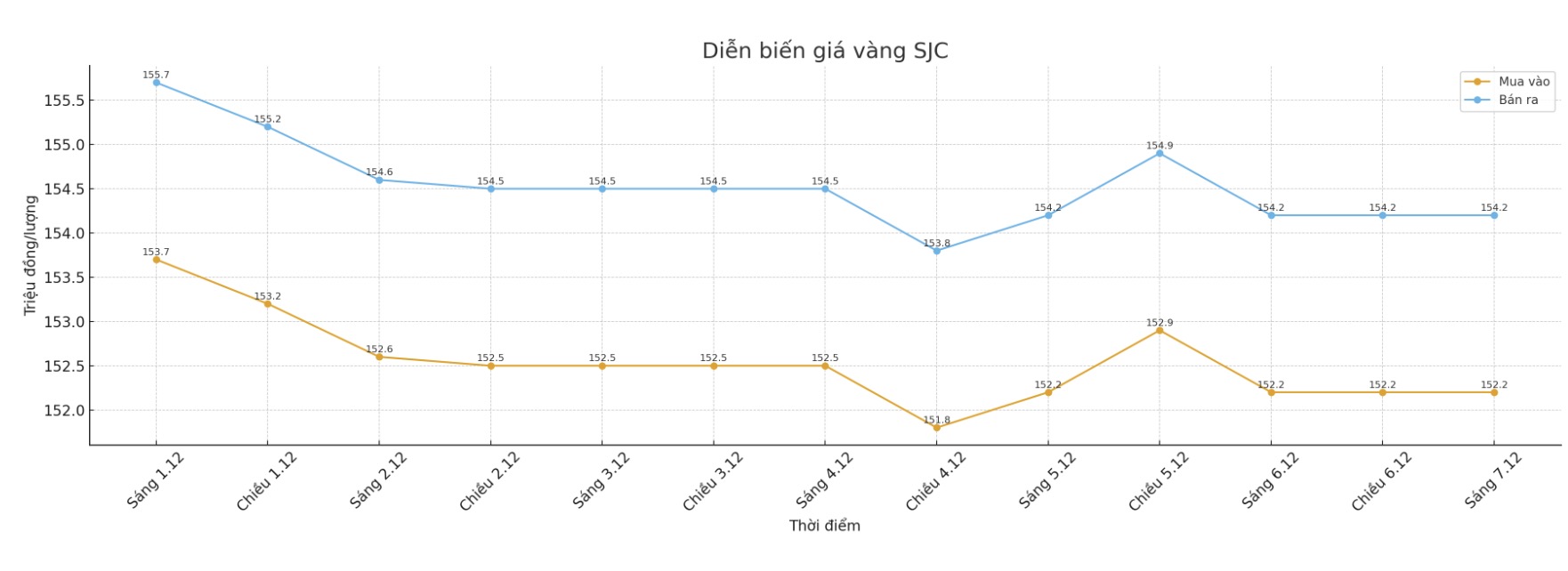

SJC gold bar price

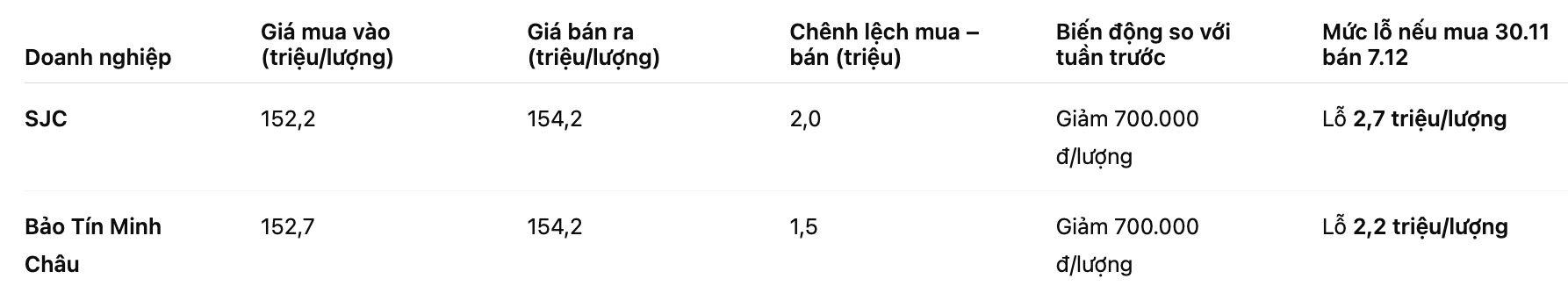

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 152.2-154.2 million VND/tael (buy in - sell out). The difference between buying and selling is at 2 million VND/tael.

Compared to the closing price of the previous trading session (November 30, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by 700,000 VND/tael in both directions. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 152.7-154.2 million VND/tael (buy in - sell out). The difference between buying and selling is 1.5 million VND/tael.

Compared to a week ago, the price of SJC gold bars was reduced by 700,000 VND/tael by Bao Tin Minh Chau in both directions.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau on November 30 and selling it today (December 7), buyers will lose VND2.7 million and VND2.2 million/tael, respectively.

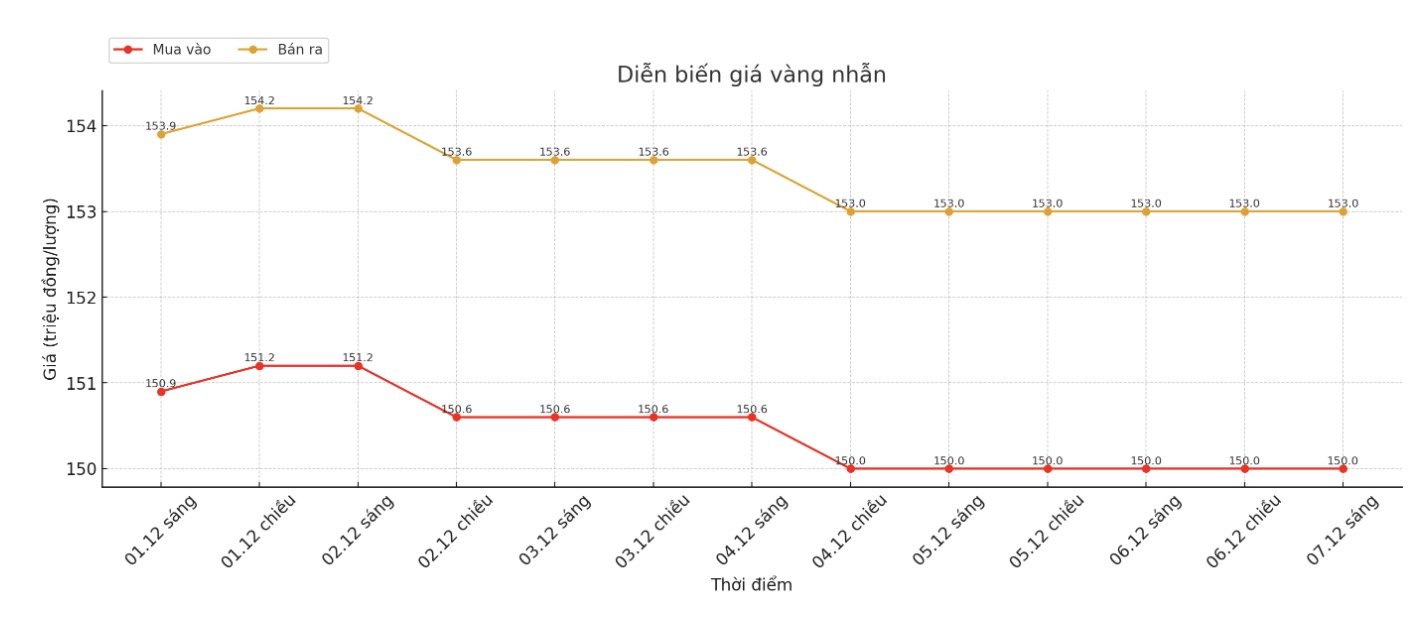

9999 gold ring price

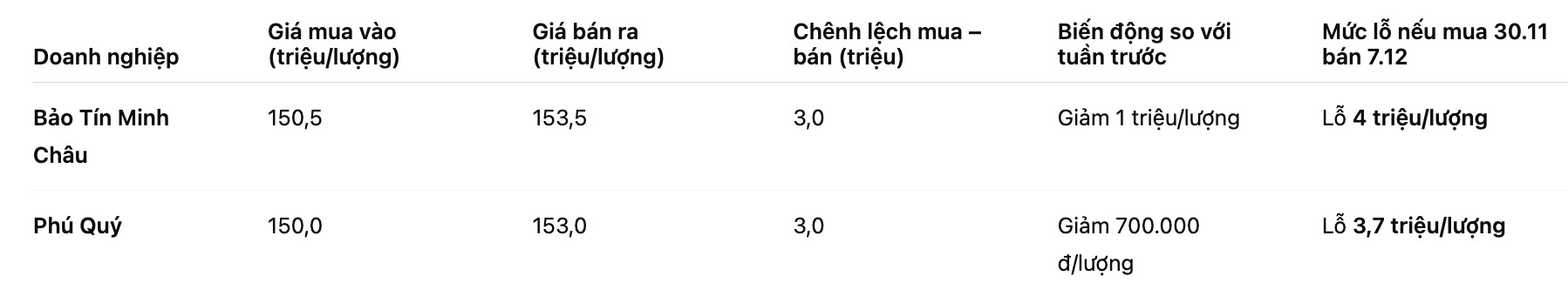

Bao Tin Minh Chau listed the price of gold rings at 150.5-153.5 million VND/tael (buy - sell); down 1 million VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 700,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of November 30 and selling in today's session (December 7), buyers at Bao Tin Minh Chau will lose 4 million VND/tael. Meanwhile, the loss when buying in Phu Quy was 3.7 million VND/tael.

World gold price

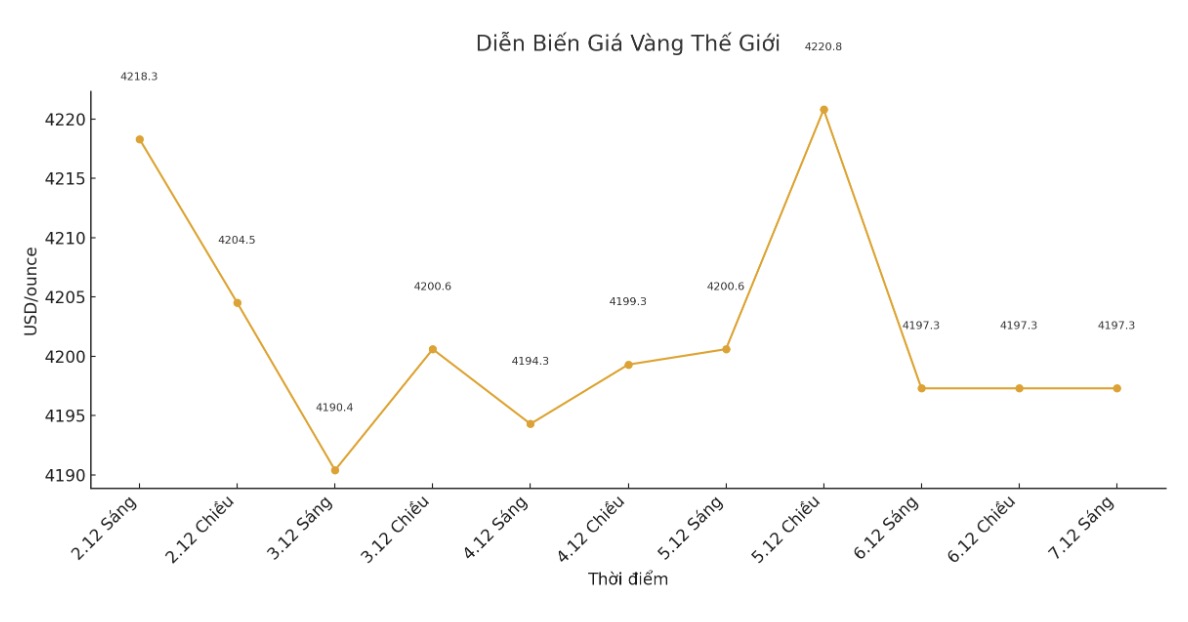

At the end of the trading session of the week, the world gold price was listed at 4,197.3 USD/ounce, down 21.1 USD compared to a week ago.

Gold price forecast

The latest weekly gold survey from an international financial information platform shows that the sentiment on Wall Street is divided between optimism and neutrality.

This week, there were 13 analysts participating in the survey. 6 experts (46%) expect gold prices to rise next week. Meanwhile, 6 others predict that this precious metal will fluctuate sideways. The remaining experts (accounting for 8% of the total) predict that gold prices will decrease.

Mr. Aaron Hill - Head of Market Analysis at FP Markets - commented: "The outlook for gold in the coming time will depend on whether the Fed continues to loosen, as well as macroeconomic factors such as weak growth or escalating geopolitical risks.

agreed, Mr. Lukman Otunuga - senior market analyst at FXTM - said that gold prices will fluctuate strongly due to uncertainties surrounding the Fed's monetary policy orientation.

Its worth noting that the market is expecting the US to cut interest rates for the third time this year, but the outlook for 2026 is much more unpredictable. The lack of the latest data on the non-farm payrolls (NFP) in October and CPI has forced officials to make decisions in the context of incomplete information, in the context of the FOMC being more divided than in recent years.

Economic data to watch next week

The economic news calendar next week will revolve around central banks, as Australia, Canada, the US and Switzerland simultaneously make interest rate decisions. However, the market only expects the US to adjust key interest rates.

On Monday, the Reserve Bank of Australia (RBA) will announce its monetary policy decision. On Tuesday morning, the market will receive the US job search report (JOLTS) in November.

Investors will watch the central bank of Canada's monetary policy decision on Wednesday morning, before all eyes turn to Washington, where the US Federal Reserve (Fed) is expected to cut interest rates by 25 basis points. More notably, the Fed will also release an updated dot plot chart and new economic forecasts.

Key economic events of the week will concluded on Thursday, with the Swiss Central Bank's monetary policy decision and the US weekly jobless claims report.

See more news related to gold prices HERE...