Deposit interest rates may increase from the end of 2025

Deposit interest rates at banks are expected to soon enter an increase cycle again after a long period of staying at a low level.

According to KB Vietnam Securities Company (KBSV), deposit interest rates may increase by about 12 percentage points from the fourth quarter of 2025 due to recovering capital demand and increased liquidity pressure. KBSV commented: "The possibility of further reductions is very low because real interest rates are no longer attractive, especially for a 6,12 month term".

Sharing the same view, VNDirect Securities Company forecasts that 12-month term deposit interest rates could increase to 5.25.3%/year by the end of this year, when credit growth is necessary to achieve the GDP target of 8%, causing banks to raise deposit interest rates.

Mr. Nguyen Quang Huy - CEO of the Faculty of Finance - Banking, Nguyen Trai University, assessed that the interest rate level is currently at the lowest level in 15 years, generally 4.5% - 5.5% for mobilization and 8% - 9:00% for lending. "There is not much more space for further reduction. Banks are moving to a period of stabilization and interest rate refinement, said Mr. Huy.

Forecasting the upcoming trend, Mr. Huy said: "In the second half of 2025, if inflation and exchange rates are well controlled, the interest rate level will remain at a reasonable low, increasing by a maximum of 0.5 percentage points".

Highest special interest rate 6.5-9.65%

The highest deposit interest rate at banks ranges from 69.65%/year. However, to enjoy this interest rate, customers must meet special conditions.

ABBank leads in special interest rates, at 9.65%/year for newly opened/repetited customers with savings deposits of VND1,500 billion or more, term of 13 months.

PVcomBank also applies a special interest rate of 9%/year for a term of 12-13 months when depositing money at the counter. The applicable condition is that customers must maintain a minimum balance of VND 2,000 billion.

HDBank applies an interest rate of 8.1%/year for a 13-month term and 7.7%/year for a 12-month term, with the condition of maintaining a minimum balance of VND500 billion.

Vikki Bank applies an interest rate of 7.5%/year for term deposits of 13 months or more, with a minimum amount of 999 billion VND; Bac A Bank is listing the highest interest rate of 6.2% for a term of 18-36 months for deposits over 1 billion VND; IVB applies an interest rate of 6.15% for a term of 36 months, with conditions applied to deposits of 1,500 billion VND or more.

ACB applies an interest rate of 6%/year for a 13-month term with interest paid at the end of the term when customers have a deposit balance of VND200 billion or more.

At LPBank, for deposits of VND300 billion or more, the mobilization interest rate applied to customers receiving interest at the end of the term is 6.5%/year, receiving monthly interest of 6.3%/year and receiving interest at the beginning of the term is 6.07%/year.

Banks with interest rates from 6%

Currently, interest rates above 6%/year are being listed by some banks for long-term deposits, without a minimum deposit requirement.

Cake by VPBank applies an interest rate of 6%/year for 12-18 month and 24-36 month terms; HDBank applies an interest rate of 6% for 18-month terms; BVBank also pays 6.1%/year for 60-month terms and 6.0%/year for 48-month terms. VietABank maintains the only 6.0%/year for the 36-month term; Bac A Bank applies an interest rate of 6% for the 18-36 month term.

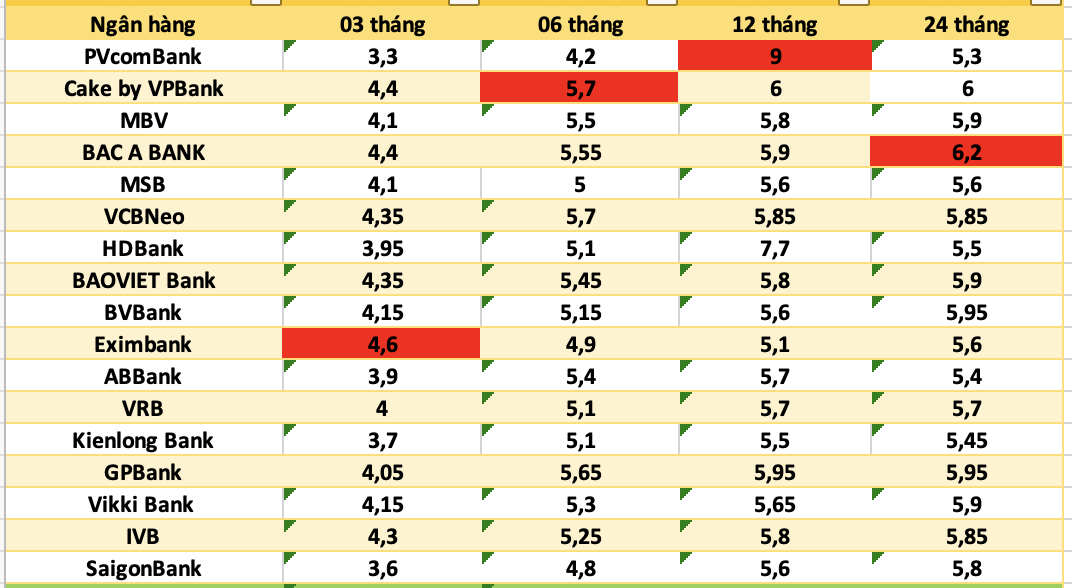

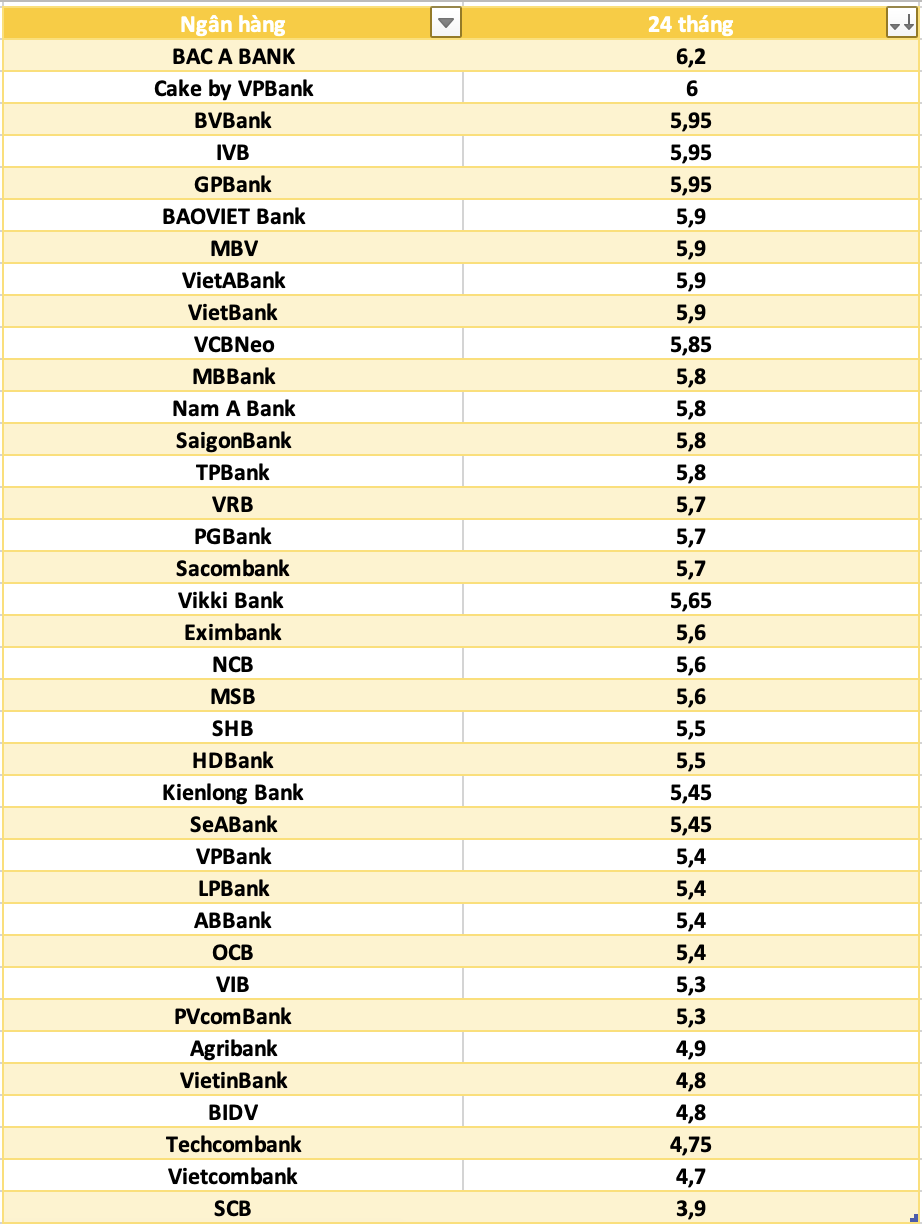

Statistics of banks with the highest savings interest rates today:

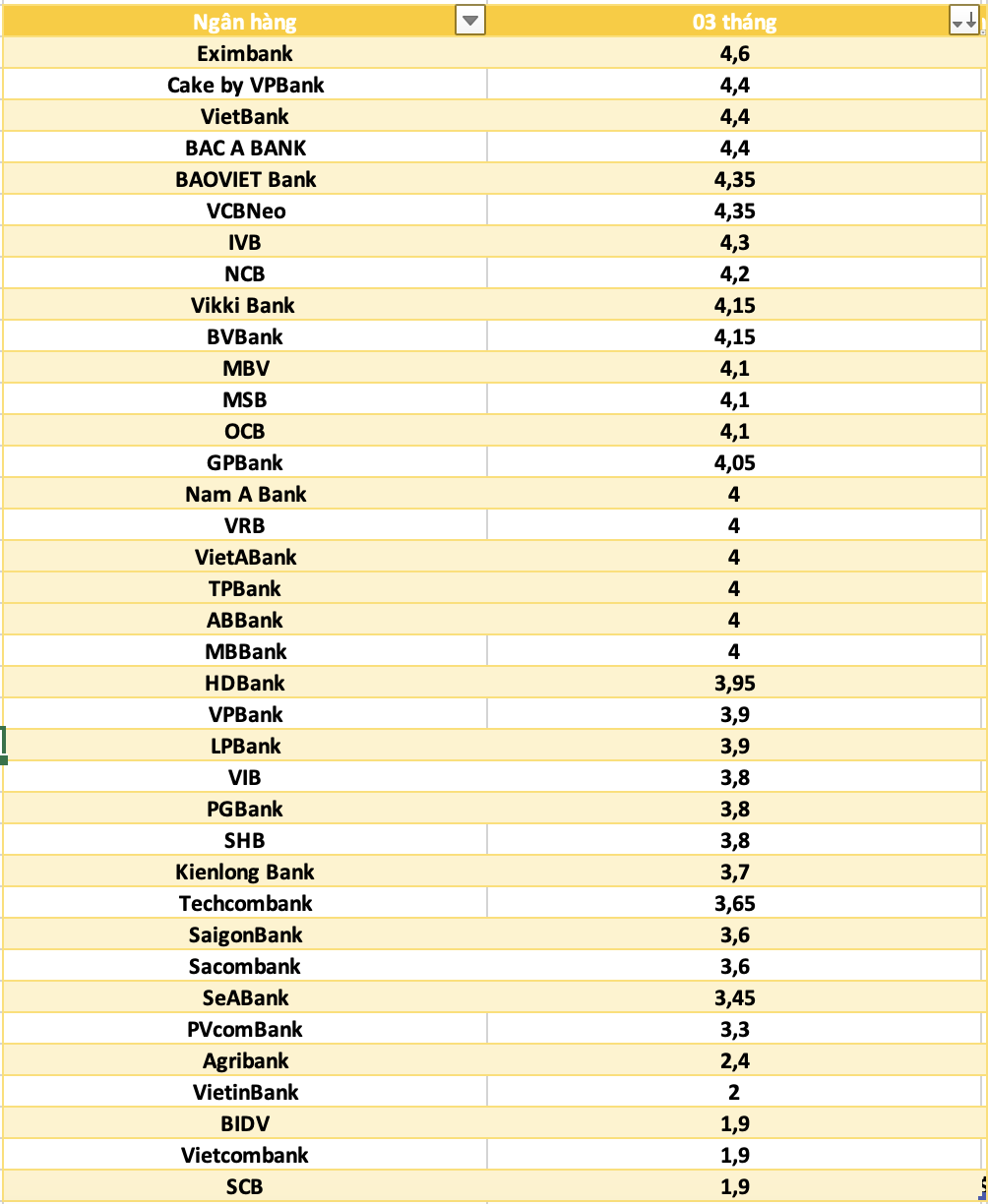

Compare the highest bank interest rates for 3-month terms

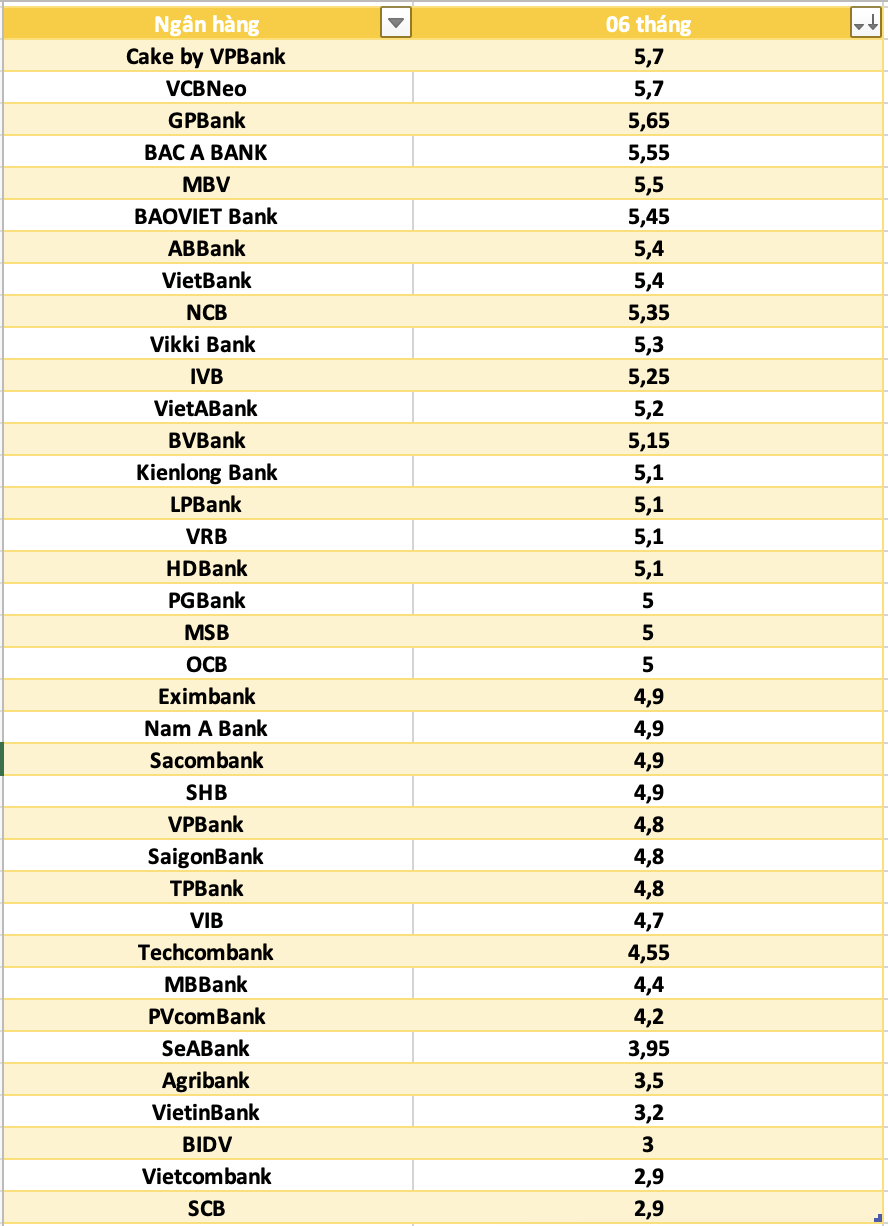

Interest rates for savings deposits at banks for 6-month terms

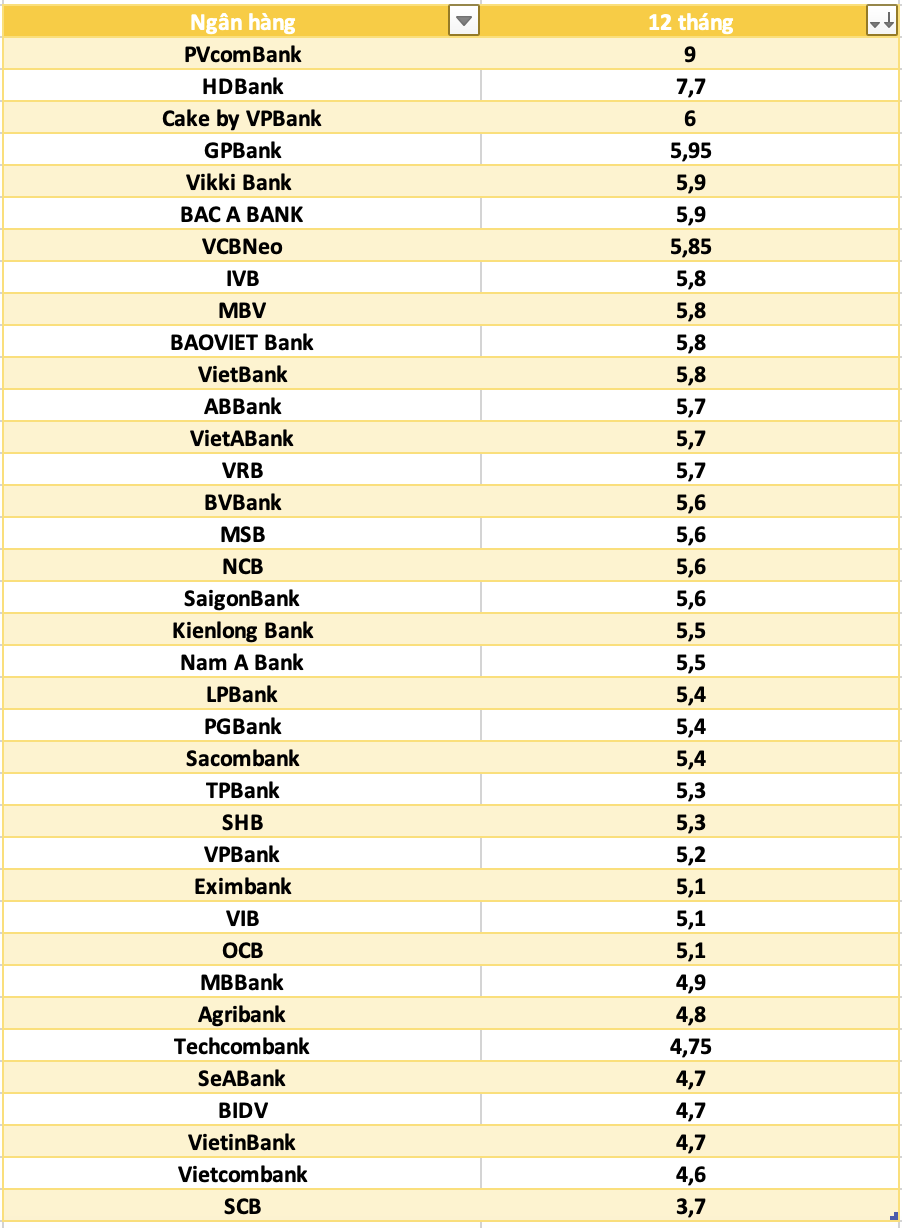

For 12-month savings, which bank has the highest interest rate?

Agribank interest rates, Sacombank interest rates, SCB interest rates, Vietcombank interest rates... are the highest for a 24-month term.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles on interest rates HERE.