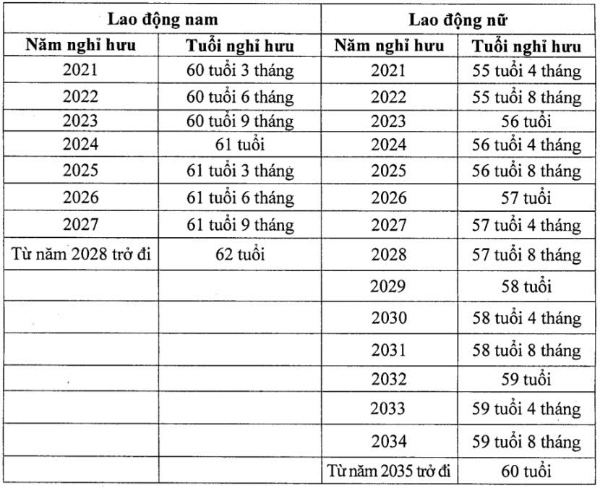

The 2019 Labor Code stipulates that the retirement age of workers in normal working conditions is adjusted according to a roadmap, until reaching 62 years old for male workers in 2028, and 60 years old for female workers in 2035.

Starting from 2021, the retirement age of workers in normal working conditions is 60 years and 3 months for male workers and 55 years and 4 months for female workers. Then, every year, it increases by 3 months for male workers and 4 months for female workers.

According to this roadmap, in 2026, male workers will retire at 61 years and 6 months, female workers at 57 years. This is the retirement age in normal working conditions.

The law also stipulates a number of special cases where employees are entitled to retire at a lower age than normal working conditions, but still must ensure the minimum social insurance contribution period.

For employees doing heavy, hazardous, dangerous jobs or working in areas with particularly difficult socio-economic conditions: Employees with a total compulsory social insurance contribution period of 15 years or more when doing these jobs, or working in particularly difficult areas (including working time in places with regional allowances with a coefficient of 0.7 or higher before January 1, 2021) are entitled to retire at a lower age than general regulations.

The retirement age in this case may be lower, but not more than 5 years compared to the retirement age in normal working conditions at the time of retirement as prescribed.

For workers doing coal mining work in underground mines: Employees who have been doing coal mining work in underground mines for 15 years or more are entitled to retire at a minimum age of 10 years lower than the retirement age in normal working conditions.

Specific tasks are specified in Appendix I of Decree No. 158/2025/ND-CP of the Government detailing and guiding the implementation of a number of articles of the Law on Social Insurance on compulsory social insurance.

For officers, professional soldiers, people's police and some other specialized subjects: These subjects when resigning, having compulsory social insurance contributions for 15 years or more, can retire at a minimum age of 5 years younger than the general regulations, unless otherwise specified in specialized laws.

For employees infected with HIV/AIDS due to occupational accidents: Employees in this case are entitled to a pension when they have had enough time to pay compulsory social insurance for 15 years or more, regardless of age.

For workers with reduced working capacity: Workers with reduced working capacity can also retire early, but must meet the condition of a longer social insurance contribution period and the pension level will be deducted from the rate due to early retirement. Each year of early retirement is reduced by 2%.

Regarding the conditions for enjoyment, employees must have a compulsory social insurance contribution period of 20 years or more. Specific cases, regulations are as follows: Retirement at a maximum of 5 years earlier if working capacity is reduced from 61% to below 81%; retirement at a maximum of 10 years earlier if working capacity is reduced from 81% or more.

People who have worked for 15 years or more in a particularly heavy, hazardous, dangerous profession or job and have had a working capacity reduction of 61% or more are also entitled to a lower pension.