Update SJC gold price

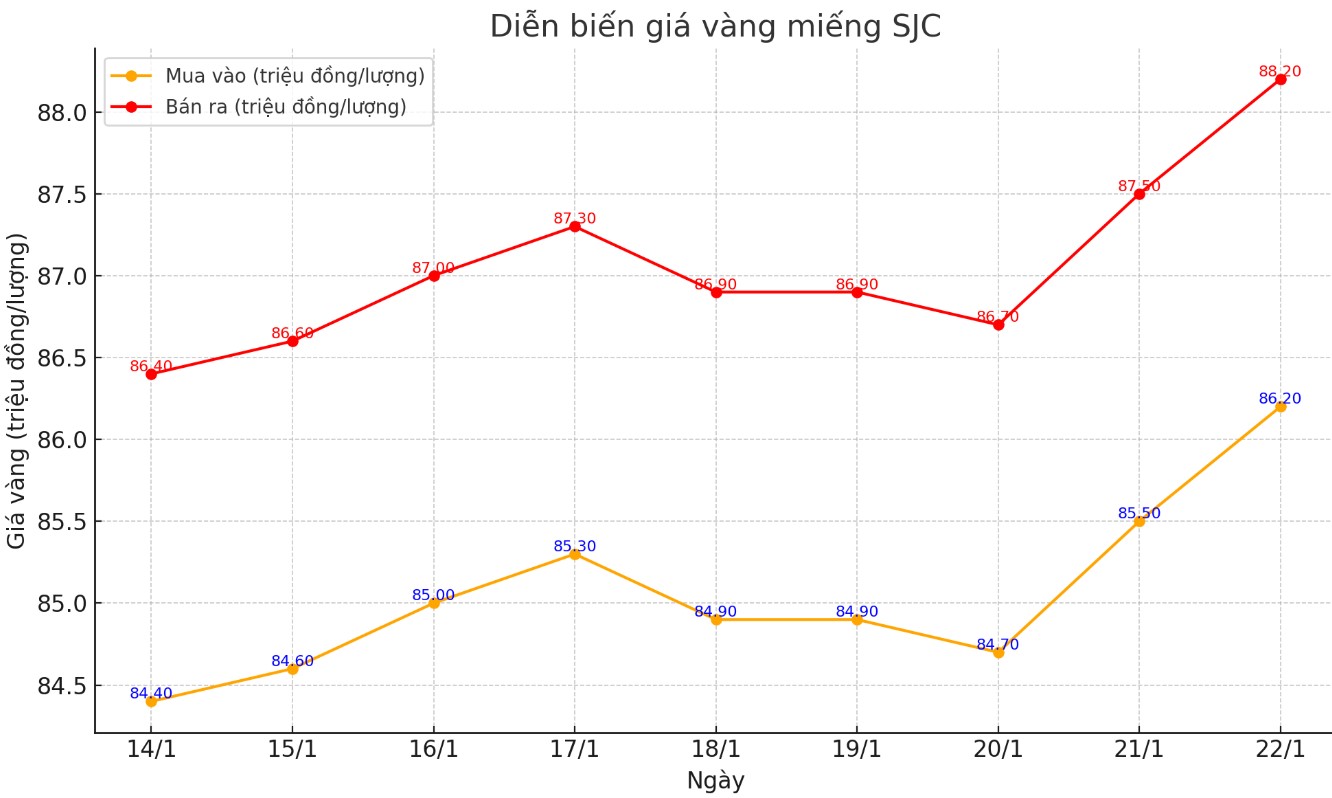

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.2-88.2 million/tael (buy - sell); an increase of VND700,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.2-88.2 million VND/tael (buy - sell); an increase of 700,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.2-88.2 million VND/tael (buy - sell); increased by 700,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

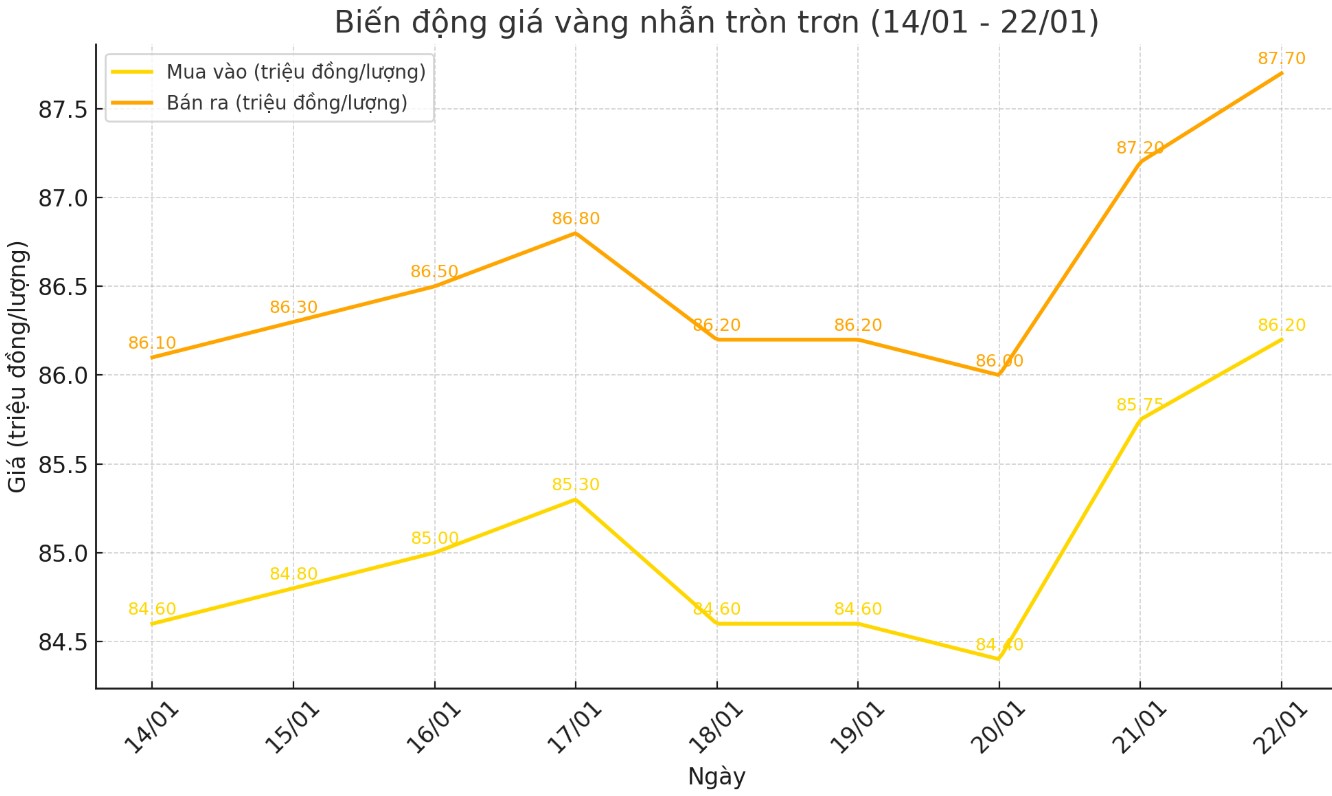

As of 6:30 p.m. today, the price of round gold rings listed by DOJI Group was at 86.2-87.7 million VND/tael (buy - sell); an increase of 450,000 VND/tael for buying and 500,000 VND/tael for selling compared to the closing price of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 86.2-88.15 million VND/tael (buy - sell), an increase of 700,000 VND/tael for both buying and selling compared to the close of yesterday's trading session.

World gold price

As of 6:05 p.m., the world gold price listed on Kitco was at 2,758.3 USD/ounce, up 38.2 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased in the context of the USD index decreasing. Recorded at 6:05 p.m. on January 22, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 107.610 points (down 0.23%).

Kitco - A positive start to January could signal another big year for gold prices, even after prices rose about 27% last year.

In his 2025 outlook report, Eric Strand, founder of precious metals company AuAg Funds, predicted that gold prices will surpass $3,000/ounce this year.

“We expect gold to break $3,000 an ounce during the year and could end higher, with a realistic target of $3,300 an ounce,” he said.

Strand's bullish price represents a 20% increase from current levels. Strand believes the new Trump administration could usher in a new era of economic stimulus and loose monetary policy.

“Both Donald Trump and Elon Musk have built their careers on massive borrowing and bold strategies. In the next four years, the same situation may occur: The government will do everything possible to avoid crises and promote growth. However, this will lead to monetary inflation. Strong inflation will create a financial environment that pushes up commodity prices, including gold,” Strand said.

While the US government debt has grown to record levels, now above $36 trillion, Strand noted that the US is not alone. He stressed that governments around the world continue to run deficits.

“The amount of money in the economy is increasing, but the real growth is negligible. This makes the value of each currency decrease,” he said.

The comments came as gold prices continued to trade near record highs against major currencies such as the euro, pound, yuan, Canadian dollar and Australian dollar.

Gold remains an attractive global safe-haven currency as deglobalization increases and countries diversify away from the US dollar.

There is still some uncertainty regarding the timing of US President Donald Trump’s plans to implement tariffs on major US trading partners, which has created uncertainty about the direction of the US dollar, which is the main short-term catalyst for gold prices, said Kelvin Wong, senior market analyst for Asia Pacific at OANDA.

A weaker dollar makes gold more attractive to holders of other currencies, which is considered a safe investment in times of economic and geopolitical uncertainty.Trump has vowed to impose tariffs on the European Union and said his administration is discussing a 10% tariff on Chinese imports starting Feb.

1.

See more news related to gold prices HERE...