Initially, gold prices showed signs of a breakthrough, but later on, gold was "stuck" in a narrow price range, failing to create any major breakthroughs. Once considered a "shield" against inflation and economic risks, this precious metal is now facing strong enough forces to not be able to create clear price increase momentum.

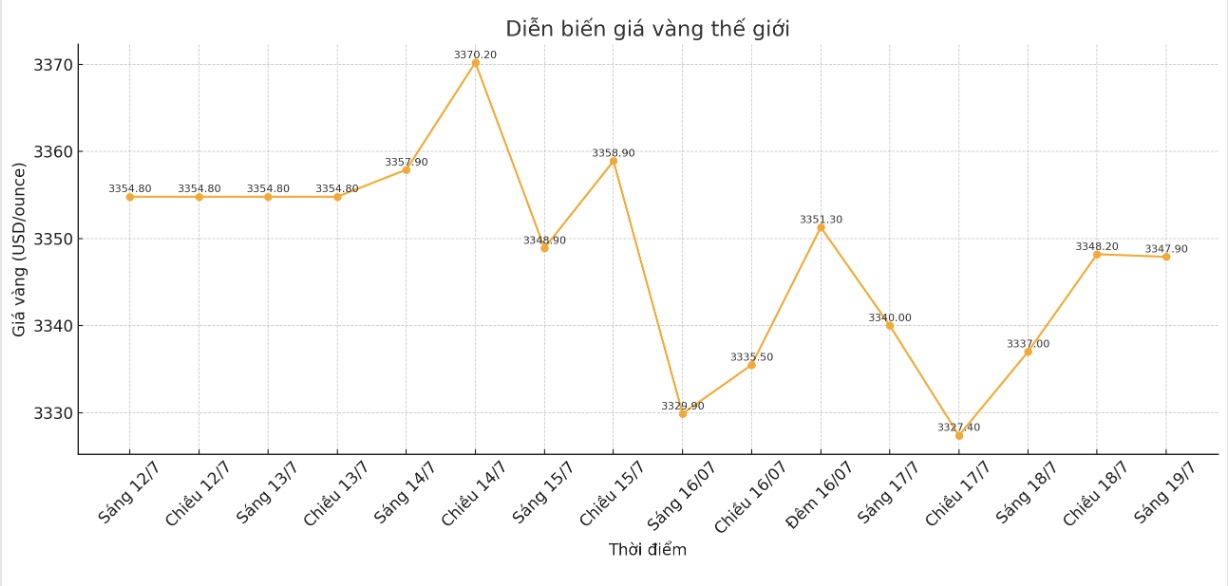

Gold prices are currently stable around $3,240 to $3,446 an ounce reflecting market skepticism. After reaching a peak at the beginning of the year, prices could not maintain the trend but continuously fluctuated within a narrow range.

This makes investors wonder: What will free gold prices from the current tug-of-war? Let's look back at factors that have affected gold and scenarios that can shape the next trend.

USD strength: Key factor holding back gold prices

The most obvious factor affecting gold prices in the short term is the strength of the USD. Gold and the USD have an inverted relationship when the USD strengthens, gold often weakens, and vice versa. Currently, the USD is still stable thanks to the interest rate policy of the US Federal Reserve (FED) and the stable US economy.

To see gold prices increase sharply, there needs to be a weakening of the USD - which only happens if the FED cuts interest rates. However, this possibility in the short term is very low. The Fed has said it will act on data, and with the US economy still strong, especially in the labor and consumer markets, there is no clear reason for the Fed to ease policy. In fact, early interest rate cuts could raise concerns about new inflationary pressures, leading to market instability.

Therefore, when the FED has not yet taken a move to reduce interest rates, the USD still tends to strengthen, making it difficult for gold to maintain its upward momentum. Investors will continue to prioritize the USD as a profitable asset over gold, which does not bring interest.

Economic data: Big barrier to gold

Another factor that could cause gold prices to surge is a sign of weakening the US economy. If GDP, the job market or consumer spending slow down significantly, the Fed will have to consider adjusting policy. Concerns that recession will prompt cash flow to seek gold as a safe-haven asset.

But the current reality is the opposite. The latest metrics such as retail sales and non-farm payrolls have all exceeded expectations showing the US economy remains stable. The labor market still creates jobs, consumer spending has not decreased sharply. These figures show that the risk of recession is not approaching, and the Fed is not under pressure to cut interest rates.

In other words, the conditions for gold to break out have not appeared.

Outside the scope factor: Mr. Donald Trump and the FED

One unknown that could change the picture is the possibility of US President Donald Trump replacing Fed Chairman Jerome Powell. Although this possibility is not high, Mr. Trump has repeatedly criticized Powell and the Fed's current interest rate policy.

If Trump can put his person who is willing to cut interest rates to support growth at the top of the Fed, the financial market could reverse strongly.

A change in leadership at the Fed in the "puppet" direction (supporting policy easing) could weaken the USD and increase gold prices. However, even if Trump replaces Powell, institutional constraints and global regulations could prevent too sudden a policy change. However, that possibility is still what gold speculators expect as a rare opportunity to create a breakthrough.

Gold investors need to wait patiently for a "fire" strong enough for gold prices to break out. With no unexpected fluctuations in the US economy or a change from the FED, the most likely scenario is for gold to continue to be stuck within the current range.

The USD may continue to rise again, dragging gold prices down. Only a sudden event such as a change in Fed leadership or policy can change the path between USD and gold.

For now, gold will continue to be held back by a strong US dollar and a solid US economy making the possibility of a breakout very fragile.