Update SJC gold price

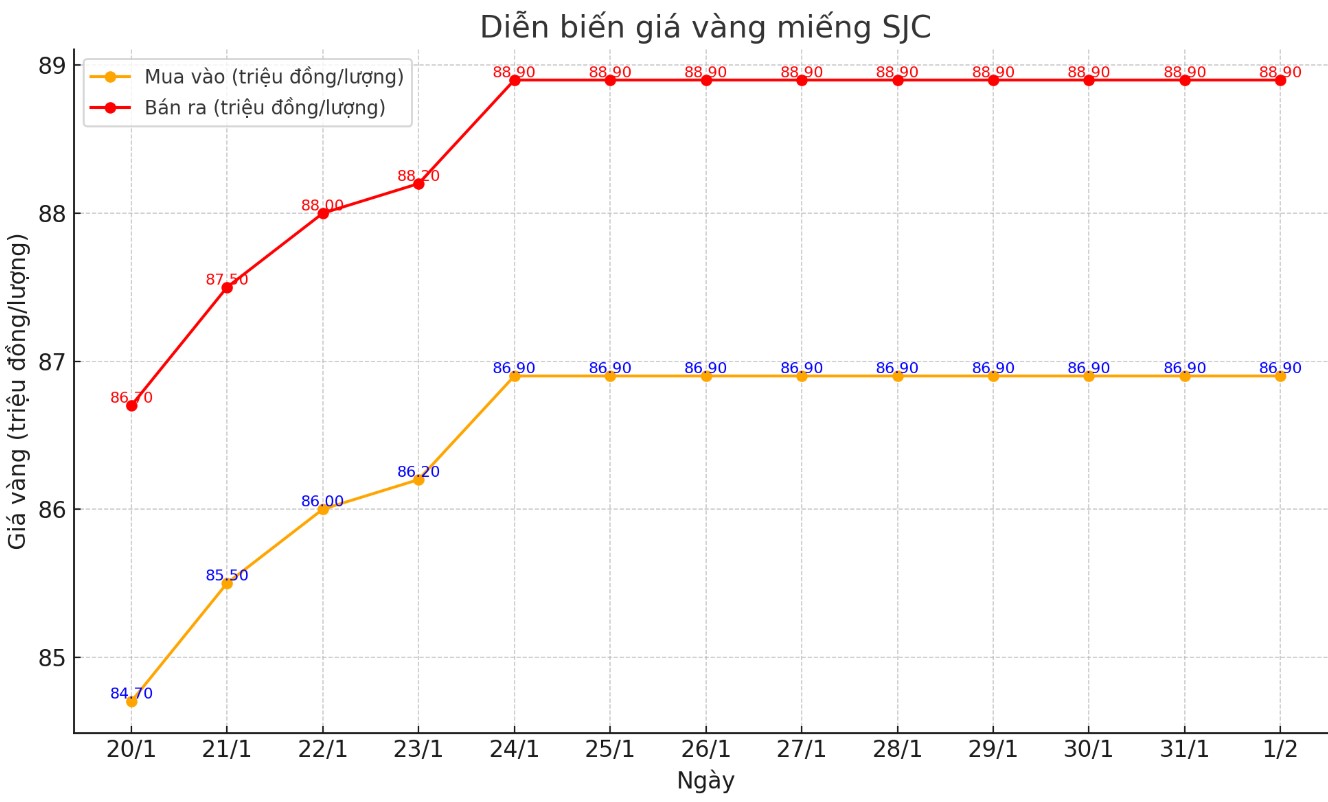

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.9-88.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); increased by 100,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

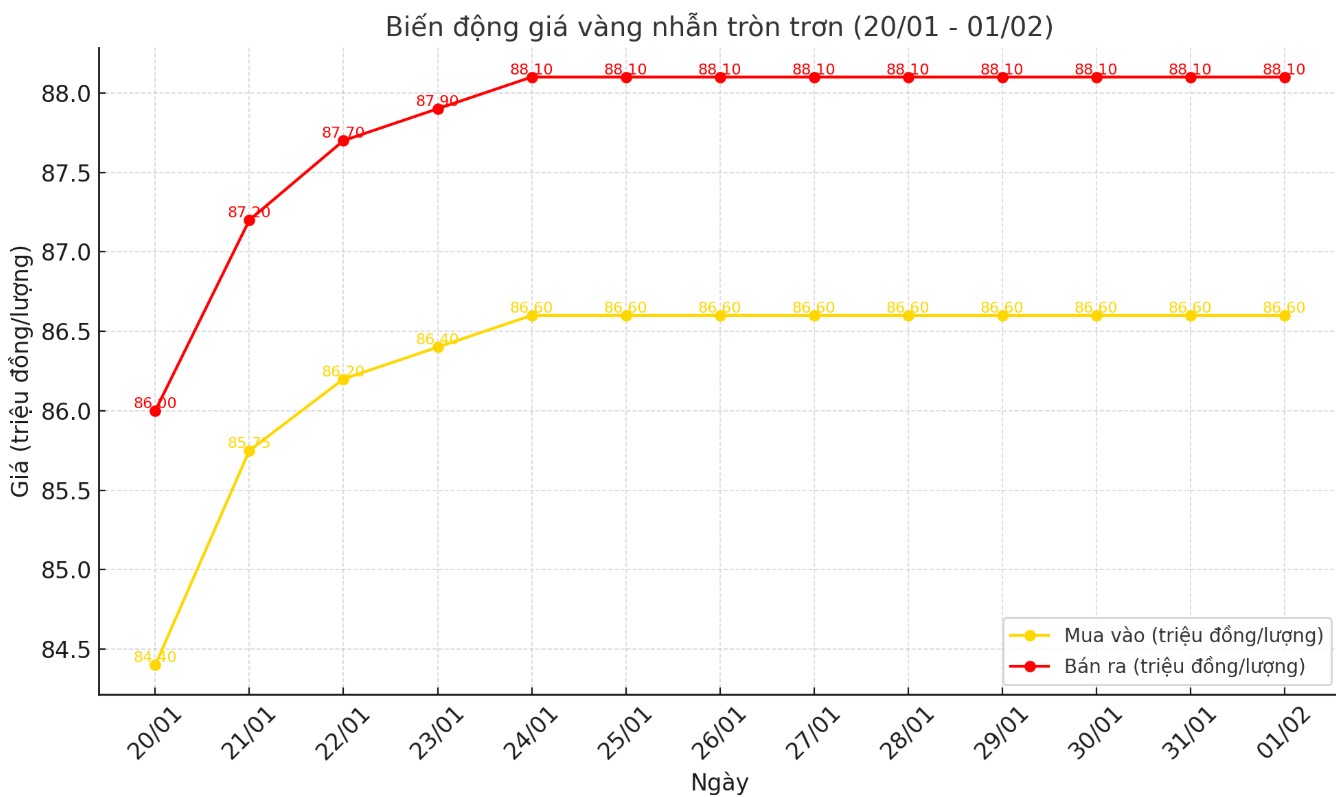

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.6-88.1 million VND/tael (buy - sell); both buying and selling prices remain the same compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to early this morning.

World gold price

As of 6:00 a.m. on February 2, the world gold price listed on Kitco was at 2,797.9 USD/ounce, down 9.6 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices fell slightly as the USD index increased. Recorded at 6:00 a.m. on February 2, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.220 points (up 0.55%).

Gold prices remain supported by concerns about tariffs, inflation and safe-haven demand. Many experts have very positive views on short-term gold prices.

Daniel Pavilonis, senior commodities broker at RJO Futures, analyzed the short-term factors that caused gold prices to surge this week.

“I think the main reason is the sharp decline in bond yields and the US dollar, although the US dollar seems to be inching up a bit but is still far from its peak,” he said.

“In addition, the possibility of tariffs that could increase inflation, the tariff war with Canada, Mexico, and possibly China. So the market is seeing money looking to gold as a safe haven. The market is really bullish, any little reason can drive demand for gold, towards the ultimate target of $3,000 an ounce. That level seems to be very close. I think psychologically it is like a magnet, and any news right now can help gold get closer to that.”

Pavilonis believes that even if the tariff issues are resolved, the key factors that have pushed gold to record highs in recent years will continue to be in place. “I think gold will hit $3,000 an ounce by the end of this quarter,” he predicted. “However, depending on how the tariffs play out, we could also see some profit-taking that would take gold down to around $2,750 an ounce, or to the 50-day or 100-day moving average, before it recovers.

The factors driving gold prices will not change, unless the situation becomes too tense and exchanges are forced to raise margin margins to abnormally high levels, then there could be a sell-off.”

“Up,” predicted Darin Newsom, senior market analyst at Barchart.com. “The volatility created by the new U.S. administration is not going away anytime soon. In fact, it’s only going to get worse.

It will take a long time for the markets and the media to become numb and stop paying attention to the noise. Until then, continue to expect gold (along with silver and other precious metals) to attract safe-haven flows, even as the market sets new record highs,” said Darin Newsom.

See more news related to gold prices HERE...