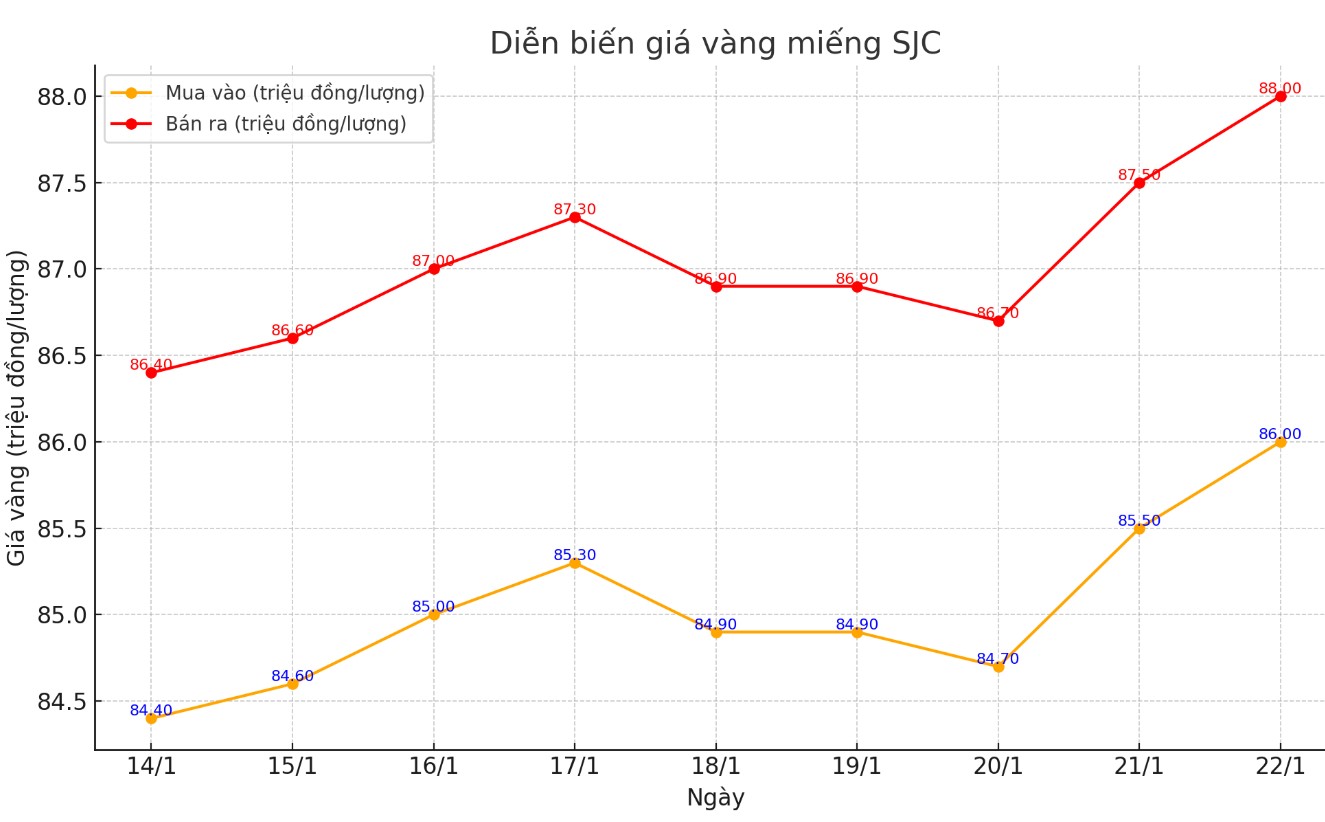

Update SJC gold price

As of 8:50 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 86-88 million VND/tael (buy - sell); an increase of 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 86-88 million VND/tael (buy - sell); an increase of 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 85.5-87.45 million VND/tael (buy - sell); increased 500,000 VND/tael for buying and increased 450,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market.

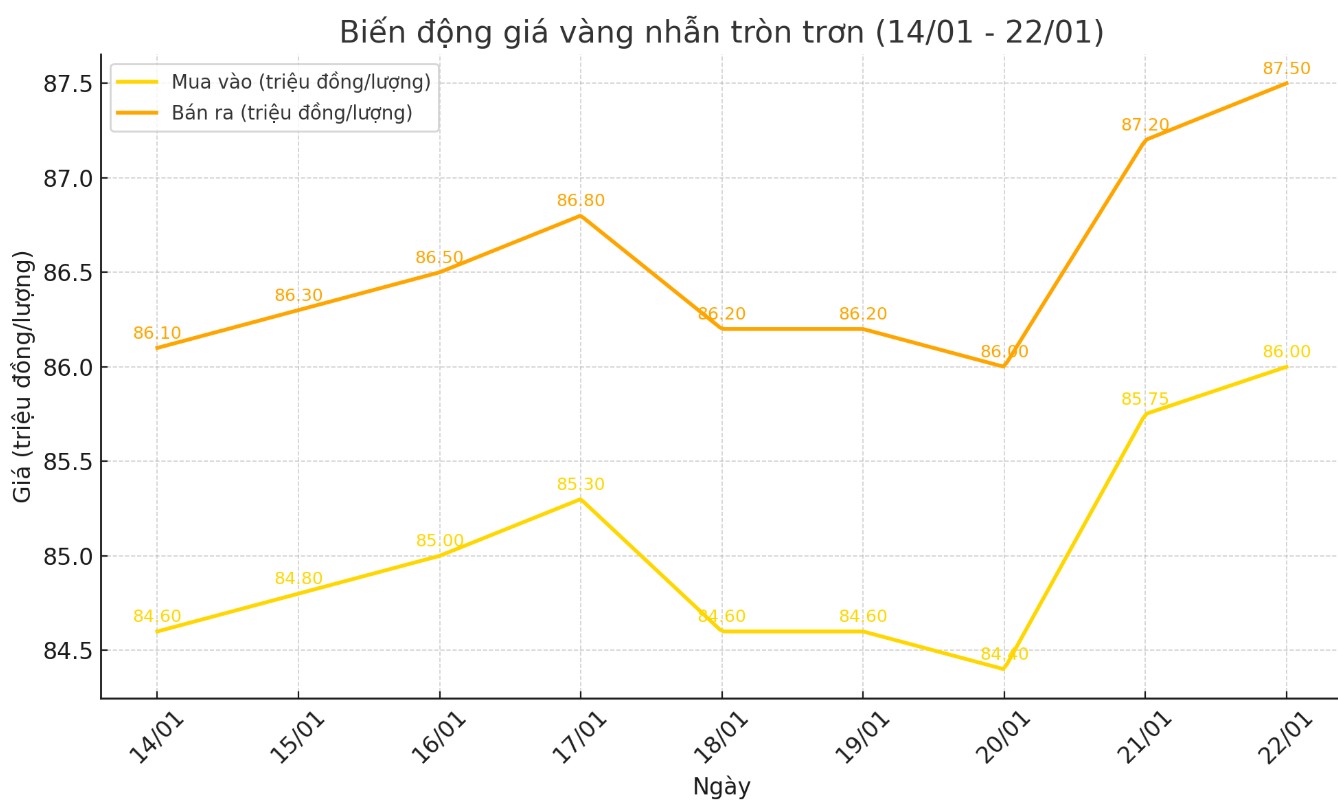

Price of round gold ring 9999

As of 8:55 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86-87.5 million VND/tael (buy - sell); an increase of 1.1 million VND/tael for buying and an increase of 1 million VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 85.5-87.45 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and 300,000 VND/tael for selling compared to early this morning.

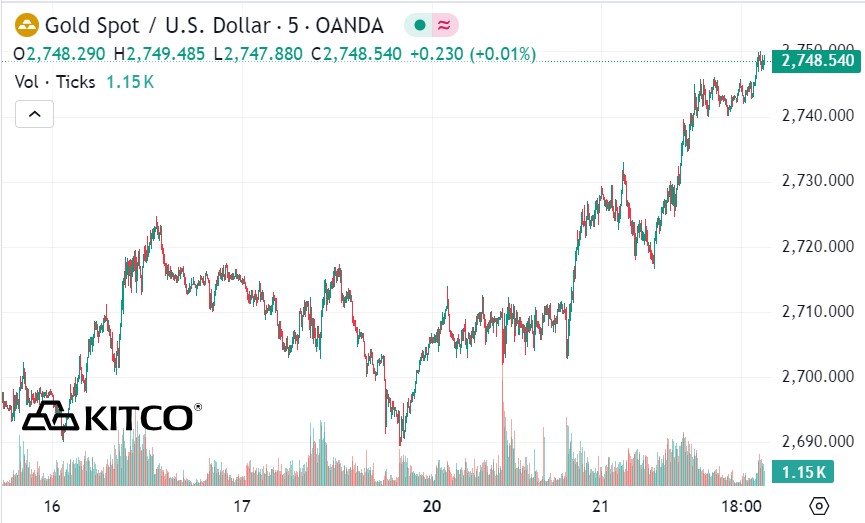

World gold price

As of 8:45 a.m., the world gold price listed on Kitco was at 2,748.5 USD/ounce, up 26.7 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased despite the increase in the USD. Recorded at 8:45 a.m. on January 22, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 107.920 points (up 0.15%).

Gold prices rose to their highest in more than two months, supported by a weaker dollar and investors flocking to safe-haven assets amid uncertainty surrounding the potential imposition of tariffs by US President Donald Trump, Reuters reported.

The new president has not provided any details on blanket tariffs or additional levies on key trading partners — a central plank of his campaign — but he has hinted at the possibility of imposing tariffs on goods from Canada and Mexico as early as Feb. 1.

In the first year of Mr Trump's first term in 2017, gold prices rose 13% for the year, marking its best annual performance in seven years.

Gold is seen as a safe investment during times of economic and geopolitical uncertainty. However, Mr Trump’s proposed policies are widely seen as inflationary, which could prompt the US Federal Reserve to maintain higher interest rates for longer to curb price pressures. Higher interest rates reduce the appeal of gold, an asset that does not yield interest.

"The market is probably also looking ahead to next week's Federal Open Market Committee (FOMC) meeting and Personal Consumption Expenditures (PCE) data, especially inflation numbers," said Peter Grant, vice president and senior metals strategist at Zaner Metals.

“I don’t think anyone expects the Fed to act next week, but certainly the policy statement will be closely watched for clues about the rest of the year,” he added.

In his 2025 outlook report, Eric Strand, founder of precious metals company AuAg Funds, predicted that gold prices will surpass $3,000/ounce this year.

“We expect gold to break $3,000 an ounce during the year and could end higher, with a realistic target of $3,300 an ounce,” he said.

Strand's bullish price represents a 20% increase from current levels. Strand believes the new Trump administration could usher in a new era of economic stimulus and loose monetary policy.

“Both Donald Trump and Elon Musk have built their careers on massive borrowing and bold strategies. In the next four years, the same situation may occur: The government will do everything possible to avoid crises and promote growth. However, this will lead to monetary inflation. Strong inflation will create a financial environment that pushes up commodity prices, including gold,” Strand said.

See more news related to gold prices HERE...