Mr. Tran Minh Tien, Director of OneHousing Center for Market Research and Customer Insight, commented that there are 3 reasons showing that apartments will continue to be the leading type of real estate market in Hanoi in 2025.

Accordingly, the number of apartment transactions including primary and transfer types accounts for 55% of the total transactions in the whole market, equivalent to about 46,000 transactions. Every year, Hanoi increases by 200,000 people, the demand for housing is increasing.

Apartments are a type of real estate with a relatively affordable price compared to ground-level houses, and legal procedures for bank loans are easier than for apartments with certificates. Within the budget of 3-5 billion VND, apartments will still be "favored" when most projects are located on wide roads, fire protection is guaranteed, and there are many internal and surrounding facilities.

Meanwhile, with the same price segment, townhouses can only be purchased in areas far from the center of Hanoi, or in the center but with limited area and in relatively small alleys.

Finally, with fierce competition and increasing customer demand, investors are increasingly paying more attention to construction quality and handover standards, along with many preferential sales policies with loan interest support packages and payment extensions. This has helped apartments recently become a new investment channel, attracting more customers to buy for investment to accumulate and increase assets, helping to significantly increase absorption in the market.

Apartment prices in Hanoi are forecast to continue to grow into 2025. The average price of newly opened apartments will reach VND70 million/m2 (excluding VAT and maintenance fees) - an increase of 75% compared to the first quarter of 2022.

Updated to the end of the fourth quarter, the supply of newly opened apartments for the whole year of 2024 reached about 35,000 units, higher than the previous forecast of 22,000 - 24,000 units. The absorption rate of opened projects reached 80-90% thanks to the diversity of customer types buying for living and investment.

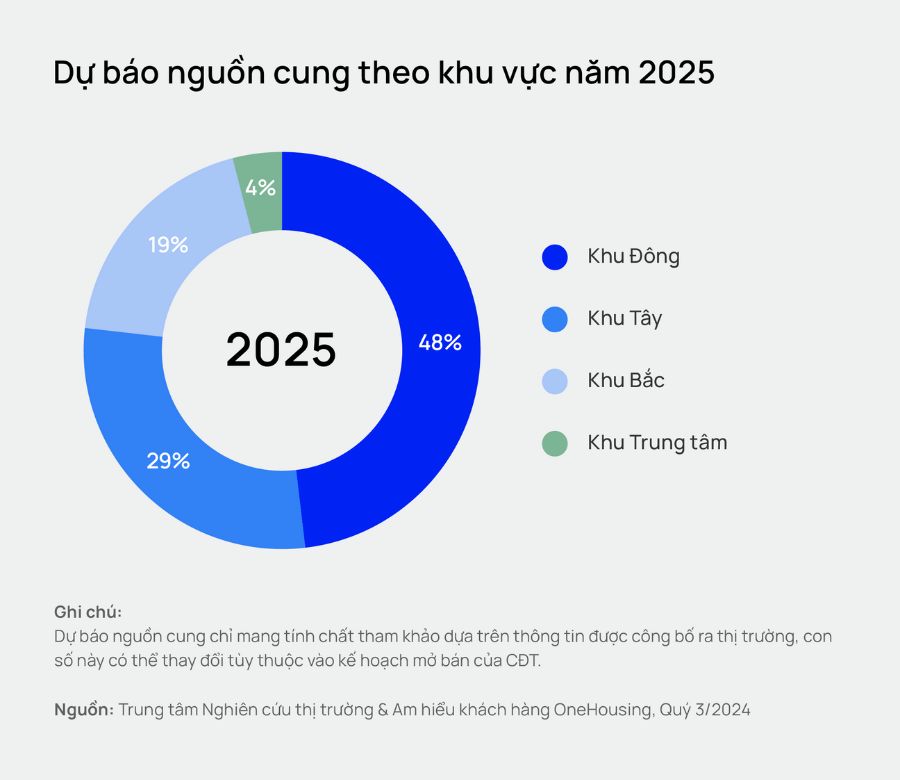

Due to the vibrant market situation at the end of 2024, many projects were decided to open for sale earlier than expected, causing the total supply in 2025 to reach about 29,000 apartments - a slight decrease compared to 2024. Of which, the Eastern area of Hanoi accounts for 48% of the total new supply; the Western area previously accounted for the second proportion, while the Northern and Northeast areas emerged as a "promised land" for the apartment segment. The shift in primary supply by investor will continue to take place strongly in 2025.