Gold prices fell on Tuesday after hitting a six-week high in the previous session, due to rising US Treasury yields and profit-taking activities causing pressure, as investors awaited US economic data to assess the Federal Reserve's (Fed) policy roadmap.

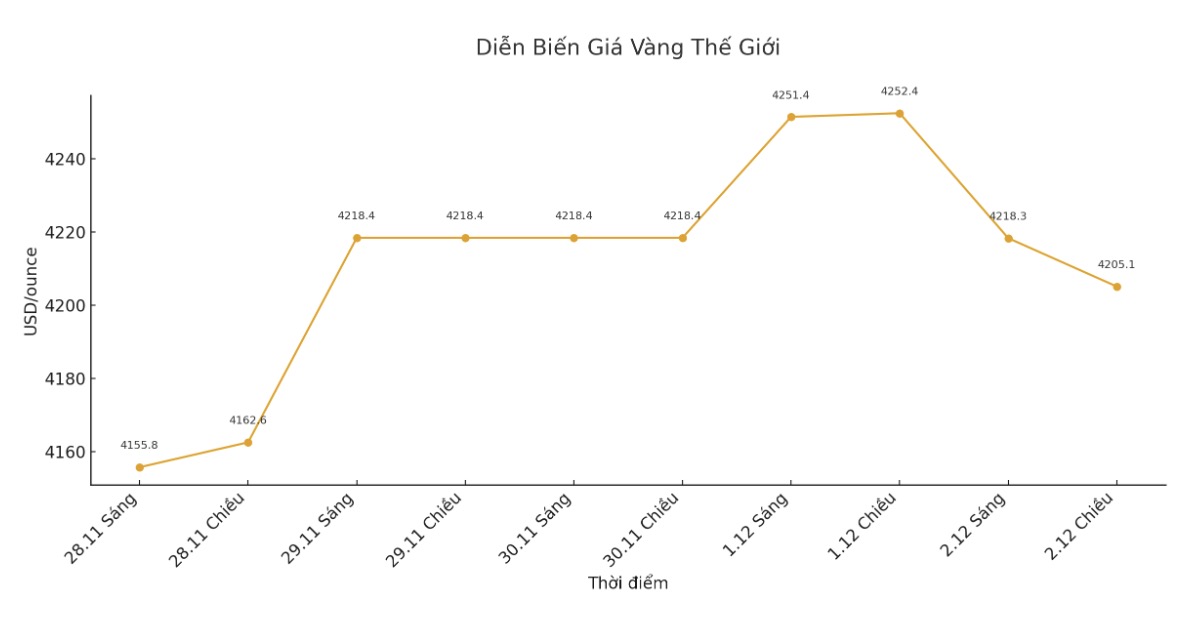

Spot gold prices fell to 4,205.1 USD/ounce at 16:32 on December 2 (Vietnam time).

The yield on the 10-year US Treasury note hovered near a two-week high set in the previous session, reducing the appeal of non-yielding gold.

Gold is having a weak performance today, but the picture is basically unchanged a picture including expectations of a Fed rate cut, which is a support for gold in terms of yield factors, said Mr. Tim Waterer - Head of Market Analysis at KCM Trade.

The market is cautious as Fed Chairman Jerome Powell is expected to not give a dovish view like some of his colleagues, and the core personal consumption price index (PCE core) - the Fed's preferred inflation measure - released on Friday is expected to remain relatively "tedent", Mr. Waterer added.

Powell, in a speech at Stanford University on Monday evening, did not comment on the economy or monetary policy.

Important US data this week include the ADP jobs report for November on Wednesday and the PCE for September (delayed) on Friday.

According to CME's FedWatch tool, traders are pricing the possibility of the Fed cutting interest rates in December at 88%.

Meanwhile, White House economic adviser Kevin Hassett said he is willing to take the Fed Chairman's position, after Finance Minister Scott Bessent hinted that he could nominate before Christmas. Hassett, like US President Donald Trump, supports a rate cut.

Low interest rates are often beneficial for gold - an unyielding asset.

SPDR Gold Trust, the world's largest gold ETF, said its holdings rose 0.44% to 1,050.01 tonnes on Monday, up from 1,045.43 tonnes on Friday.

Silver prices fell 1.3% to 57.24 USD/ounce, platinum prices fell 0.9% to 1,643.1 USD/ounce, and palladium prices fell 0.4% to 1,419.5 USD/ounce.

See more news related to gold prices HERE...