Eximbank's credit growth is the highest in half a decade

2024 will witness a bright business picture of the Vietnamese banking industry with impressive numbers. In particular, Vietnam Export-Import Commercial Joint Stock Bank (Eximbank, code: EIB) made a strong impression when all financial indicators grew at double digits.

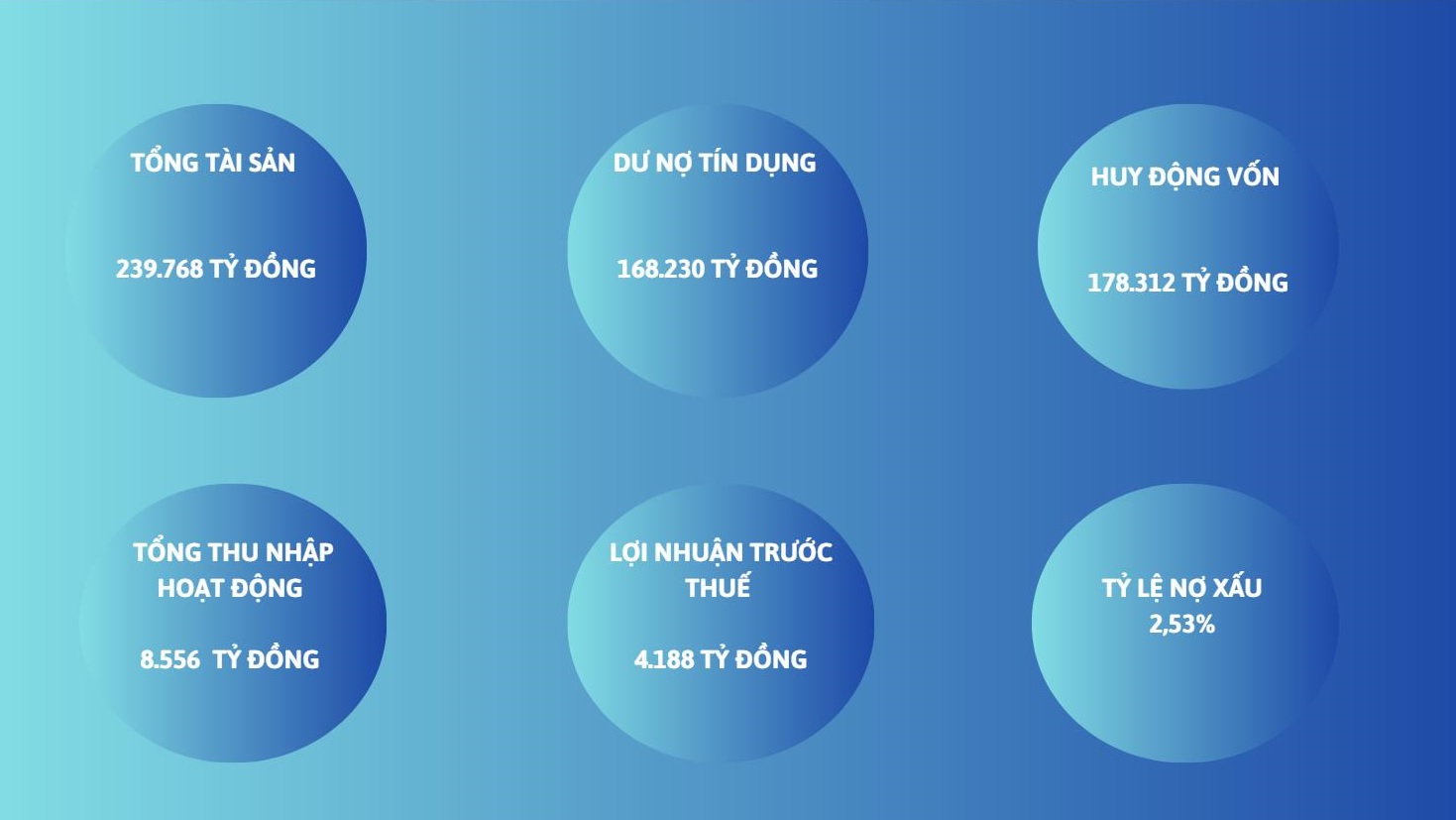

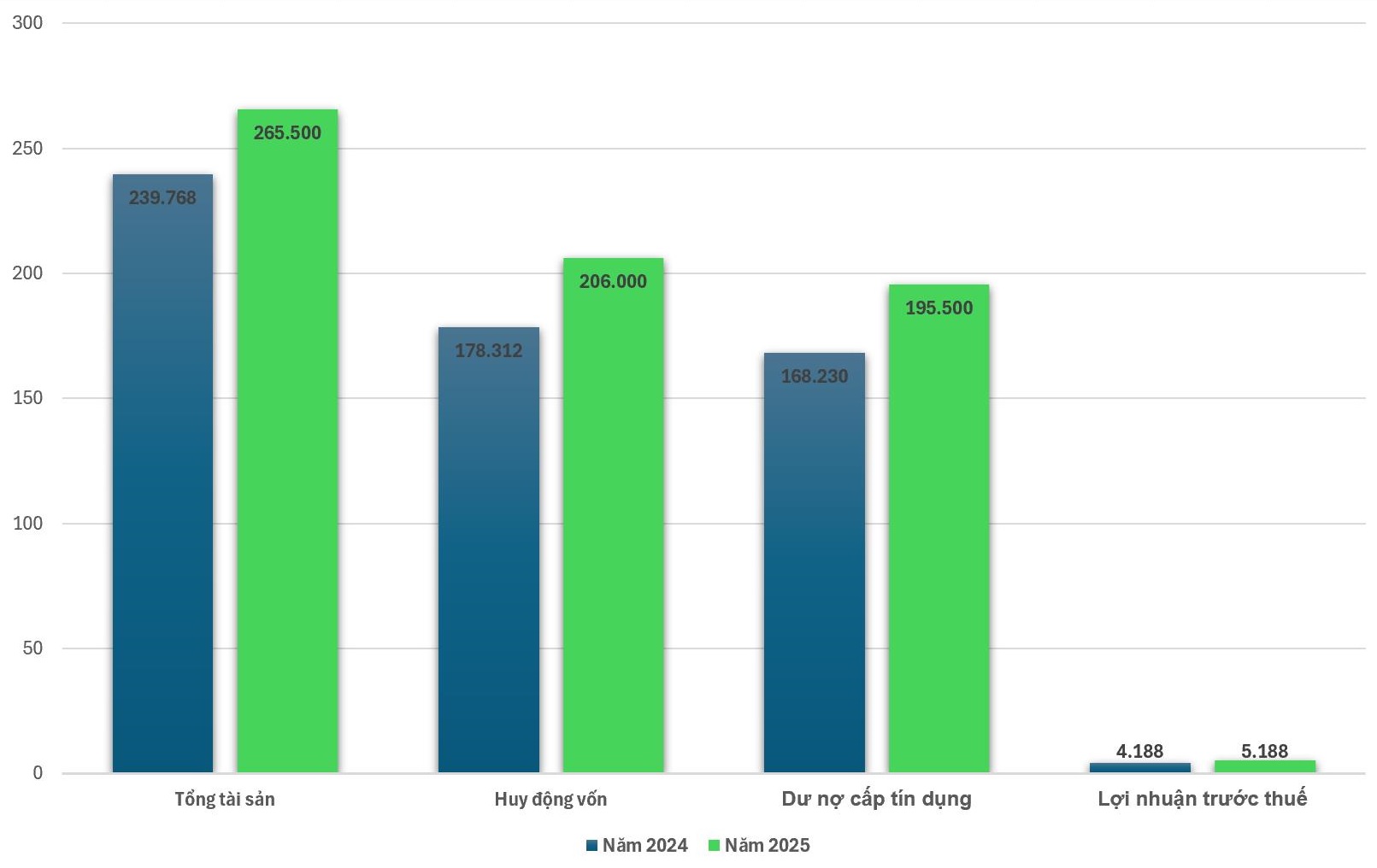

As of December 31, 2024, Eximbank's total assets increased by 19,29% to VND 239,768 billion, capital mobilization reached VND 178,312 billion, up 12.6% over the previous year. Outstanding credit has grown the highest in half a decade (compared to 2019) when it surpassed VND168,230 billion, up VND27,706 billion, equivalent to an increase of 19.7% compared to the beginning of the year.

Eximbank's credit continues to flow into key segments and sectors that the bank has identified as priorities, including retail banking, SME businesses, large corporate customer ecosystems and FDI businesses in line with the Government and State Bank's orientation on providing credit capital for the economy.

Eximbank's pre-tax profit reached VND4,188 billion for the first time, up 54% over the previous year - a record level for the bank over the past 35 years. In terms of absolute value, Eximbank's profits are still modest, but the high growth rate and ROE (net profit rate on equity) tend to increase rapidly, showing that the bank is developing more and more effectively and sustainably.

In 2024, Eximbank was approved by the State Bank to increase its charter capital to VND 18,688 billion. This is an important step forward, helping Eximbank strengthen its financial capacity, expand its scale of operations and improve its ability to meet capital safety standards according to international practices.

Eximbank has well controlled the safety indicators in the SBV's regulations, with the ratio of short -term capital for lending to medium and long -term loans to maintain around 24% - 25%, lower than the limit of the SBV up to 30%; The ratio of credit balance to Eximbank's mobilized capital (LDR) is maintained around 82% - 84% compared to the provisions of the State Bank of 85%; Car capital adequacy ratio ranges around the threshold of 12%-13%, higher than the specified level of the State Bank of 8%...

Total operating income exceeds VND 8,500 billion for the first time with two breakthrough factors

The financial report recorded that Eximbank's total operating income grew by a remarkable margin in 2024 to VND 8,556 billion, up 30% over the previous year.

Of which, net interest income reached VND 5,923 billion, up 28.8% over the previous year. Two factors of breakthrough growth include net profit from service activities exceeding VND 1,080 billion, up 110.1% over the previous year. Interest from foreign exchange trading activities increased by 38.7% to VND674 billion. In addition, net profit from other activities reached VND947 billion, up 13.4% over the previous year.

Separating revenue from service activities is a mysterious factor. In 2024, revenue from service activities will reach a total of VND 2,165 billion, an increase of 55.4% over the previous year, of which card services will reach VND 1,026 billion (up 13%), insurance agents and related support fees will reach VND 754 billion (up 399%), payment and cashier services will reach VND 261 billion, and other services will reach VND 122 billion. Strong growth in insurance distribution has contributed greatly to the bank's profit growth in 2024.

In addition to good credit growth, the bank's net interest margin (NIM) has improved slightly. To improve NIM, instead of increasing output interest rates, Eximbank has proactively restructured its asset structure and capital sources, thereby controlling effective capital costs (COF). As a result, Eximbank's NIM improved quarter-on-quarter and reached 2.8% by the end of 2024.

During the year, Eximbank also set aside credit risk reserves of up to VND 969 billion, using reserves to handle risks reaching VND 729 billion.

Bad debt quality has improved, in which the bad debt ratio decreased to 2.53%, down 12% compared to the previous year. Group 2 debt also remained stable around 1%. With the continuous push to set aside provisions and handle bad debts in recent years, Eximbank's board of directors expects the bank's bad debts to decrease to 1.99% in 2025.

CASA's average growth rate is 24.8%

To effectively control capital costs, Eximbank has increased the regulation of mobilized capital between terms, combined with promoting the increase in the rate of non-term deposits (CASA).

According to statistics, Eximbank has an amount of non-term deposits in VND and foreign currency of VND 22,700 billion, accounting for 13.6% of customers' deposits at Eximbank. The average CASA growth rate is 24.8% compared to 2023.

In 2025, CASA growth and CASA's proportion in total mobilized capital are one of Eximbank's key tasks.

Control operating costs well

One of Eximbank's great successes in 2024 is controlling operating costs well, this is the basis for helping banks reduce interest rates for businesses and people.

While profits increased by 54%, Eximbank's operating expenses in 2024 increased by only 8.2% compared to the previous year. Good control of operating costs has reduced the CIR ratio (operating costs/total income) to 31.79%, down sharply from more than 40% in 2023. This shows that Eximbank manages operating costs better, reduces costs, and contributes to better banking performance. To control operating costs well, Eximbank has invested heavily in digital transformation, applying technology to the operation of digital banking services as well as banking governance, improving labor productivity and optimizing resources.

2024 not only marks Eximbank's strong growth but also a solid foundation for sustainable development in the future, contributing positively to the development of the Vietnamese economy.

In 2025, Eximbank will determine a scale growth strategy and improve banking performance in the direction of Sustainability - Safety - Efficiency. Improve NIM by promoting the retail banking and SME segments, enhancing the exploitation of the large corporate and FDI customer ecosystem, increasing non-term capital (CASA), low-cost capital from economic and residential organizations.

In the 2025 General Meeting of Shareholders document, Eximbank's Board of Directors has submitted to the General Meeting of Shareholders a business plan for 2025. Eximbank aims to increase total assets by 10.7% to VND265,500 billion, mobilize VND206,000 billion, up 15.5% over the previous year. Outstanding credit is expected to increase by 16.2% to VND195,500 billion. Eximbank's pre-tax profit target is VND 5,188 billion, up 23.8% over 2024.