Which bank has just adjusted interest rates?

After recent fluctuations, many banks have adjusted their deposit interest rates down, notably:

VietBank: Reduced by 0.1 - 0.4%/year for terms under 12 months.

BVBank: Reduced by 0.1 - 0.3%/year for both counter and online deposits.

MSB: Reduced by 0.2%/year for terms of 12 months or more.

KienlongBank: Reduced 0.7%/year for some long terms, bringing interest rates below 6%/year.

However, some banks still maintain or have attractive interest rates, especially for long terms.

Highest interest rates at banks today

According to the latest report of the State Bank of Vietnam (SBV) on interest rate developments in January 2025, the average deposit interest rate at commercial banks is as follows:

Deposit under 1 month: 0.1 - 0.2%/year.

1 term - less than 6 months: 3.1 - 4.0%/year.

6 - 12 month term: 4.4 - 5.3%/year.

Term over 12 - 24 months: 4.9 - 5.9%/year.

Over 24-month term: 6.9 - 7.2%/year ( currently highest level according to the report of the State Bank).

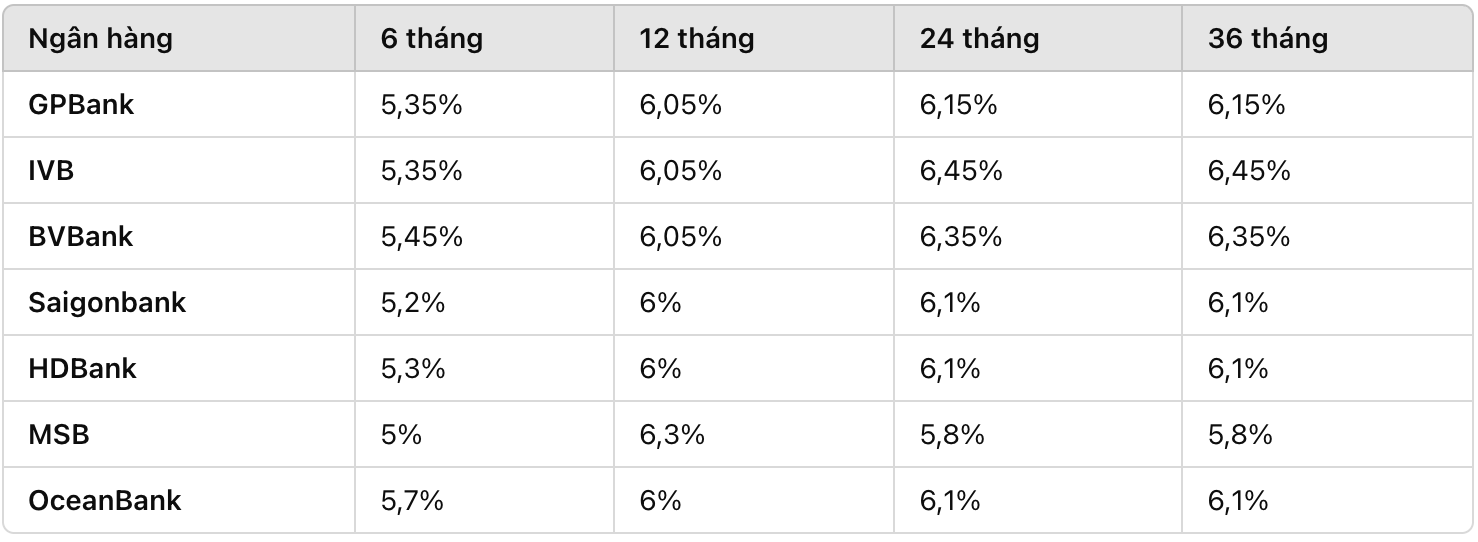

Regarding the deposit interest rates publicly listed by banks, the interest rates are as follows:

Interest rate developments: The decreasing trend?

Experts say that the move to reduce deposit interest rates at many commercial banks may lead to a trend of reducing lending interest rates, making it easier for businesses and people to access capital sources.

The State Bank continues to closely monitor interest rate developments and requires transparency in lending interest rates on the websites of each bank.

In the coming time, the interest rate level may continue to be adjusted to suit the orientation of stabilizing the financial market.