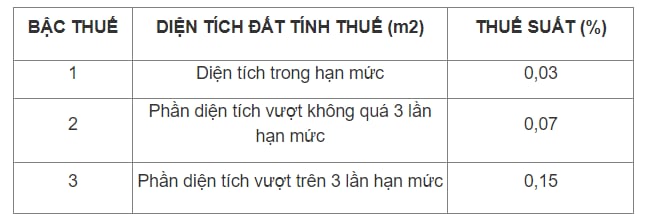

According to Article 7 of Circular 153/2011/TT-BTC, the tax rate for non-agricultural land use is prescribed as follows:

1. Residential land:

- Residential land including land used for business purposes is subject to the following progressive tax schedule:

- Land for multi-storey houses with many households, apartment buildings, and underground construction works applies a tax rate of 0.03%.

2. Land for non-agricultural production and business, non-agricultural land specified in Article 2 of Circular 153/2011/TT-BTC used for business purposes is subject to a tax rate of 0.03%.

3. Land used for improper purposes or land not used in accordance with regulations is subject to a tax rate of 0.15%.

4. Land of investment projects in phases as registered by investors approved by competent state agencies shall apply a tax rate of 0.03%.

5. Encroached land is subject to a tax rate of 0.2%.