Gold prices increased on Monday thanks to a weakening USD and safe-haven cash flow in the context of concerns about global trade conflicts, while investors waited for more signals about the interest rate policy of the US Federal Reserve (FED).

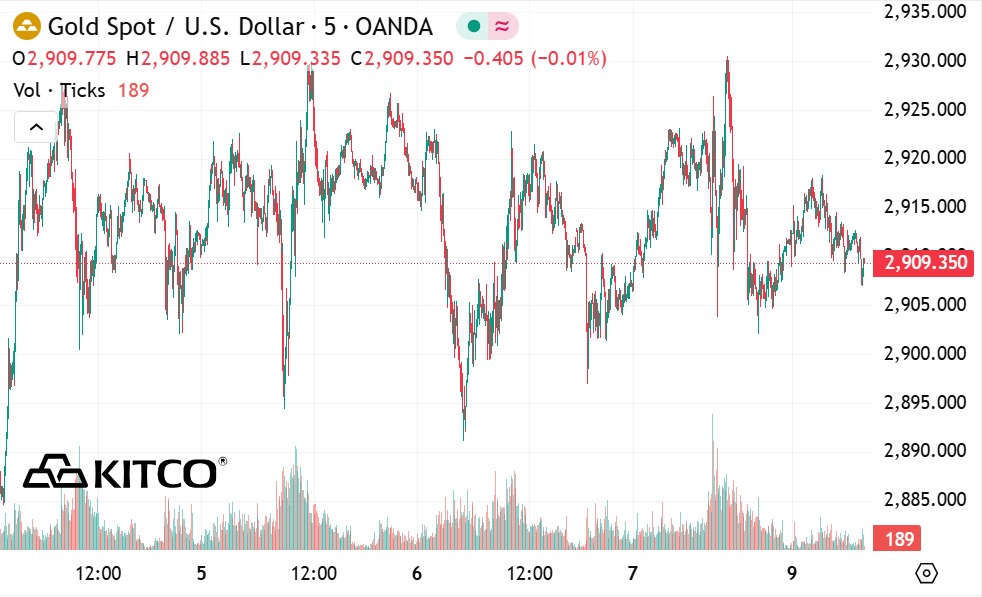

At 4:47 a.m. GMT, spot gold rose 0.1% to $2,911.71/ounce, while US gold futures rose 0.1% to $2,917.9/ounce.

Kyle Rodda - a financial market analyst at Capital.com - commented: "The risk of a slump in growth is increasing, while US foreign policy is also a factor of instability, thereby boosting demand for gold. I think $3,000 an ounce will soon break maybe in the next few months.

US President Donald Trump refused to predict whether the US economy will fall into recession, as the stock market is concerned about his tax moves on Mexico, Canada and China related to fentanyl.

The constantly changing tax declarations have caused wall Street to stir, as investors believe that the Donald Trump administration has continuously changed its stance on tariffs on trading partners, causing confusion instead of bringing stability.

Last week, Mr. Donald Trump imposed a 25% tariff on imports from Mexico and Canada, and increased the tariff on Chinese goods. However, he later waived many imports from Mexico and some from Canada for a month, creating market instability and raising concerns about inflation and US economic growth.

Investors are awaiting data from the US Consumer Price Index (CPI) on Wednesday and the US Producer Price Index (PPI) on Thursday.

Gold is considered a safe haven asset against political risks and inflation, but higher interest rates may reduce the attractiveness of this precious metal due to no interest.

Meanwhile, spot silver fell 0.4% to 32.42 USD/ounce, platinum increased 0.2% to 965.15 USD/ounce, and palladium decreased 0.1% to 949.21 USD/ounce.

Important economic data for the week

Tuesday: Number of US job positions (JOLTS).

Wednesday: US consumer price index (CPI), monetary policy decision of the Bank of Canada.

Thursday: US Producer Price Index (PPI), weekly jobless claims.

Friday: University of Michigan Preliminary Consumer Confidence Index.