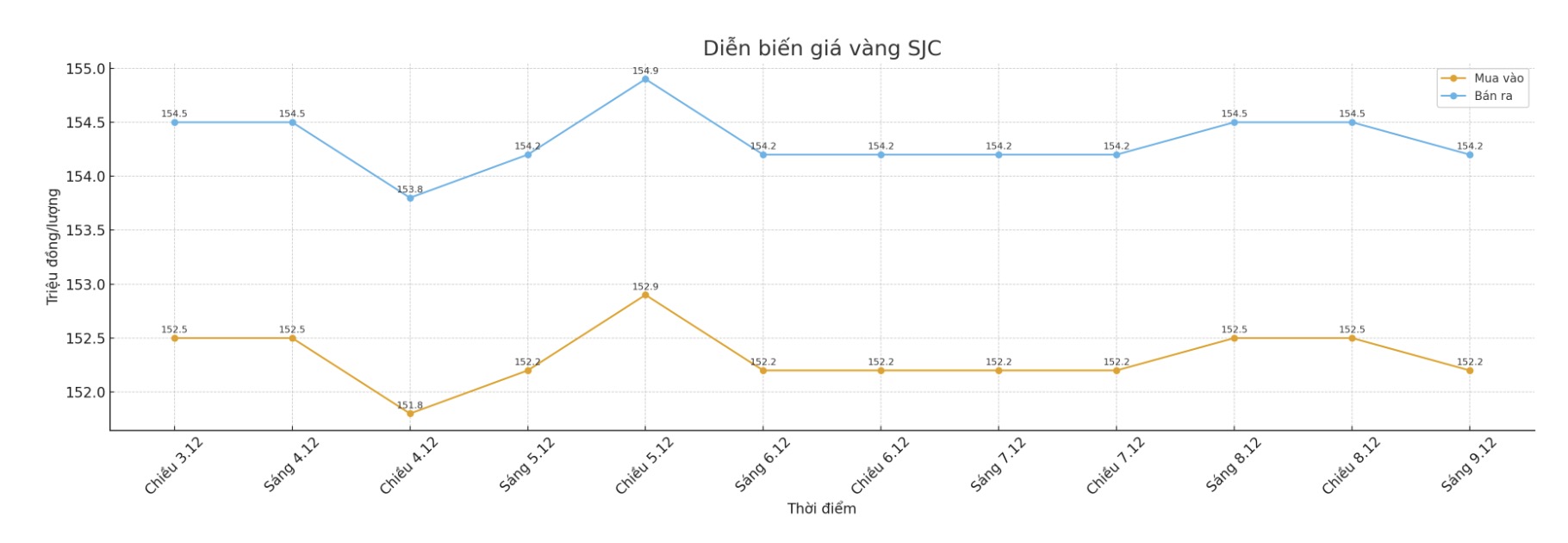

Updated SJC gold price

As of 9:30 a.m., DOJI Group listed the price of SJC gold bars at VND152.2-154.2 million/tael (buy in - sell out), down VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.2-154.2 million VND/tael (buy - sell), down 800,000 VND/tael for buying and down 300,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.5-154.2 million VND/tael (buy - sell), unchanged in both buying and down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

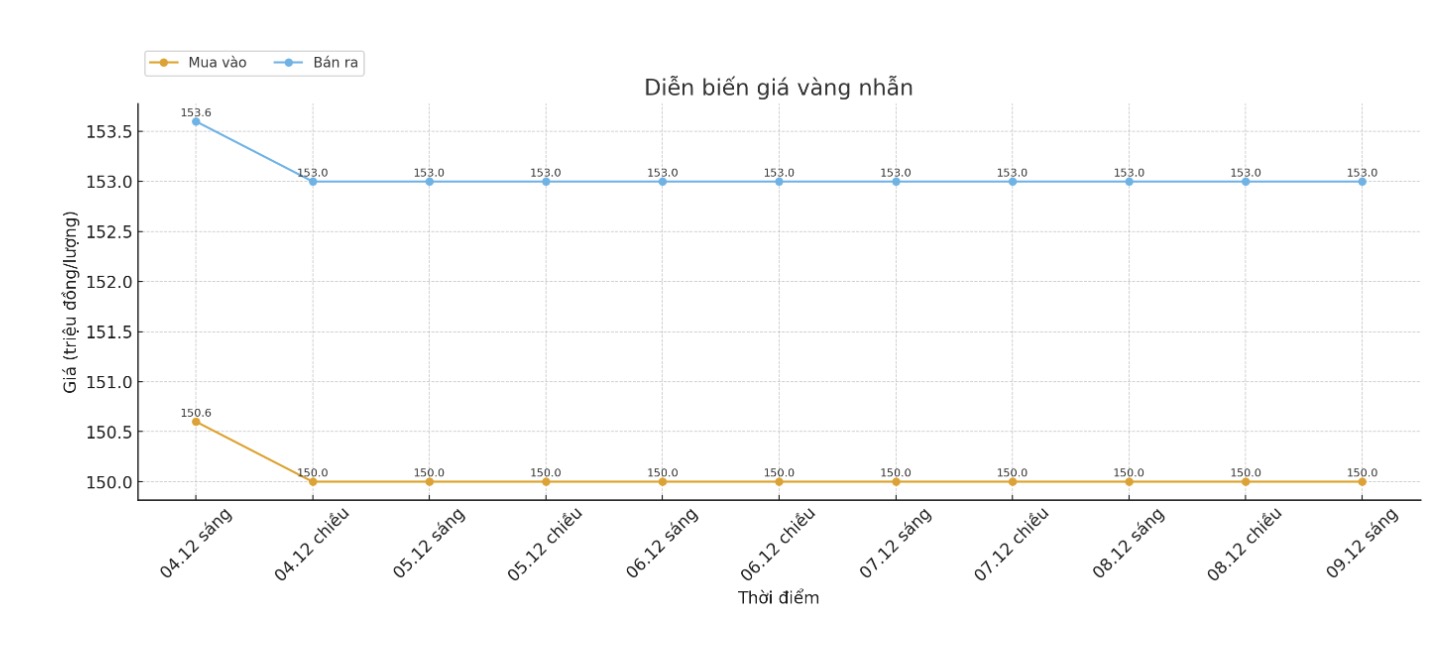

9999 round gold ring price

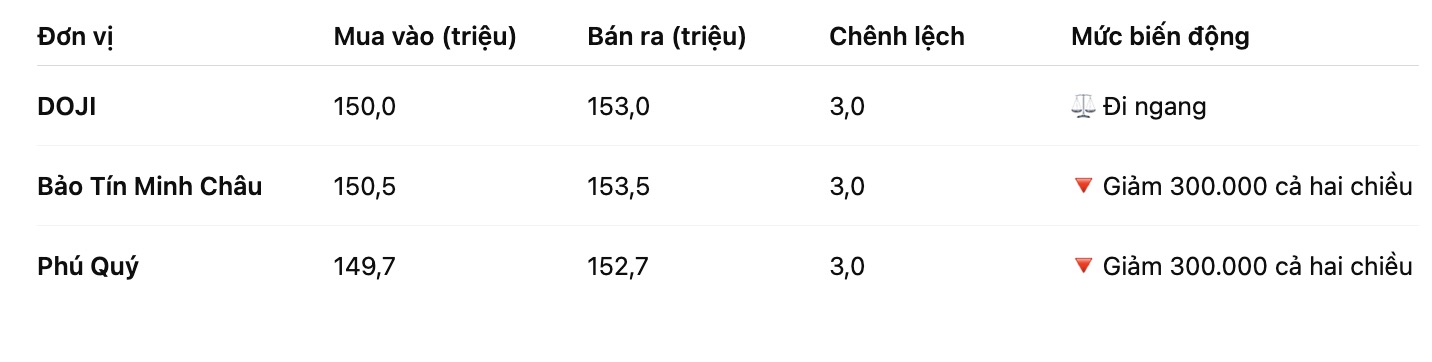

As of 9:30 a.m., DOJI Group listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.5-153.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.7-152.7 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

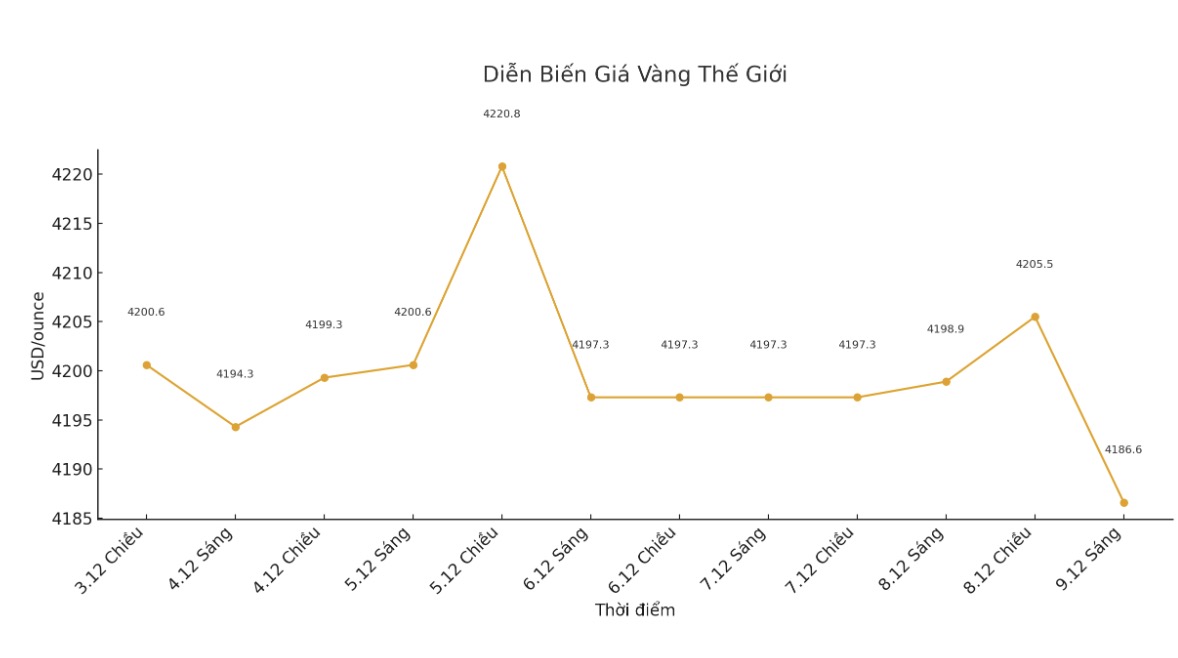

World gold price

At 9:35 a.m., the world gold price was listed around 4,186.8 USD/ounce, down 12.1 USD compared to a day ago.

Gold price forecast

The cooling of geopolitical tensions is reducing the push for gold prices, an asset that is considered a safe haven.

US Trade Representative Jamieson Greer told Fox TV that China is implementing the terms of the bilateral trade deal. He stressed that Washington always monitors and verifies Beijings commitments and that everything is being done correctly so far.

Marc Chandler - CEO at Bannockburn Global Forex, commented that the current accumulation period of gold is constructive. If spot gold prices surpass $4,265 an ounce, the market could look to re-evaluate the historical peak around $4,380.

The market is waiting for clearer information about the US Federal Reserve's (Fed) policy meeting this week. Many predictions suggest that the US may cut interest rates again this year.

If interest rates fall, gold prices will benefit. The USD Index (DXY) is also struggling around the 99-point mark - the lowest mark in more than a month.

In the 2026 precious metals outlook report by Heraeus (a German technology and precious metals corporation), analysts pointed out that gold prices still have room to increase next year, but there may be a period of adjustment and accumulation.

Heraeus described the recent gold rally as too exciting and said that while supporting factors are still present in 2026, after a strong rally, the market is unlikely to avoid a consolidation phase.

Heraeus predicts gold prices will fluctuate between 3,750 - 5,000 USD/ounce in 2026.

The US has so far avoided the recession that the yield curve had predicted, but the labor market is weakening.

The Fed often prioritizes supporting economic growth, so if the labor market continues to be weak, more interest rate cuts may take place, even if inflation remains above the target. This reduces real interest rates - a factor that is often beneficial for gold" - experts warned.

Notable economic data for the week

Tuesday: US job openings (JOLTS).

Wednesday: BoC interest rate decision, Fed monetary policy decision.

Thursday: SNB interest rate decision, US weekly jobless claims.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...