About 17 million Vietnamese people have participated in cryptocurrency transactions

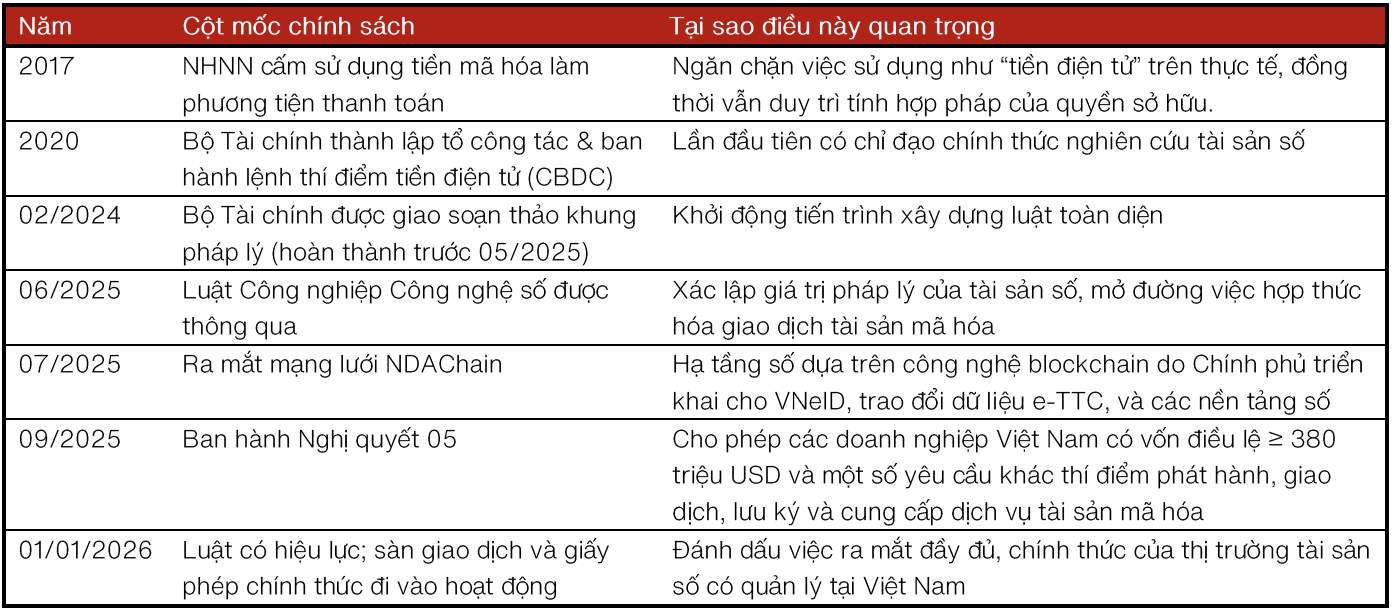

On September 9, 2025, the Vietnamese Government issued Resolution 05, officially starting a 5-year pilot phase for the cryptocurrency asset market in Vietnam. This move shows the Government's acceptance of cryptocurrency assets after a long period of consideration, in the context of this asset becoming increasingly familiar to the people.

According to a report from VinaCapital, it is estimated that up to 17 million Vietnamese people have participated in cryptocurrency transactions, with a total annual value of over 100 billion USD. Most of the activities take place on foreign exchanges such as Binance, Bybit or platforms in Singapore, Korea, Hong Kong (China),....

VinaCapital stated that the Government's goal is to shift cryptocurrency activities from a large-scale informal market, dependent on foreign channels, to an official market that can manage taxes and integrate into the domestic financial system.

In July, the National Assembly passed the Law on Digital Technology Industry, recognizing digital assets and requiring trading platforms to have a domestic operating license, and providing a monetary transaction portal from January 1, 2026. Also in July, the Government launched NDAChain - a national blockchain platform, allowing safe-haven financial transactions and secure online shopping.

By August, Vietnam plans to pilot 5 licensed digital asset exchanges, supporting Bitcoin, Ethereum and about 50 other types of cryptocurrency assets.

New legal framework shaping the digital asset market

VinaCapital analyzed that the Government is focusing on 3 goals:

First, legalize and calculate taxes on transactions of cryptocurrency assets, aiming to shift billions of USD in transactions from international exchanges to domestic markets to generate revenue.

Second, integrating digital assets into the domestic financial system, opening new capital mobilization channels, supporting the development of the digital economy and reducing dependence on cash transactions.

Third, strengthen investor protection and market monitoring, set records and reporting standards, and include digital assets in anti-money laundering (AML) and anti-terrorism finance (CFT) regulations.

The report cited the experience of Korea, which has applied strict regulations since 2021: linking bank accounts with real names, controlling AML/CFT and punishing market manipulation. As a result, the transaction activities are concentrated on 5 exchanges that meet regulations, and at the same time apply many tax forms such as "supervisory fee" of 0.6% of revenue.

While South Korea has tightened from the start, some countries in the region have chosen to open first, tighten later and face risks. In June 2025, Singapore forced the unlicensed platform to stop operations, and Thailand also blocked major platforms from abroad. This shows that even open markets are ready to tightly control when risks increase.

In Vietnam, according to Resolution 05, pilot platforms must have a domestic operating license, transact in VND and a minimum charter capital of VND 10,000 billion (nearly USD 380 million). The transaction fee has not been determined, initially it may be a reference to the stock fee of about 0.15%.

Enterprises join, expand blockchain application

In parallel with the pilot program, many developments in the private enterprise sector are also taking shape. MB cooperates with Dunamu (Korea), the operator of Upbit, to build an international standard trading platform. The joint venture with Techcombank (1 Matrix) is developing grassroots blockchain, integrating banking, serving public services and digital finance.

Binance launched the "Blockchain for Vietnam" initiative, sponsoring education and application in the locality. Tether discussed piloting the limitation of USDT transactions in Da Nang, while Chainalysis proposed providing blockchain monitoring tools for Vietnam's new compliance infrastructure.

VinaCapital experts commented that after a cautious period, Vietnam is accelerating significantly: regular dialogue between management agencies and businesses, many industry events and the launch of NDAChain - a national data center blockchain platform - all show the shift in digital asset recognition in the financial system.

The implementation of NDAChain will promote the encryption process (tokenization) in Vietnam, helping familiar financial assets such as bonds, fund certificates, commercial invoices, and carbon credits to be issued and traded as digital assets on banking management infrastructure and linkages.

VinaCapital assessed that three key factors supporting the prospects of the digital asset market in Vietnam are: the scale of large individual investors, a rapidly growing economy and the determination of the Government to manage. The stock market also reacted quickly, with MBB and TCB stocks - two banks participating in cooperation with the pilot exchange - increasing by 63% and 56% respectively from the beginning of 2025.