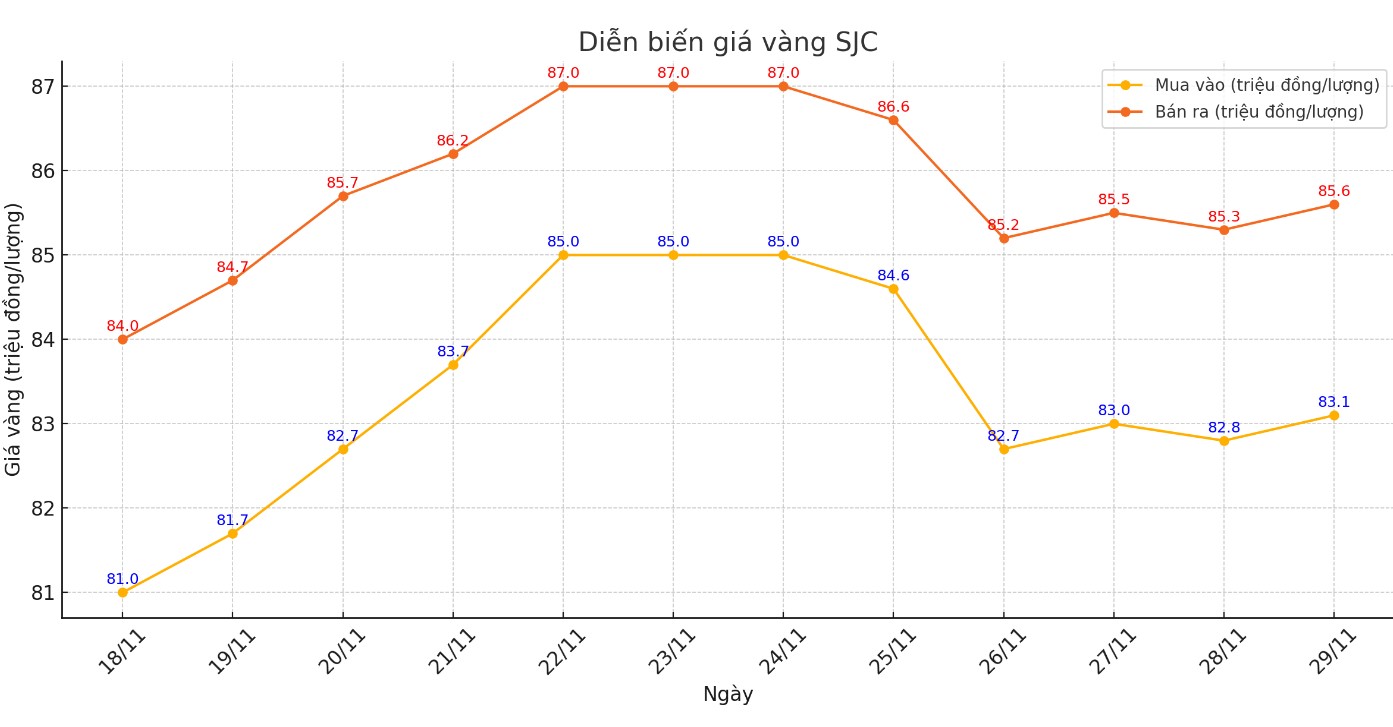

Update SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 82.9-85.4 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83.1-85.6 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.1-85.6 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

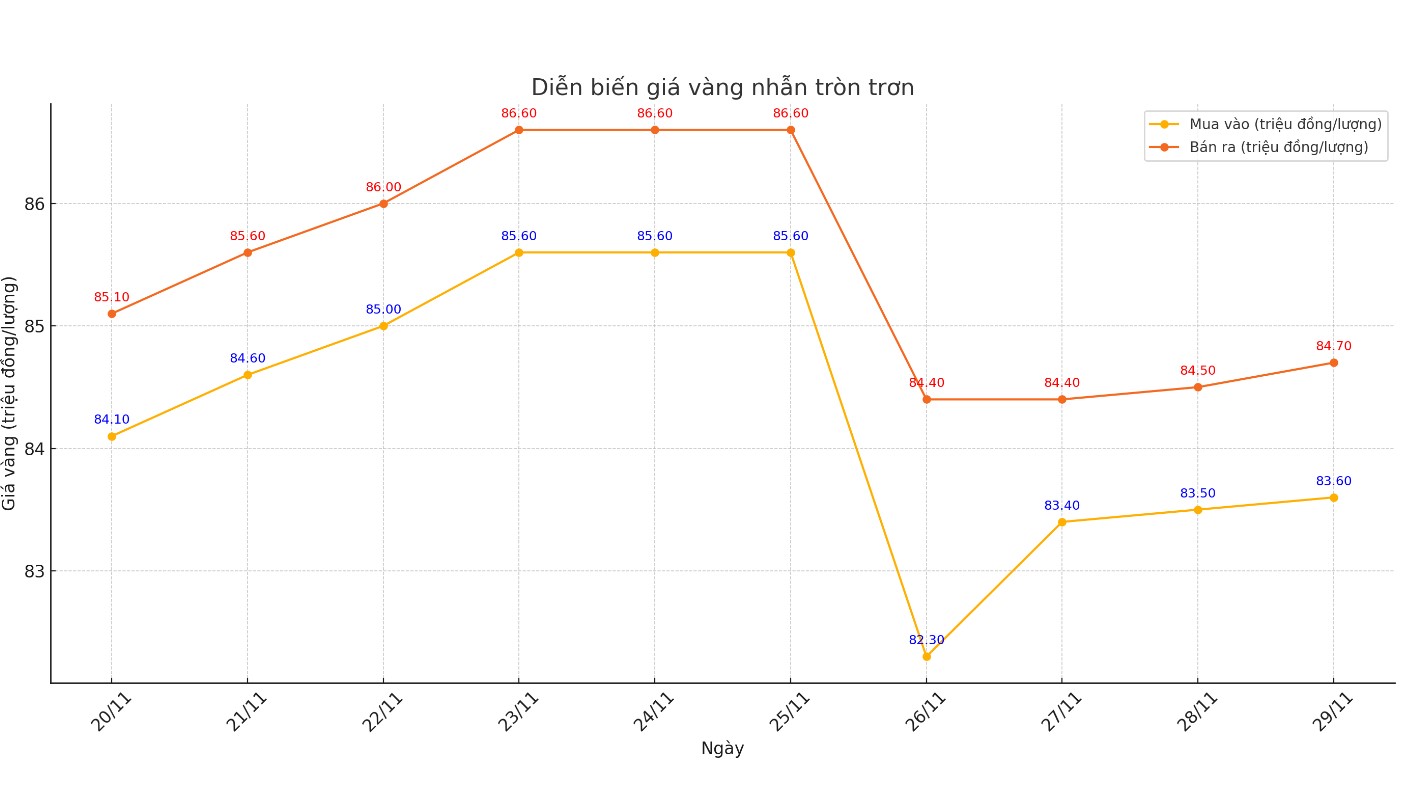

9999 round gold ring price

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.6-84.7 million VND/tael (buy - sell); an increase of 100,000 VND/tael for buying and an increase of 200,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.58-84.68 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and 200,000 VND/tael for selling compared to early this morning.

World gold price

As of 9:45 a.m., the world gold price listed on Kitco was at 2,657.2 USD/ounce, up 27.5 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices recovered amid a decline in the US dollar. At 9:45 a.m. on November 29, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 105.840 points (down 0.27%).

Han Tan, a market analyst at Exinity Group, said the weakening greenback and expectations that the US central bank will cut interest rates in December are helping gold extend its slight recovery after a sharp decline earlier in the week.

Investors are now focused on the US Federal Reserve's (FED) interest rate cut after the core personal consumption expenditure (PCE) report showed inflation is slowing, leading to expectations that the FED's monetary policy could continue to be loosened next year.

However, the possibility of increased tariffs under the upcoming Donald Trump administration could limit the US Central Bank's ability to cut interest rates. According to the CME FedWatch tool, the market is currently forecasting a 64.7% probability that the Fed will cut interest rates by 0.25% in December.

Some analysts believe that geopolitical risks are still increasing due to the ongoing war in Russia - Ukraine as well as the Middle East, causing investors to still choose gold as a shelter for their capital. This helps gold to be supported to maintain at a high level.

According to Grace Peters - Head of Global Investment Strategy at JPMorgan, although inflation tends to increase again and new policies are being implemented, the US economic growth outlook in 2025 is still very positive. Grace Peters believes that investing in gold and infrastructure stocks will help reduce risks.

“Spread your exposure globally, diversify your portfolio, hold your investments steady, but add protective elements like infrastructure stocks and gold,” she concluded.

Phillip Streible, chief market strategist at Blue Line Futures, predicts that gold prices could reach $3,000 an ounce in the first two quarters of 2025, unless inflation spikes and forces the Fed to raise interest rates.

See more news related to gold prices HERE...