According to some economic experts, the gold market continues to seek a balance and could attract bottom-fishing buying power as retail inflation falls sharply, creating more room for the US Federal Reserve (FED) to cut interest rates this year.

The US Department of Labor announced on Thursday that the entire Producer Price Index (PPI) fell 0.5% in April, after falling 0.4% in March. The latest inflation data was much lower than expected, as economists forecast a 0.2% increase.

Over the past 12 months, wholesale retail inflation increased by 2.4%, also lower than the forecast of 2.5%.

Excluding food and energy prices - which fluctuated strongly, the core PPI decreased by 0.4% in April, after falling 0.1% in March. Meanwhile, economists are forecasting a 0.1% increase.

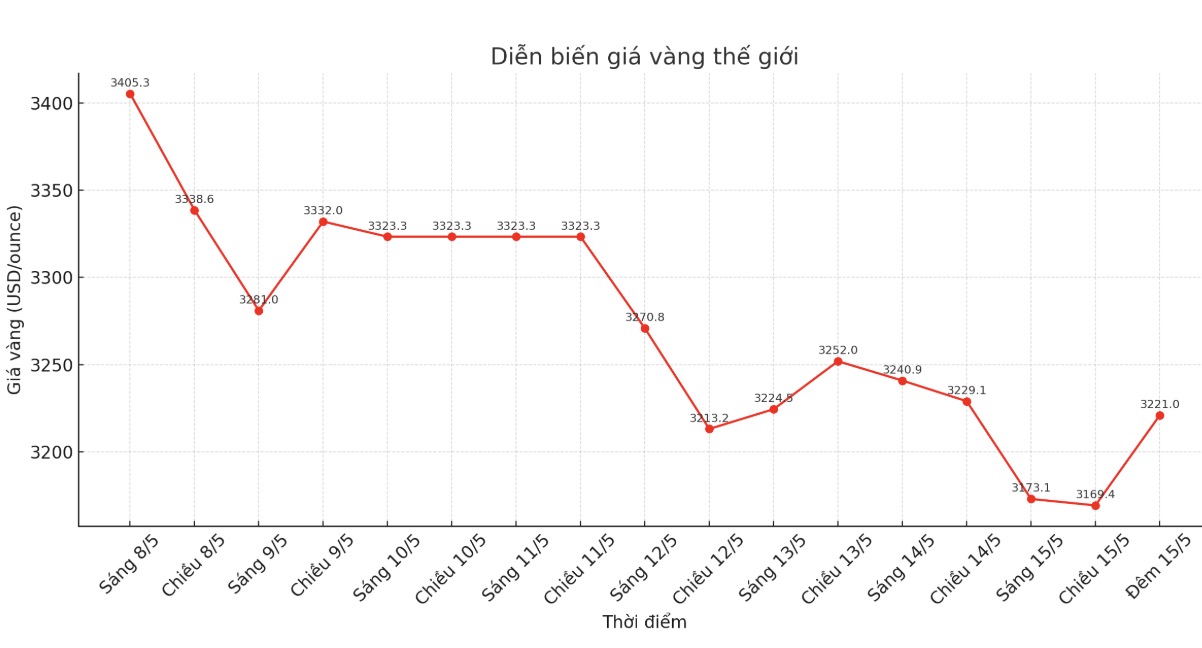

Gold prices have recovered strongly from their overnight lows. Some analysts believe that weak inflation data could add upward momentum for the precious metal. The last spot gold was traded at $3,182 an ounce, up 0.19% on the day.

The latest economic data is good news for consumers. PPI is seen as an early indicator of inflation, as manufacturers often shift input costs higher to customers.

According to the US Department of Labor, US labor market data is in line with forecasts, with the number of first-time unemployment claims unchanged at 229,000.

In the week ended May 10, the number of unemployment benefit applications adjusted seasonally for the first time was 229,000; in line with experts' expectations. Last week's figure was also revised up to 229,000.

As the number of unemployment benefit applications has not increased sharply, the market has found that the US labor market is still relatively strong, not weak enough for the Fed to rush to cut interest rates, but not too strong to put pressure on gold. This has caused gold prices to fluctuate steadily.