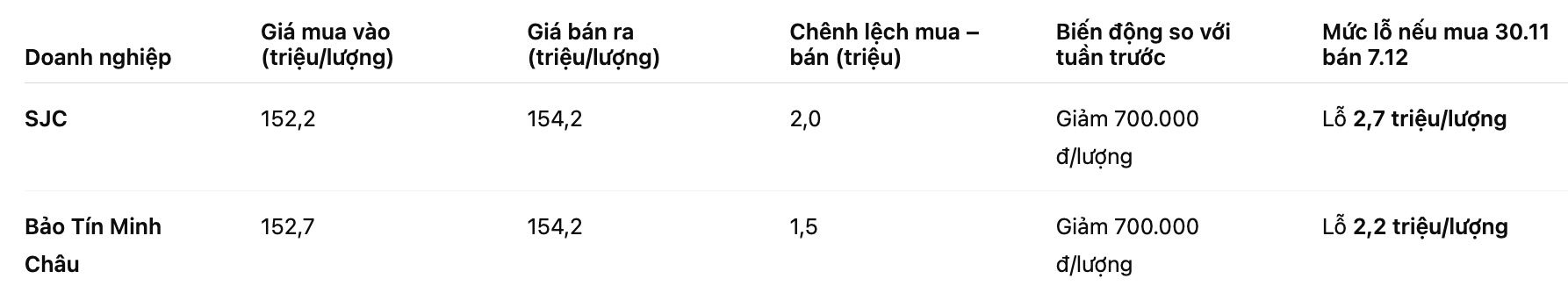

At Saigon Jewelry Company SJC, the closing price of gold bars on December 7 was listed at 152.2 - 154.2 million VND/tael (buy - sell), down 700,000 VND/tael compared to the closing price of the previous session. The difference between the two trading directions remains at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold at 152.7 - 154.2 million VND/tael, also down 700,000 VND per tael, with the buy-sell difference at 1.5 million VND/tael. If buying gold on November 30 and selling on December 7, investors at SJC will lose about 2.7 million VND per quantity, while at Bao Tin Minh Chau the loss will be about 2.2 million VND.

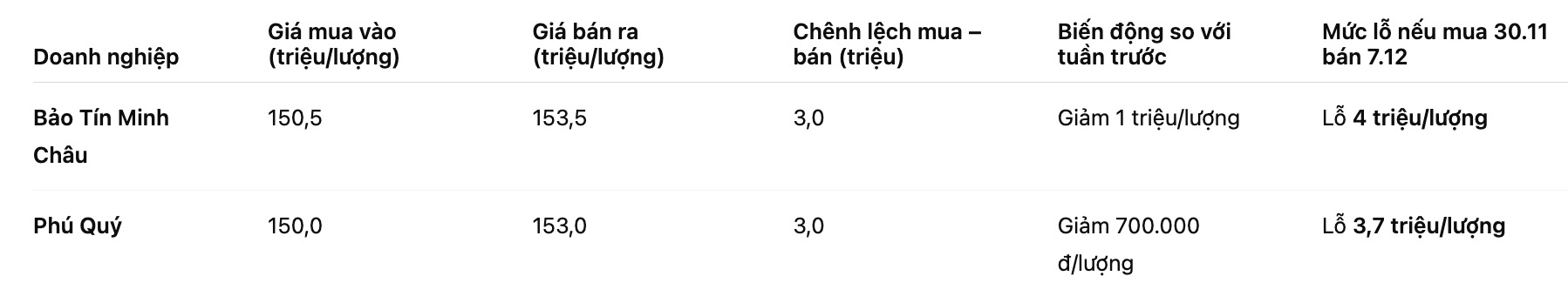

Notably, the 9999 gold ring group is the item with the highest loss. Bao Tin Minh Chau currently listed the price of gold rings at 150.5 - 153.5 million VND/tael, down 1 million VND/tael compared to a week ago, while the buy-sell gap was pushed up to 3 million VND/tael. With this difference, buyers of gold rings here lost up to 4 million VND per tael after only one week.

In Phu Quy, the price of gold rings is at 150 - 153 million VND/tael, down 700,000 VND per tael, causing investors to lose about 3.7 million VND.

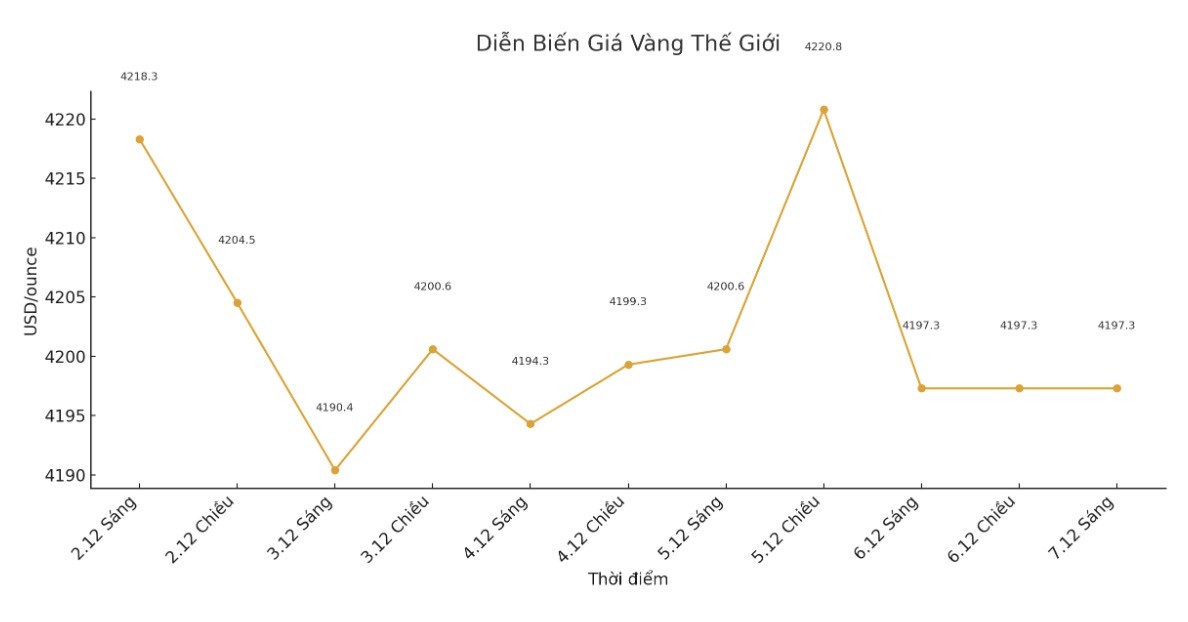

Domestic gold prices decreased in the context of the world gold market also adjusting slightly. At the end of the trading session of the week, the world gold price decreased by 21.1 USD per ounce, down to 4,197.3 USD/ounce.

Converted to Vietcombank's USD/VND exchange rate on December 7, the decrease of 21.1 USD/ounce of world gold prices is only equivalent to about 660,000 - 675,000 VND per tael (exchanged for 1 tael of gold - 1.2057 ounce).

This figure shows that the adjustment of world gold prices last week was not large. This shows that the main reason why buyers losing millions is the high difference between buying and selling in the domestic market.

Enterprises are maintaining a buy-sell gap of 1.5 to 3 million VND per quantity, causing trading risks to skyrocket. With this difference, right at the time of purchase, the investor had already "carried" a large loss. As soon as gold prices do not increase strongly enough or adjust slightly, the entire difference immediately turns into actual losses. This explains why the gold price has only decreased by a few hundred thousand VND per quantity, but the loss to buyers is up to a few million VND.

Market developments in recent times have also issued a big warning for investors against the psychology of buying to chase price increases. When gold prices continue to stay high for a long time, many people are likely to fall into a state of being impatient, expecting to surf to make quick profits.

However, in the context of gold prices standing at a record level, just a slight correction can put buyers at significant risk, especially when the buy-sell gap remains high and there are no signs of cooling down.

Participating in gold surfing at the present time requires high caution. The huge difference in trading is "eating" almost all profit opportunities, while price fluctuations can reverse very quickly. If they continue to chase the crowd mentality and FOMO in the high price zone, investors may face the risk of short-term losses.

See more news related to gold prices HERE...