Neils Christensen - an analyst at Kitco News shared: "Last week, we warned that the gold market could be under selling pressure in the short term as speculators take profits due to weak growth.

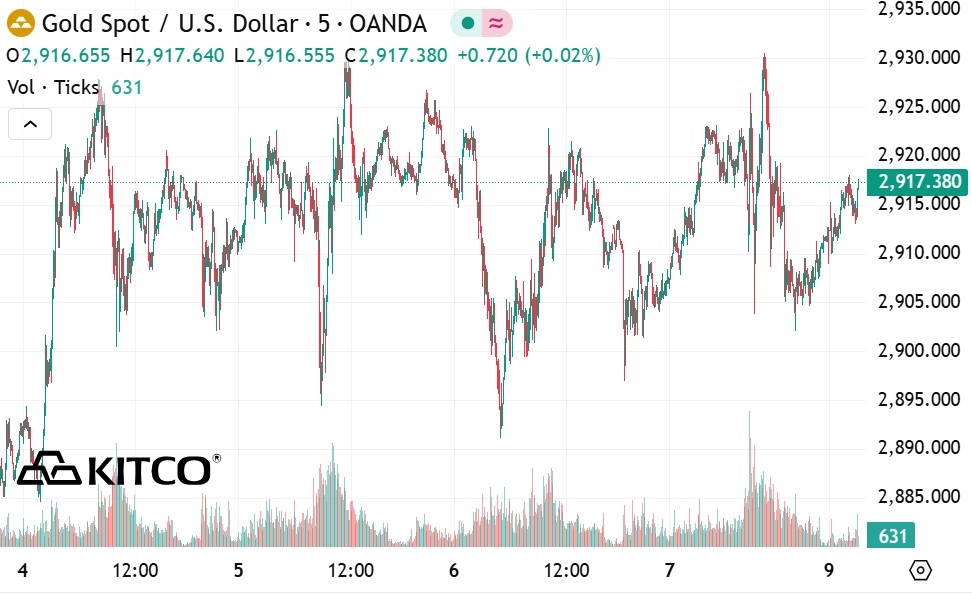

Although not yet completely off the risk, gold prices still showed solidity when they ended the week above $2,900/ounce".

Neils Christensen said that gold continued to follow the trend from last year, as short-term corrections were quickly bought in. Since the rally began in October 2023, gold's average weekly decline has been around 0.6%. In the past 75 weeks, gold has only had 32 weeks of decline above 1%, of which only 6 weeks have decreased above 3% and 2 weeks have decreased to 5%.

At the same time, since the start of this rally, gold has only had nine consecutive weekly declines; only two adjustments lasting more than two weeks.

"In short, gold's corrections are often short and do not fall deeply. So if you want to buy gold when prices drop, you have to be quick" - Neils Christensen commented.

It is not surprising that gold maintains a strong uptrend. The global economy is facing many fluctuations and last week was no exception.

Neils Christensen said the new week had begun with the US withdrawing from the role of global police, forcing Europe to urgently support Ukraine in the war with Russia. As a result, the European Union has launched a spending package of nearly €1,000 billion to strengthen the defence of member states.

This means that the large budget deficit will continue to grow. As the global financial deficit increases, the purchasing power of legal entities will weaken, leading to higher inflation and slower growth, creating an ideal environment for gold.

North America also experienced a volatile week as trade tensions between the US, Mexico and Canada escalated over two days, strongly affecting the stock market.

Although the S&P 500 index recovered slightly, it still closed the week down 3% - the strongest decline since September last year.

Economists say that the instability surrounding the US import tax policy is affecting the psychology of investors and businesses. More and more business leaders are concerned that Donald Trump's continuous changes in tariff policies are creating great fluctuations, making it difficult to plan and invest in the long term.

Over the past few months, analysts have warned that tariffs and global trade wars will push up prices, slow growth, creating a favorable sluggish inflation environment for gold. In addition, the low correlation between gold and other assets makes gold an attractive safe haven.

See more news related to gold prices HERE...