Outdated family deductions

Ms. Ngoc Lan, 34 years old, lives in Hanoi, with a family income of 40 million VND per month, but after deducting living expenses, she cannot save, "at the end of the month it's all gone".

She said that after deducting VND7 million for rent, VND8 million for her two children's tuition, and daily living expenses, her family only has a small amount left to save for unexpected events such as illness. "The family deduction of VND11 million per person is too low compared to actual spending," Lan shared.

According to the General Statistics Office, the CPI has increased by more than 15% since 2020, while the family deduction has remained "frozen" since July 2020. This causes workers like Ms. Lan to be subject to higher progressive tax rates, even though the prices of many goods tend to increase.

Associate Professor, Dr. Dinh Trong Thinh, a financial expert, commented: “With the regulation of adding 20% of CPI to adjust family deductions, this policy is outdated, unable to keep up with the pace of change in the economy and living costs. Since 2020, prices have been increasing continuously, but the deduction level remains fixed, which is unreasonable.”

Progressive tax schedule: Pressure on middle-income groups

Besides the family deduction, the current progressive tax schedule with 7 tax brackets also creates many problems.

Minh Hoang, 28 years old, a software engineer in Hanoi, shared: “My income has just reached 18 million VND, but I have to pay a tax rate of 15%. Meanwhile, the cost of renting a house, eating out and sending money back home each month has consumed more than 70% of my salary.”

The current tax schedule, with high tax rates such as 25% for income over 32 million VND, puts many people in a situation where income increases but tax pressure is greater.

Experts say that a tax schedule with too many levels not only causes difficulties for taxpayers but also creates a large gap between levels.

According to Dr. Nguyen Ngoc Tu - Lecturer at Hanoi University of Business and Technology, the gap between tax brackets, especially from bracket 4 to bracket 5 (VND 18 million to VND 32 million), is an invisible burden, causing the real income of workers to not improve significantly.

How to solve the problem?

Returning to Ngoc Lan’s story, she had hoped for a more flexible deduction policy, such as allowing deductions for home loan interest or tuition and medical expenses. “My family is paying in installments to buy a small apartment, but the loan interest is not deductible from taxable income. Meanwhile, expenses such as extra classes and medical treatment for children are not deductible,” she said.

According to Associate Professor Dr. Ngo Tri Long, the current family deduction level has been too outdated compared to the growth rate of the economy and the living standards of the people. "While waiting for the law to be amended, it is urgent to increase the family deduction level immediately to reduce difficulties for workers," Mr. Long emphasized.

Many other experts such as Dr. Nguyen Ngoc Tu and Associate Professor Dr. Dinh Trong Thinh also believe that the method of calculating personal income tax needs to be reformed, closely following the principle of "revenue minus expenditure". That is, essential expenses such as tuition, medical examination and treatment, and home loan interest should be deducted before calculating tax, similar to the current corporate income tax method.

In addition, Mr. Tu proposed that the family deduction level should be linked to the regional minimum wage, instead of being anchored to the CPI.

* Inadequacies in current personal income tax policy Family deduction level:

Currently: 11 million VND/month for individuals; 4.4 million VND/month for each dependent. Applicable time: From July 2020. CPI period 2020-2024: Increase by more than 15%, but the deduction level has not been adjusted.

Progressive tax schedule: Includes 7 tax brackets, with large differences between higher brackets. Tax pressure increases sharply on the middle-income group.

Deductions: Essential expenses such as mortgage interest, tuition, and medical expenses are not allowed.

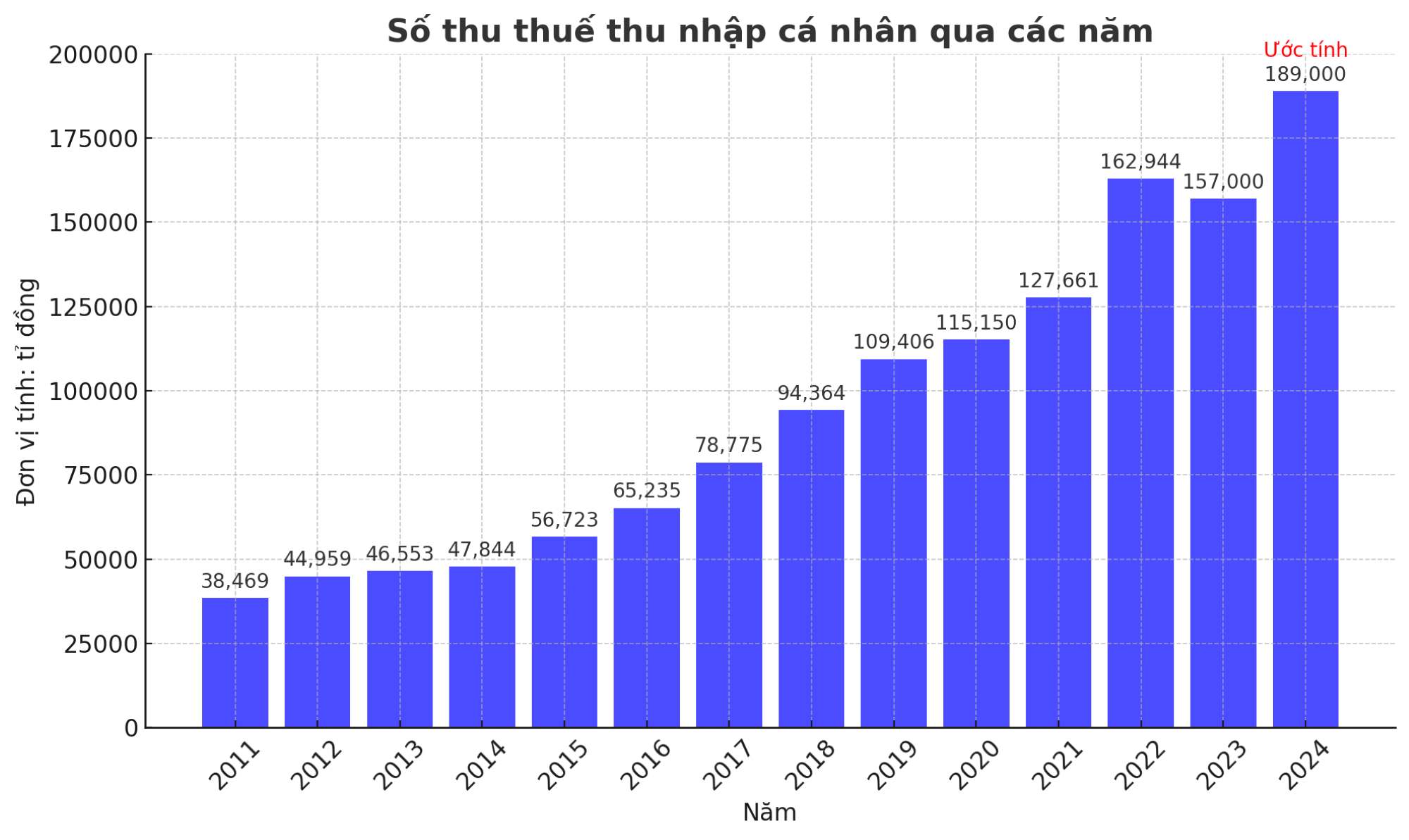

* Ministry of Finance plans to revise family deduction level

At the press conference on January 7, 2025, Mr. Truong Ba Tuan - Deputy Director of the Department of Tax Administration (Ministry of Finance) - said that the CPI may fluctuate strongly in 2025, and the Ministry of Finance will propose adjusting the family deduction level without amending the Personal Income Tax Law. It is expected that the October meeting will consider this issue, and the Ministry of Finance is reviewing and planning to amend the Law in 2025.