In an interview with Kitco News, Nitesh Shah - Director of European Commodity and macroeconomic Research at WisdomTree said that in addition to global trade instability, the next major risks he sees for the economy are US monetary policy and the independence of the US Federal Reserve (FED).

FED Chairman Jerome Powell has faced a lot of criticism from President Donald Trump for his monetary policy stance. Up to this point, central banks have maintained a neutral and cautious policy in cutting interest rates, as inflation risks continue to increase in the context of relatively stable growth.

Last week, President Trump called Mr. Powell " Foolish" after the Fed reiterated that it was in no rush to loosen monetary policy. Although the conflict continues, Trump said he has no intention of sacking Powell. However, Mr. Powell's term will end in May 2026.

Mr. Shah said that gold could move positively if investors begin to question the Fed's independence as Mr. Trump begins to look for Mr. Powell's replacement. He noted that the market could lose confidence in the Fed as the Trump administration continues to pressure the central bank to cut interest rates.

If the independence of the Federal Reserve begins to be questioned, it is likely that its institutional strength will weaken. Gold could see a strong rally, as it is counterproductive to the statute of limitations something that could be manipulated by central banks. At a time of great instability in monetary policy and geopolitics as it is now, demand for gold will increase, he said.

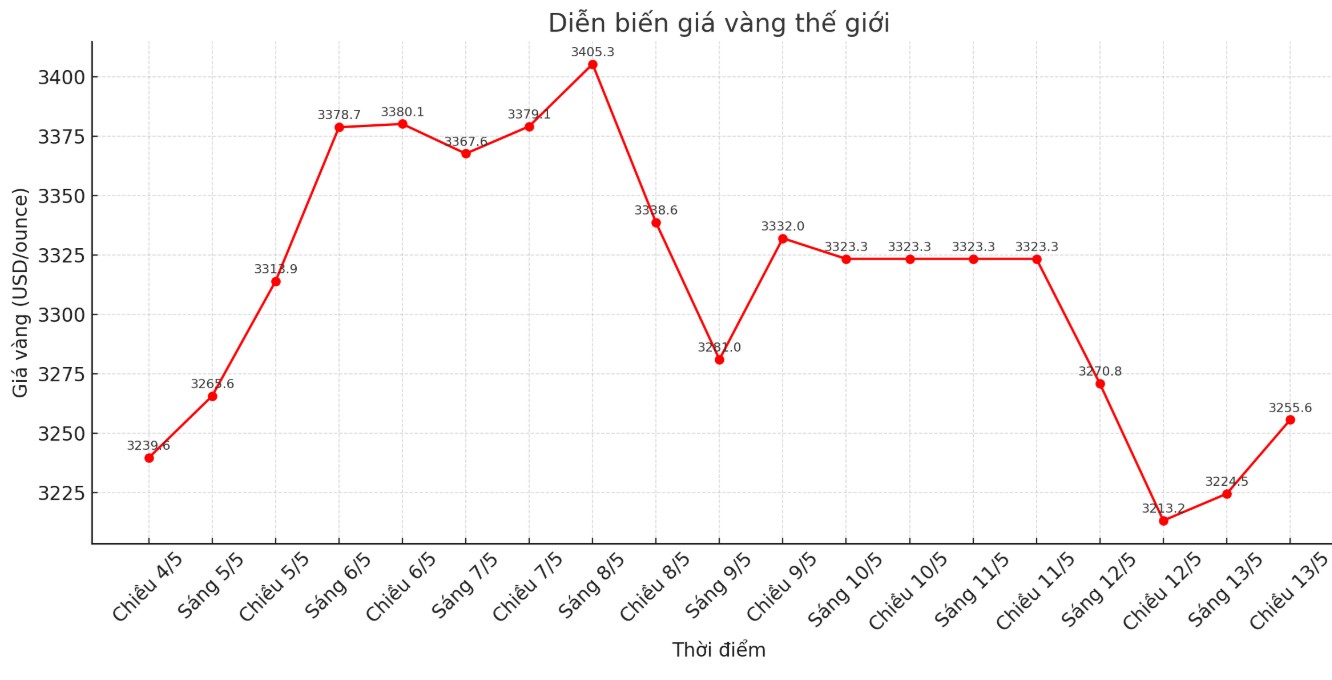

While gold is still trading much lower than the all-time high of $3,500/ounce last month, Shah said he expects it will be just a matter of time before gold finds support and sets new price records.

In the updated price forecast, Mr. Shah's model gives a base scenario that gold will reach 3,610 USD/ounce in the first quarter of 2026. However, he added that with too much uncertainty in the financial market, risks tend to increase.

We believe that demand for speculation in gold will continue to increase in the context of rising recession and inflation risks. It took gold 14 years to rise from $1,000/ounce to $2,000/ounce but it took just over a year to rise from $2,000/ounce to $3,000/ounce. Its not hard to imagine another $1000 added to the current price, bringing gold above $4,000 an ounce, he wrote in his latest report.

Along with the Fed's independence, Mr. Shah said that the US economy is facing serious problems with reputation. He noted that even as the global trade war is resolved, the USs reputation as a reliable trading partner has been damaged.

Although Mr. Shah sees upside potential for gold, he also admits that there are some downside risks. However, he said that in the current context, any price adjustment will be at a limited level.

In the negative scenario, Mr. Shah predicted that gold prices could fall to $2,700/ounce.

Looking at the scenarios, most of them show the possibility of an upward trend. Even if the only scenario shows a decrease in prices, the decrease is not large. Because there is so much uncertainty, I think investors are somewhat protected from the risk of depreciation. Gold will continue to be a necessary strategic asset, he said.