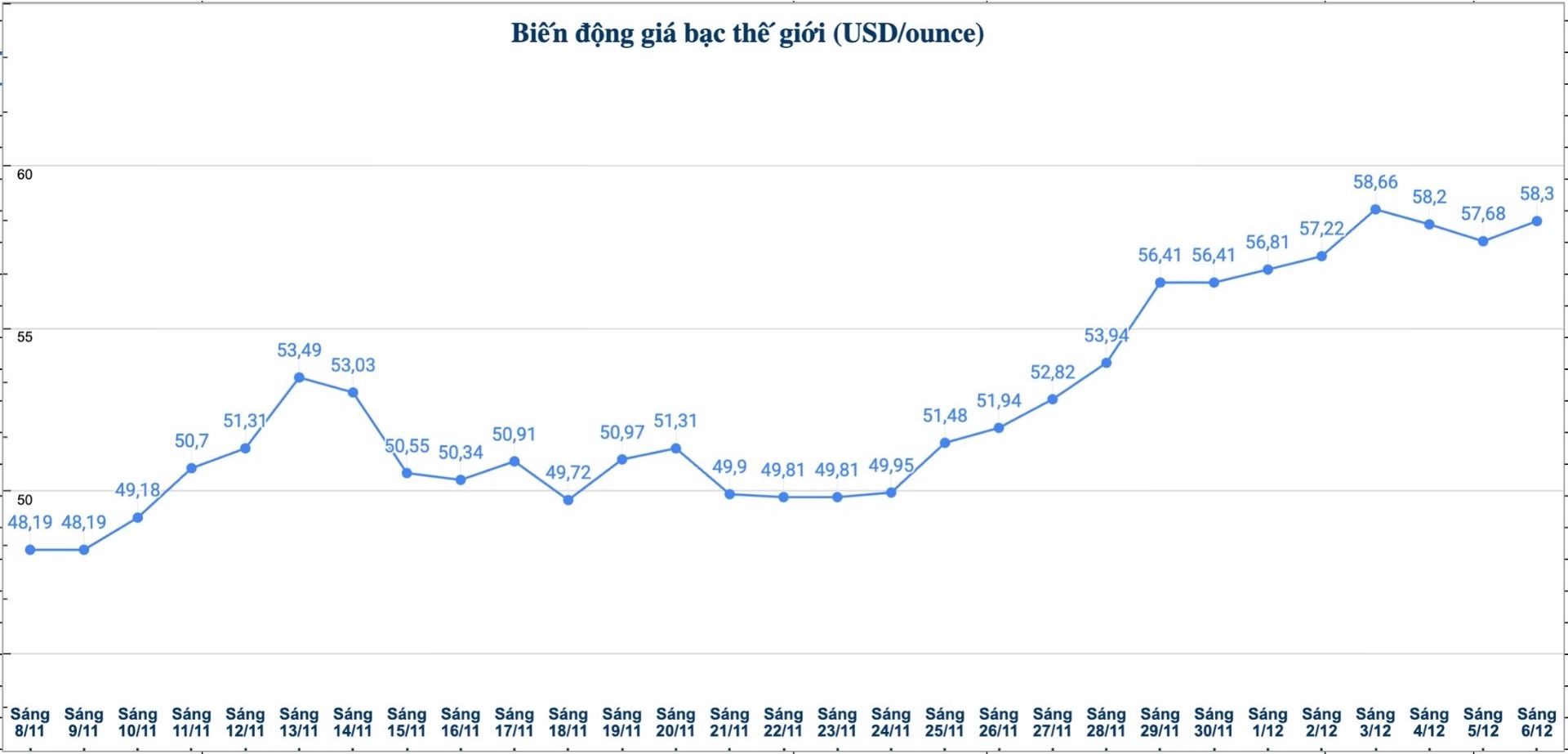

Silver prices entered the weekend at a new record high, surpassing $58/ounce. Not only did the buyer chase strongly last week, but silver's corrections were also very shallow, with the support zone remaining around last week's peak, nearly 56 USD.

In addition to the uptrend, silver has clearly outperformed gold, as the gold/ silver ratio is expected to end the week around 72 - the lowest level in 4 years. With the current technical momentum of silver, some analysts believe that this ratio could retreat to the long-term support zone around 65.

Last week, Neils Christensen - an analyst at Kitco News mentioned that the transition to green energy is strongly boosting industrial demand for silver, which is also a major factor causing a consecutive supply shortage for the past 5 years.

Research from the World Economic Forum (WEF) shows that the value of the green energy economy could reach 7,000 billion USD by 2030, up from the current annual output of 5,000 billion USD.

This week also brings a clearer view of demand from individual investors, the force is still the main driver pushing silver prices to historical peaks. According to CME's monthly trading data, the average daily trading volume of silver futures contracts reached 108,000 contracts, up 22% compared to November 2024.

Meanwhile, micro-mental contracts - only 1/5 the size of a standard 5,000-ounce contract - recorded an average trading volume of 75,000 contracts/day, up 238% over the same period last year.

We also have a better understanding of the factor supporting silver demand in India, the world's second largest silver consumer. The unprecedented buying wave in October and November has put heavy pressure on the London over-the-counter (OTC) physical trading market, causing supply chain and liquidity problems that have not been completely resolved.

One of the reasons for the sharp increase in silver demand in India is the new role of silver as a currency in the domestic economy, according to the latest report from Metals Focus.

Last month, the Reserve Bank of India (RBI) announced new regulations, allowing people, starting from April 1, 2026, to mortgage silver assets to borrow capital through banks, non-bank financial companies and housing finance institutions under a unified lending framework.

This measure could help mobilize huge amounts of silver in Indian households, expand access to formal credit and officially recognize silver as a popular mortgage asset. Although silver mortgages have long existed informally, the RBI framework marks the first time silver has been officially recognized in the asset ecosystem under guaranteed management, Metals Focus commented.

The British research firm also said that silver-based lending is expected to supplement, not replace, gold-based loans or traditional credit channels.

Although silver has recorded a significant increase this year, the market still shows a lot of room for growth. However, investors also need to be cautious, because silver is a smaller market and fluctuates more strongly than gold, making price fluctuations more intense.

In a report this week, Mike McGlone - senior market analyst at Bloomberg Intelligence, said that silver prices could have dropped to $40/ounce just as easily as they could have increased to $75/ounce.

See more news related to gold prices HERE...