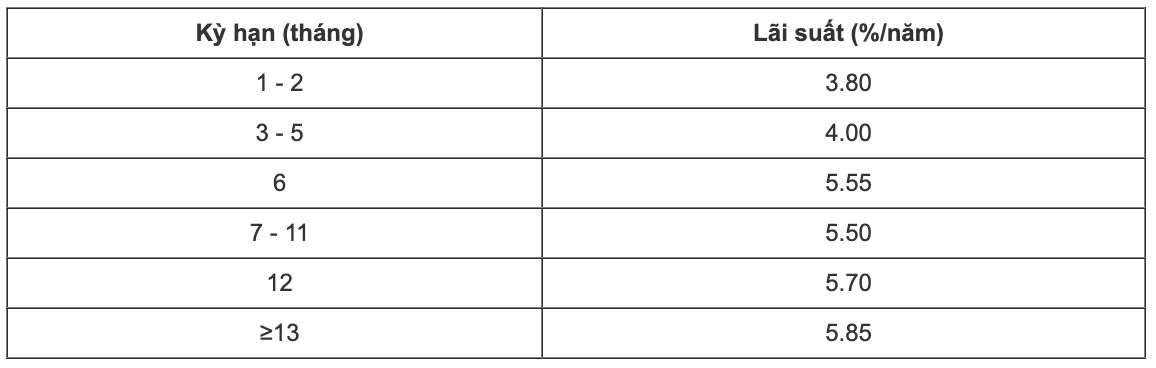

CBBank is listing the highest interest rate for a 6-month term at 5.55%/year when customers deposit money online. Currently, CBBank lists the highest interest rate at 5.85% when customers deposit money for 13 months or more.

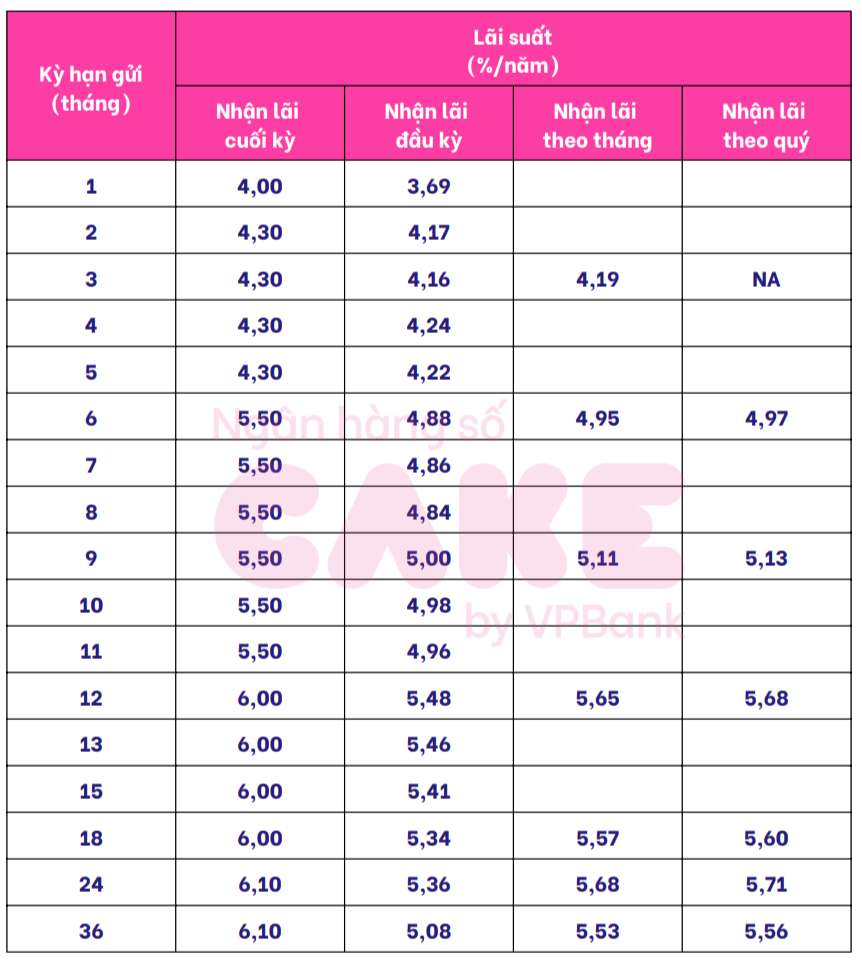

Cake by VPBank is listing the highest interest rate for a 6-month term at 5.5%/year when customers receive interest at the end of the term. For other terms, Cake by VPBank lists interest rates ranging from 3.7-6.1%/year.

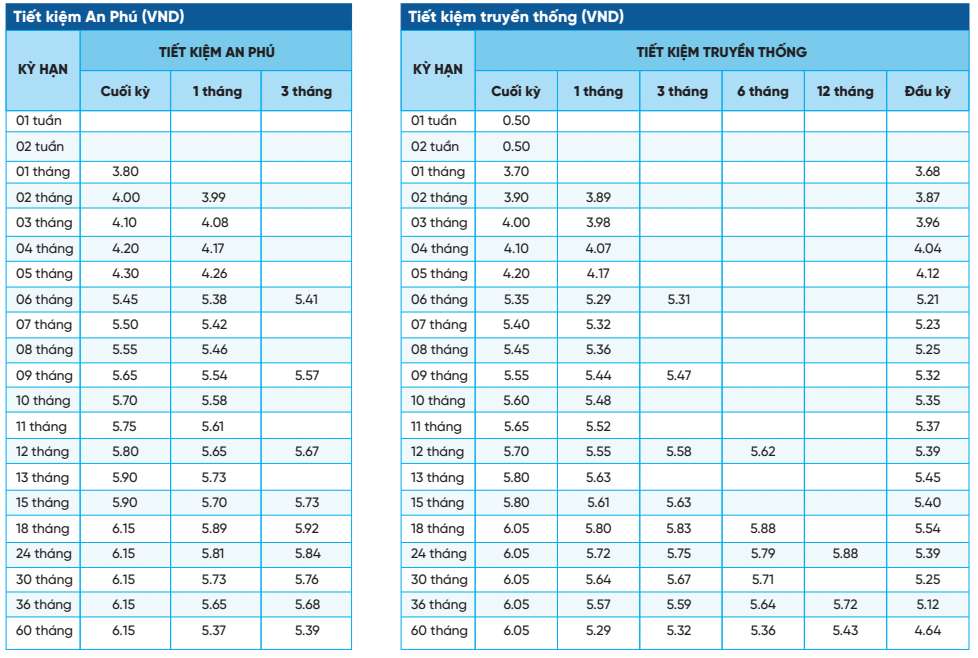

NCB is listing the highest interest rate for a 6-month term at 5.45%/year when customers deposit savings at An Phu. If customers deposit traditional money, they will only receive interest rates of 5.35%/year.

NCB is listing the highest interest rate at 6.15% when customers deposit money for 18-60 months.

How to receive interest if saving 300 million VND for 6 months?

You can quickly calculate bank interest using the following formula:

Interest = Deposit x interest rate (%)/12 months x number of months of deposit

For example, you deposit 300 million VND in Bank A, with an interest rate of 5.55% for a 6-month term. The interest you receive is estimated at:

300 million VND x 5.55%/12 x 6 months = 8.32 million VND.

So, before saving, you should compare savings interest rates between banks and interest rates between terms to get the highest interest.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles about interest rates HERE.