Interest rates are still rising

The trend of savings interest rates in Vietnam is showing clear fluctuations, with a slight increase recently. This comes from changes in the financial market and monetary policies.

According to Tien Phong Securities Company (TPS), deposit interest rates are likely to increase by the end of this year and remain stable or increase slightly in 2025. Similarly, VNDIRECT Securities Company also forecasts that the average 12-month deposit interest rate will increase by about 0.3 percentage points, reaching 5.2% - 5.3%/year by the end of 2025. This increase is explained by the need for banks to increase capital to meet Basel II standards and support credit in the context of the economy recovering from the pandemic.

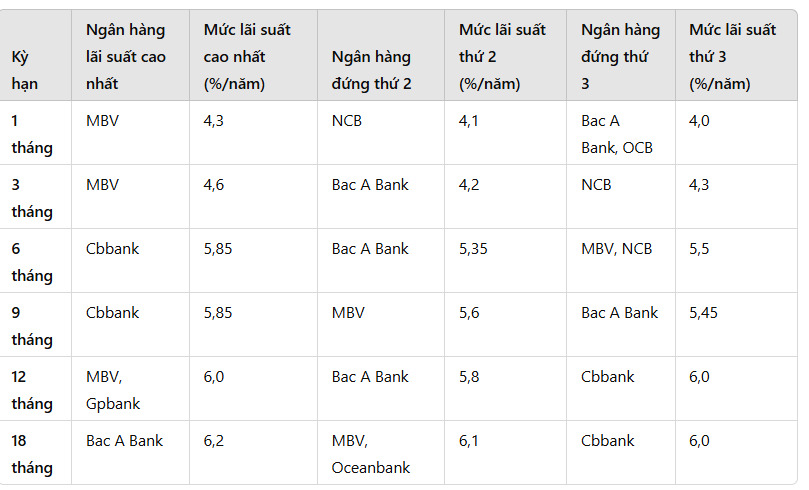

However, interest rates can vary between banks. Smaller banks tend to charge higher interest rates to compete and attract customers, while larger banks with a stable customer base tend to maintain lower interest rates.

In this context, individual investors should be cautious when choosing a bank to deposit money and regularly update market developments to make reasonable financial decisions.

Unexpected many profit milestones from 8%/year

According to Lao Dong, with a special interest rate, the highest in the market is the interest rate of 9.5%/year listed at PVcomBank. PVcomBank customers will enjoy a special interest rate of 9.5%/year when having a new deposit balance of 2,000 billion VND or more.

HDBank also listed an interest rate of 8.1%/year for a 13-month term. Applicable to savings of at least VND500 billion/savings card, not applicable to mobilization in the form of initial interest or periodic interest.

In addition, rates of 7-8%/year are also listed at many banks.

Dong A Bank is listing a special interest rate of 7.5%/year for customers depositing for a term of 13 months or more, with interest at the end of the term for deposits of VND 200 billion or more, for a period of 365 days/year.

MSB currently offers a special interest rate of 7.0%/year to customers with newly opened savings books or savings books opened from January 1, 2018, automatically renewed with a deposit term of 12 months, 13 months and a deposit amount of VND 500 billion or more.

See the latest bank interest rates HERE