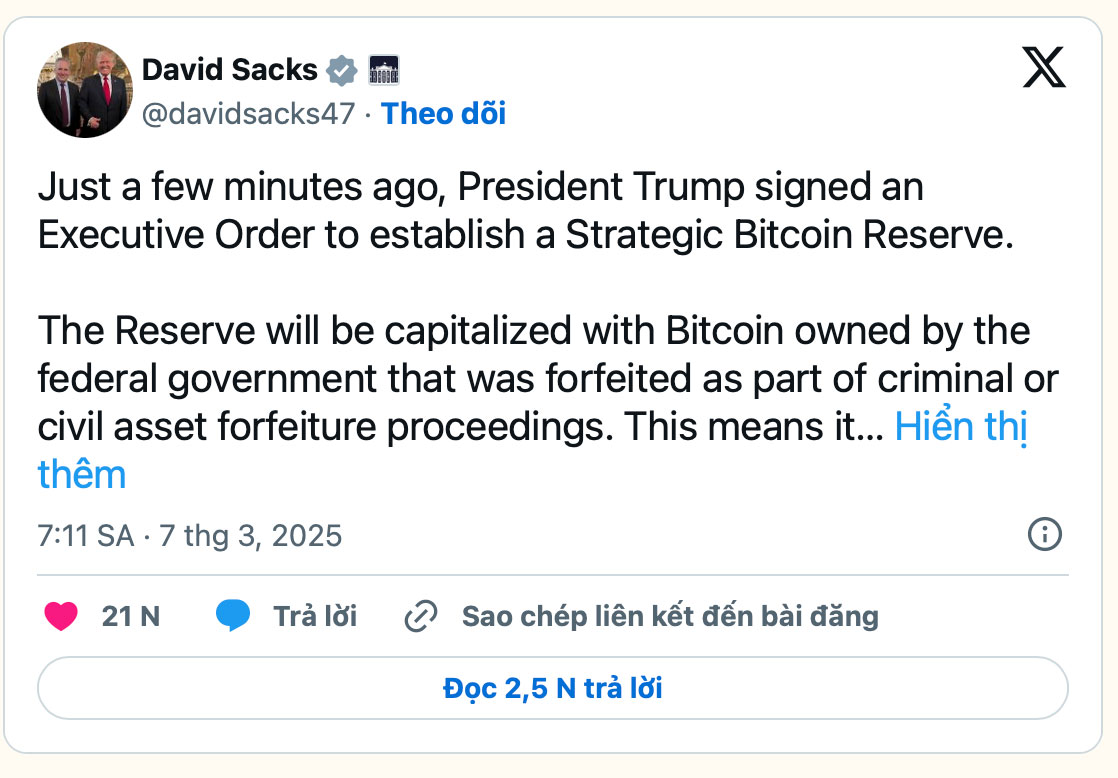

On the morning of March 7, 2025 (Vietnam time), Mr. David Sacks - Crypto and AI Policy Advisor to the US President - said on X, Mr. Trump has just signed an executive order to establish a National Strategic Bitcoin Reserve Fund.

However, contrary to initial expectations, the market reacted negatively to this decree. About an hour after the announcement, Bitcoin prices plummeted from $91,000 to below $85,000 at times. However, by 9:30 a.m. the same day, the BTC had slightly increased to over 86,000 USD.

The main reason for this sell-off is that the Bitcoin Reserve will only use the BTC that the US government is currently holding (about 200,000 BTC according to data from Arkham Intelligence), instead of planning to buy more from the market.

"The fund will be funded in bit bit bit bitons owned by the federal government, which are collected from confiscation of property in criminal or civil cases. This means it will not consume the budgets of the American people," Mr. Sacks wrote in X.

"The government will not sell any Bitcoin that is put into the Reserve Fund. Instead, they will be held as a store of value, similar to how gold is stored in Fort knox."

According to analysts, this decline comes from investor disappointment when the decree did not include the policy of buying more Bitcoin. The market has expected the US government to actively collect Bitcoin, creating strong upward momentum.

In addition, the decree did not provide specific details on how to operate the Bitcoin Reserve Fund, making market sentiment cautious. Traders are concerned that this move is only symbolic, not enough to create a long-term impact on Bitcoin prices.

Although Bitcoin is under pressure to regulate, many experts still believe that Trump's decree is a strategic step, affirming the role of Bitcoin in the US financial system.

Currently, the important support level for Bitcoin is at 83,500 USD. If prices continue to fall below this level, the sell-off momentum may increase. Conversely, if the market absorbs selling pressure well, Bitcoin can recover and retest the 88,000 - 90,000 USD area.

Investors will continue to monitor the next moves from the White House, especially funding measures for the Bitcoin Reserve Fund. If the US government plans to collect Bitcoin in the future, this could become a new driving force for the market to recover.