The implementation of the eTax Mobile application in Hai Duong province marks an important step forward in the process of modernizing the Tax sector, contributing to improving tax management efficiency and creating more favorable conditions for taxpayers.

The Chairman of the People's Committee of Hai Duong province requested Heads of departments, branches, sectors, unions, organizations, and enterprises in the province, together with People's Committees of districts, towns, cities and People's Committees of communes, wards and towns to continue to promote the expansion of the eTax Mobile application to taxpayers who are individuals, business households, taxpayers using non-agricultural land and individuals with income from salaries and wages belonging to paying agencies.

For households and individuals doing business paying taxes under the contract method, by the end of June 30, 2025, 100% of households doing business under this method are operating and are subject to tax declaration and payment and must install and use the eTax Mobile application.

For individuals with income from salaries and wages belonging to payment agencies, the province strives to install and use eTax Mobile by at least 50% of cadres, civil servants, and employees of provincial departments, branches, departments, offices, units at district, commune levels, and other payment agencies in the area by June 30, 2025. By December 31, 2025, this rate is expected to reach 95%.

For taxpayers using non-agricultural land, the goal by June 30, 2025 is to reach 50% of taxpayers installing and using the eTax Mobile application; by December 31, 2025, this rate will increase to 75%.

Regarding electronic tax payment, for households and individuals doing business under the contract method, by June 30, 2025, at least 80% of the tax amount paid to the state budget will be done electronically. For other groups of taxpayers, Hai Duong province encourages tax obligations through the eTax Mobile application for convenience and transparency.

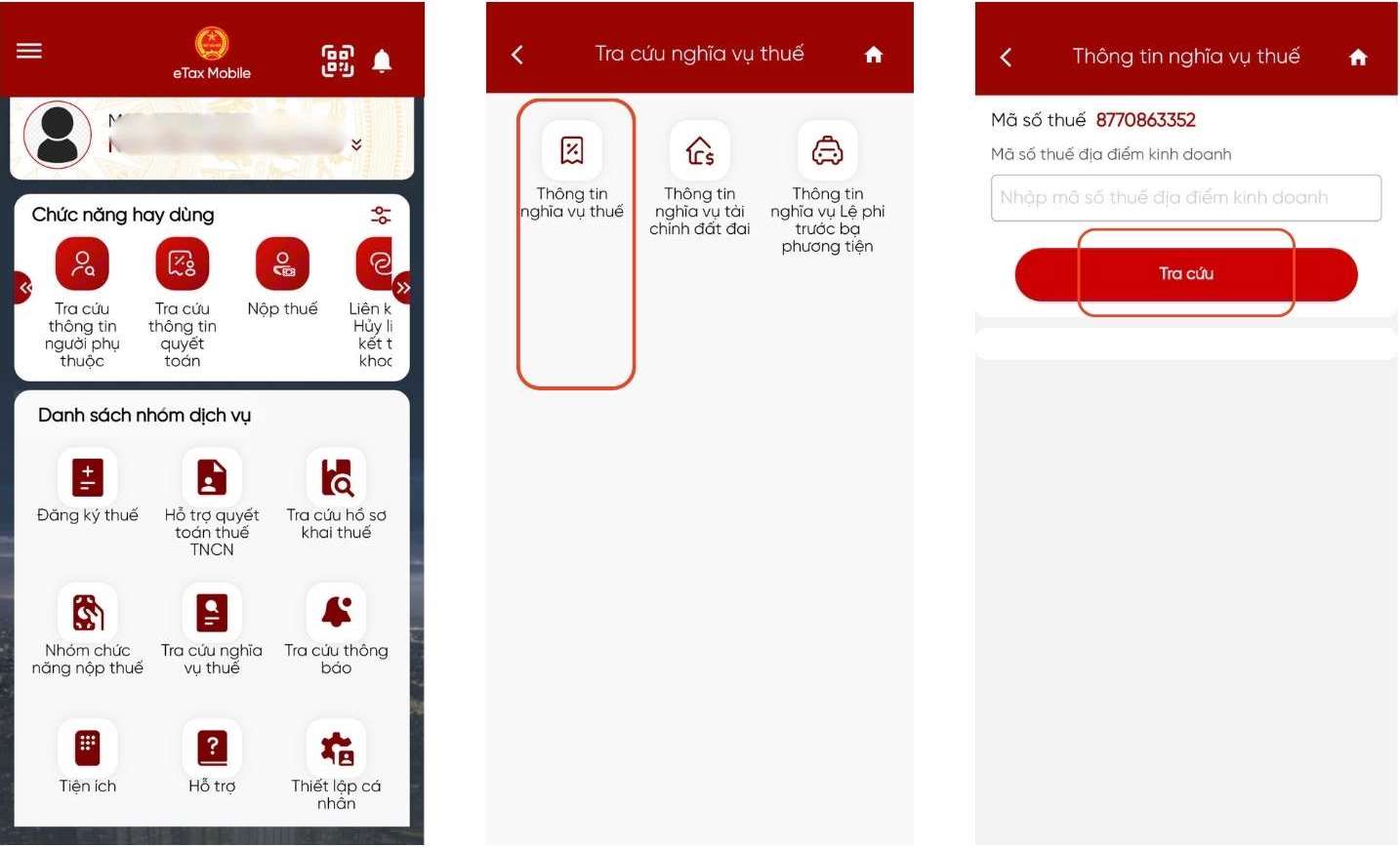

eTax Mobile is an official electronic tax application of the Vietnam Tax sector, provided free of charge to taxpayers. This application helps users look up tax obligations payable, financial obligations regarding land, vehicle registration fees and receiving notices related to taxes.

Taxpayers can interact directly with tax authorities, promptly access new policies and create close connections between people and the Tax sector.