Interest Rate of many banks increased sharply

ABBank's Interest Rate has just increased sharply in many terms. After adjustment, the online mobilization interest rate, 3-month term increased by 0.2%/year to 3.9%/year; 6-month term increased by 0.3%/year to 5.3%/year; 7-8 month term increased by 0.4%/year to 5.5%/year; 9-11 month term increased by 0.3%/year to 5.5%/year; 12-month term increased by 0.3%/year to 5.9%/year; 15-18 month term increased by 6.2%/year; 24-month term increased by 6.3%/year.

Bac A Bank has also increased its deposit interest rates. The 1-11 month term increased by 0.15%. After adjustment, the 1-2 month term interest rate increased to 3.95%/year; the 3 month term increased to 4.25%/year; the 4-5 month term was 4.35%-4.45%/year; the 6-8 month term was 5.4%/year; the 9-11 month term was 5.5%/year.

The 12-15 month term was adjusted to increase by 0.1%/year, in which the interest rate for the 12-month term increased to 5.8%/year; the 13-15 month term increased to 5.85%/year; the 18-36 month term increased by 0.3%, jumping to 6.15%/year. Currently, the highest interest rate at Bac A Bank is 6.35%, applied to deposit balances over 1 billion VND, with a term of 18-36 months.

Meanwhile, Construction Bank (CB) has not reduced its deposit interest rate after 3 months of no change.

This bank reduced interest rates for 6-36 month terms by 0.05% to 5.5% per year for 6-month deposits, 0.1% per year for 7-11 month terms, 5.45% per year for 12-month terms, 5.65% per year for 12-month terms, and 5.8% per year for 13-month terms.

Thus, from the beginning of October until now, there have been 9 interest rate increases, including: NCB, Agribank, Techcombank, MSB, LPBank, Eximbank, ABBank and Bac A Bank.

On the contrary, there are also 5 banks that reduce deposit interest rates, including: Agribank, Techcombank, NCB, VPBank and CB.

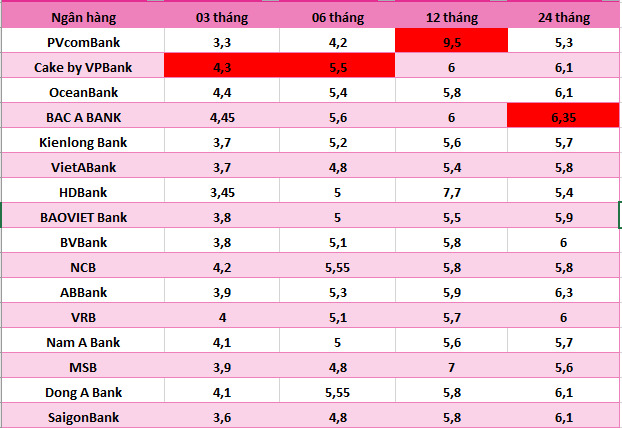

Interest Rate is especially high 7-9.5%

In the market, the interest rate of many banks listed exceeds 7%/year. However, to receive this interest rate, special conditions must be met.

PVcomBank is currently leading in special interest rates when customers deposit money at the counter, at 9.5% for a term of 12-13 months. However, the condition to receive this interest rate is that customers must have a minimum deposit balance of VND 2,000 billion.

Next is HDBank with a particularly high interest rate, up to 8.1%/year for a 13-month term and 7.7% for a 12-month term, with a minimum balance of VND500 billion. This bank also applies a 6% interest rate for an 18-month term.

MSB applies interest rates for deposits at the counter up to 8%/year for a 13-month term and 7% for a 12-month term. The applicable conditions are that the savings book is newly opened or the savings book is opened from January 1, 2018, automatically renewed with a term of 12 months, 13 months and the deposit amount is from 500 billion VND.

Dong A Bank has a deposit interest rate of 13 months or more, the final interest rate for deposits of 200 billion VND or more is 7.5%/year. This bank also applies an interest rate of 6.1% for a 24-month term.

Bac A Bank applies an interest rate of 6.35% for a 24-month term, applicable to deposits over 1 billion VND.

In addition, interest rates above 6%/year are being listed by some banks for long-term deposits but do not require a minimum deposit amount.

Currently, Cake by VPBank applies an interest rate of 6.1% for a 12-month term; OceanBank applies an interest rate of 6.1% for a 24-month term; ABBank applies an interest rate of 6.3% for a 24-month term.

BVBank and Cake by VPBank also apply an interest rate of 6% for 24-month and 12-month terms; VRB and Dong A Bank apply an interest rate of 6% for 24-month terms; SaigonBank applies an interest rate of 6% for 13, 18 and 24-month terms, and 6.1% for 36-month terms.

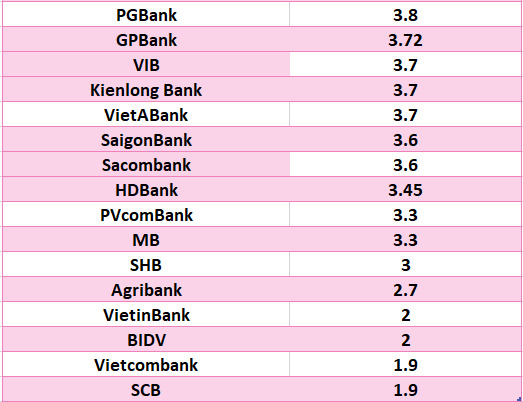

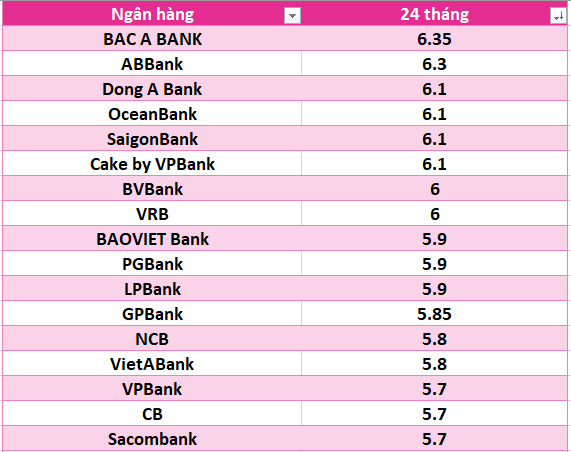

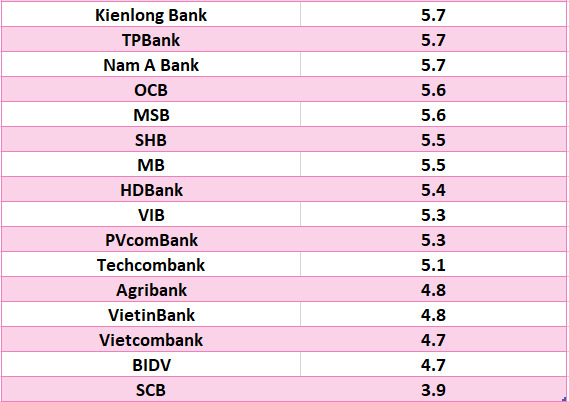

Statistics of banks with the highest savings interest rates today:

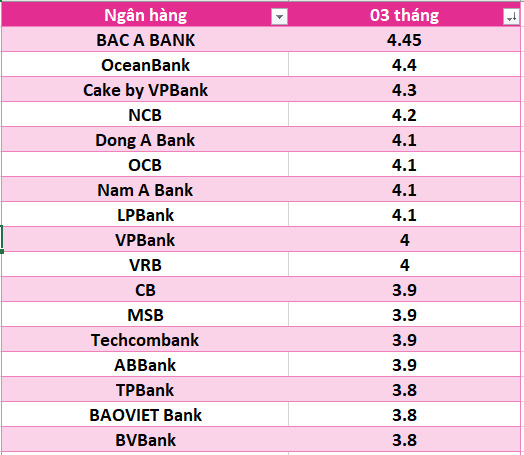

Compare highest bank interest rates for 3-month term

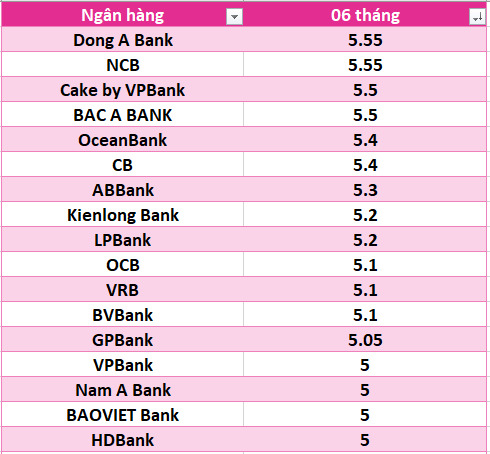

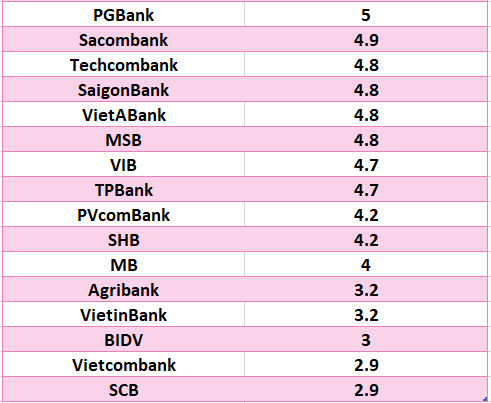

Interest Rate for 6-month savings deposits at banks

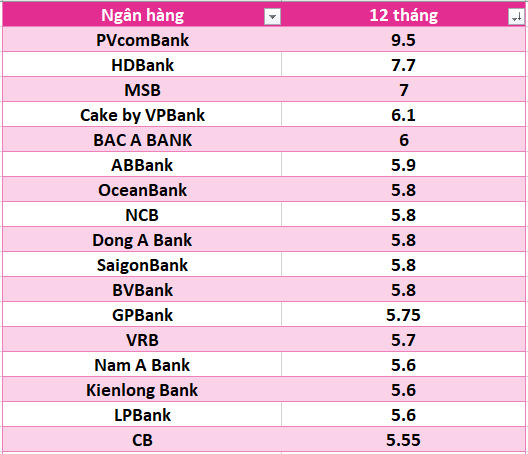

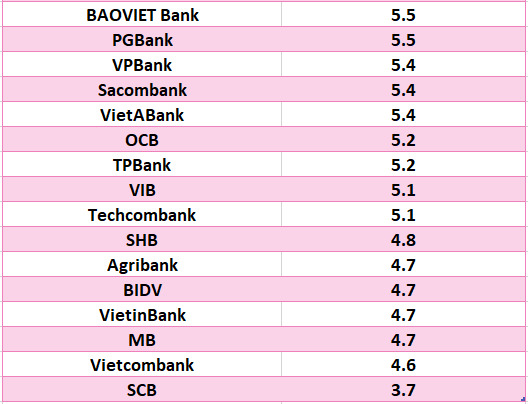

Want to save for 12 months, which bank has the highest interest rate?

Latest update of Agribank interest rates, Sacombank interest rates, SCB interest rates, Vietcombank interest rates... highest for 24-month term.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles about interest rates HERE.