Last week, domestic gold prices witnessed a sharp decline, causing many investors to suffer losses of up to nearly 7 million VND/tael after only one week of holding.

Along with the downward trend of the international market, the widened difference between buying and selling has made the loss even more serious.

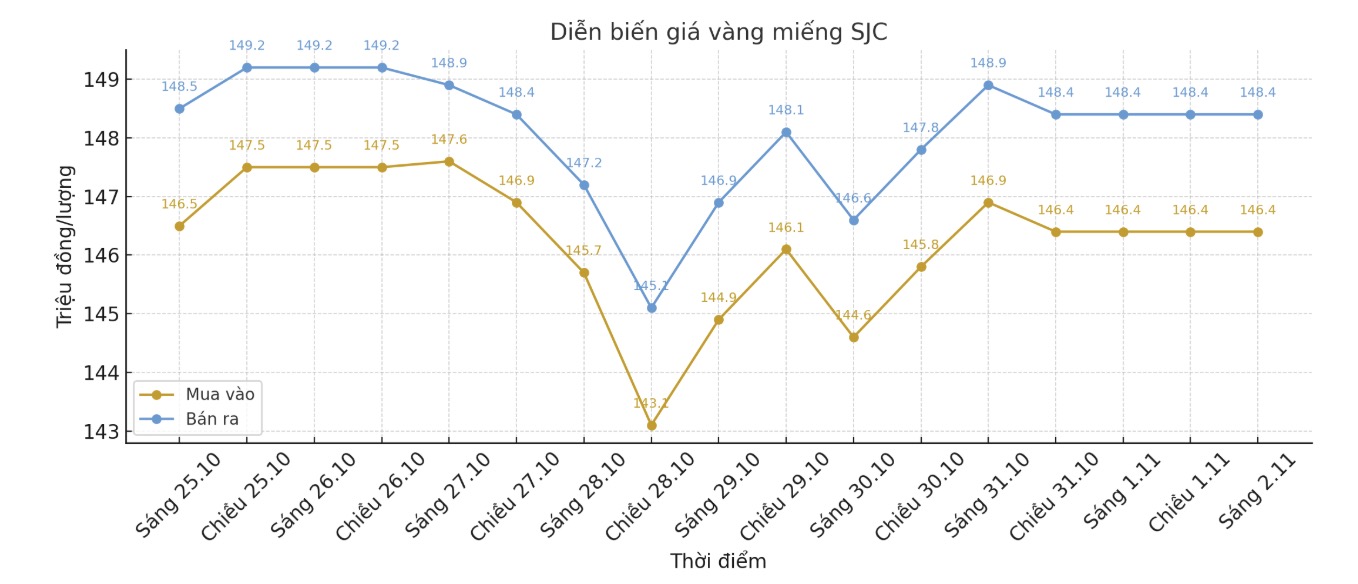

At the end of the trading session on November 2, 2025, Saigon Jewelry Company SJC listed the price of SJC gold bars at 146.4 - 148.4 million VND/tael (buy - sell), down 600,000 VND/tael compared to the end of last week. At Bao Tin Minh Chau, the price of SJC gold bars also decreased to 146.9 - 148.4 million VND/tael, corresponding to a decrease of 1.3 million VND/tael for buying and 600,000 VND/tael for selling.

The difference between the buying and selling prices at these enterprises is maintained at 1.5 - 2 million VND/tael, causing the risk of short-term investment to increase. With the above price, if investors buy SJC gold on October 26 and sell it today, they will lose 2.8 million VND/tael at SJC and 2.3 million VND/tael at Bao Tin Minh Chau, respectively.

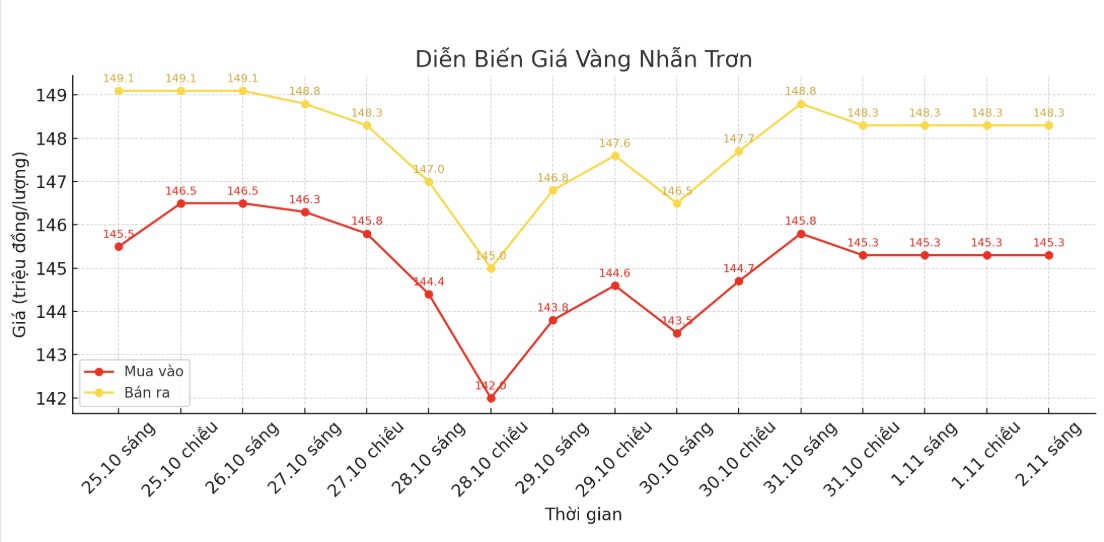

Not only gold bars, 9999 gold rings also recorded a stronger decrease. At Bao Tin Minh Chau, the price of gold rings is currently listed at 146.2 - 149.2 million VND/tael, down 3.8 million VND/tael in both directions, with the difference between buying and selling up to 3 million VND/tael.

With this price, buyers of gold rings at Bao Tin Minh Chau on October 26 and sell today will lose up to 6.8 million VND/tael - the highest loss in many weeks.

In Phu Quy, the price of gold rings is currently at 145.4 - 148.4 million VND/tael, down 800,000 VND/tael and maintains a difference of 3 million VND/tael, equivalent to a loss of 3.8 million VND/tael if sold today.

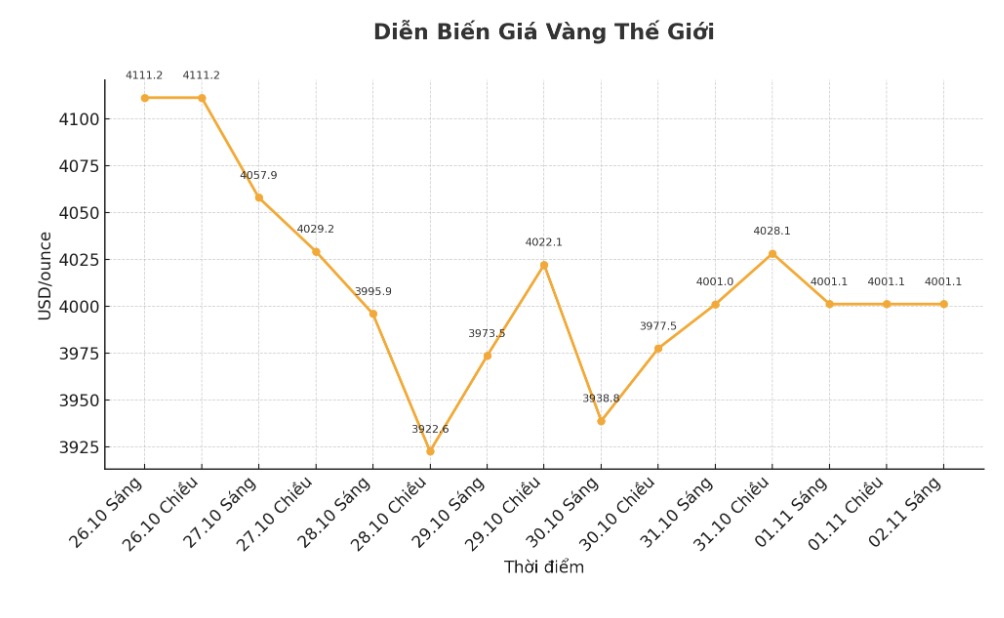

Domestic gold last week decreased largely due to the impact of the international market. World gold prices closed the week at 4,001.1 USD/ounce, down 110.1 USD compared to last week.

Thus, it can be seen that the main reason for domestic investors suffering heavy losses is not only the sharp decrease in gold prices, but also the delay in the buying - selling range. Each amount of gold when bought is already "exhausted" by 1.5 - 3 million VND compared to the selling price, so when the world price decreases, the loss is quickly widened, especially for surfer investors.

Investors should not chase the FOMO mentality (fear of missing out) when seeing gold prices fluctuate. In reality, buying gold during "hot" market periods often pushes buyers into high prices and makes them more likely to suffer losses when the correction wave occurs.

Instead, investors need to be cautious when "making money", should closely monitor world price fluctuations, monetary policies of central banks, as well as domestic buying and selling opportunities to make reasonable choices.

See more news related to gold prices HERE...