The probability of the US Federal Reserve (Fed) cutting interest rates to skyrocket is supporting gold prices, while silver prices continue to extend their increase after the record high set last week, as investment demand exacerbates the shortage of actual supply, according to precious metals analysts at Heraeus (a German corporation known for its precious metals and high-tech materials, which have a major influence on the international gold and silver market).

In the latest updated report, analysts said the possibility of the Fed cutting interest rates at the December meeting has increased sharply despite mixed economic data.

There are almost no signs from the labor market, inflation or other economic data showing that the economy is clearly deteriorating enough to need to cut interest rates, but consumer confidence has decreased sharply in November.

Two weeks ago, the probability of the Fed cutting interest rates at its December 10 meeting was only 30%. Last week, market estimates of the possibility of the Fed cutting interest rates returned to exceeding 80% when some Fed members began mentioning the possibility of cutting interest rates.

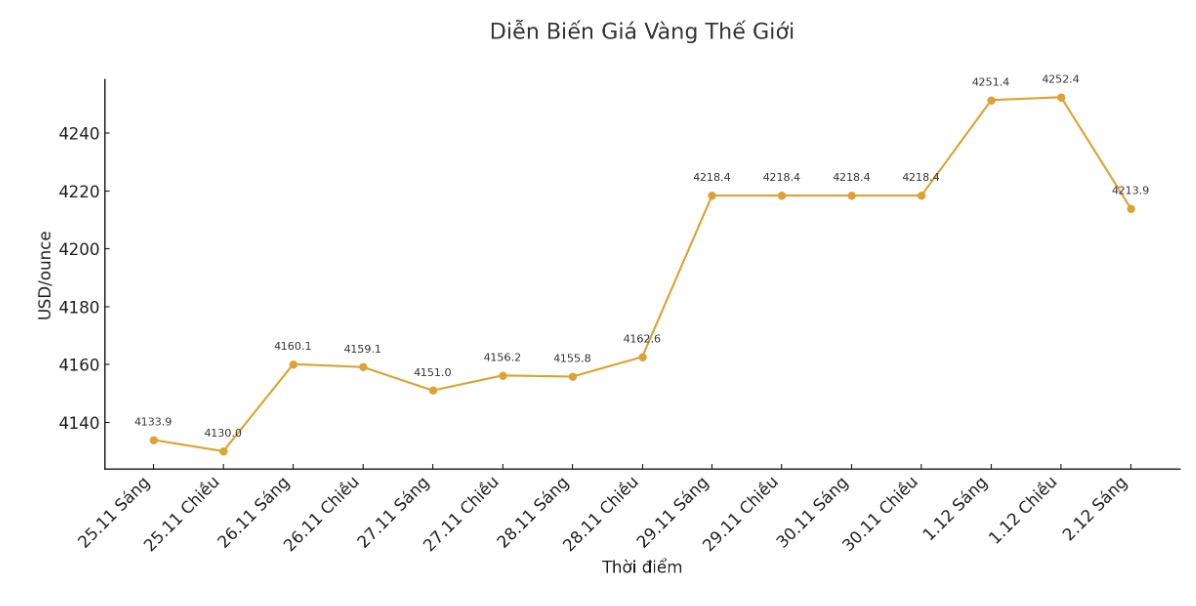

Over the past two years, the Feds interest rate range has been about 50 basis points higher than the yield on the 2-year Treasury note, with room for cut, but not as large as in October when the difference was about 75 points. Meanwhile, gold prices last week surpassed $4,200/oz - a level that created resistance in early November, the report added.

Gold prices are remaining in the high range set for the weekend before entering the second session, trading firmly above the 4,200 USD/oz mark.

For the silver market, Heraeus analysts said the physical shortage of silver has reached Shanghai, as inventories fell to a 10-year low.

Inventory at the Shanghai Commodity Exchange (SHFE) fell to 559 tons last week, down 61% since the beginning of the year. About 644 tonnes of silver have been withdrawn from the warehouse since the start of October, as tight liquidity in London triggered a short squeeze and opened up a gap in business opportunities, dragging the metal out of both COMEX and SHFE warehouses, they said.

As a result, the Chinese silver futures curve has turned to a backwardation state, with short-term delivery prices higher than term contract prices, the report said. At the same time, COMEX's inventory fell to an eight-month low of 457 million ounces, down 14% from the historical peak of 532 million ounces in October.

Heraeus also noted that investment demand rose sharply last week, with ETFs net buying 9.5 million ounces, with the fund recording 7.5 million ounces on Tuesday alone the largest net purchase in a day since October 21.

These capital flows have raised their total net purchases in November to 16 million ounces, completely reversing Octobers net sales of 13 million ounces, the analysts said.

After rising more than 12% last week to a new record high of 56.42 USD/oz and reaching an increase of 96% since the beginning of the year, silver prices continued to outperform in the second session. Prices increased sharply in the late morning, at many times approaching the 59 USD/ounce mark.

The price of silver for direct delivery at 8:55 a.m. on December 2 (Vietnam time) was recorded at 58.5 USD/oz.

See more news related to gold prices HERE...