Savings interest rates increase, but there is clear differentiation

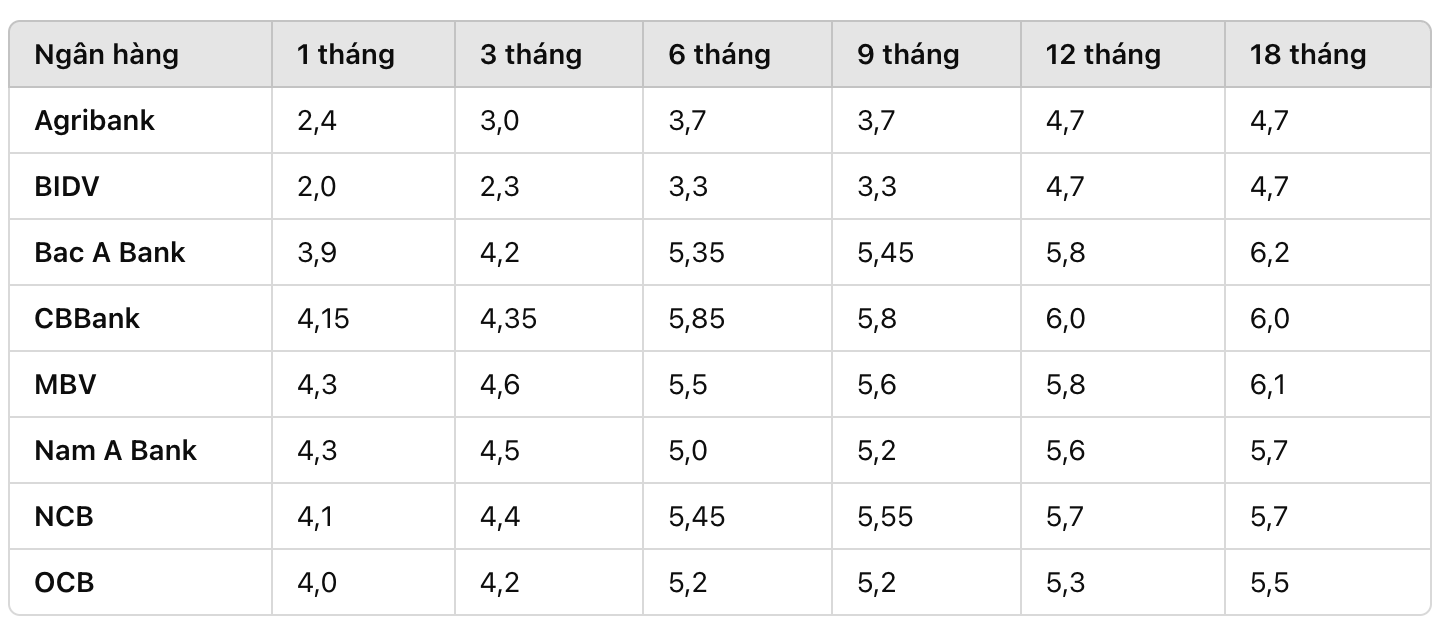

Deposit interest rates at banks will continue to increase slightly from mid-2024 and spread to longer terms. However, the differentiation between banking groups is quite clear. Small banks apply interest rates 1% to 3% higher than large banks for the same term. The highest deposit interest rates currently fall on 12- and 18-month terms, reaching over 6%/year at some banks.

In addition, the USD - VND exchange rate has remained high since the end of October last year, around 25,400 VND/USD, putting pressure on interest rates. Experts predict that the average deposit interest rate may increase by about 0.5% in 2025, from the current 5.2% to about 5.7%, without having too much impact on lending interest rates.

Nam A Bank reduces short-term interest rates

Nam A Bank has recently adjusted the interest rate for deposits with terms of less than 6 months down by 0.2% per year. From January 6, the interest rate for a 1-month term at Nam A Bank is only 4.3% per year, while the interest rate for terms from 2 to 5 months has been reduced to 4.5% per year.

Previously, Nam A Bank maintained short-term interest rates at 4.5% to 4.7% per year, close to the ceiling set by the State Bank. After the adjustment, this bank no longer holds the leading position in short-term interest rates. The highest interest rate for 3-5 month terms is currently 4.6% per year at MBV, with Nam A Bank in second place.