PNJ plummets, liquidity skyrockets

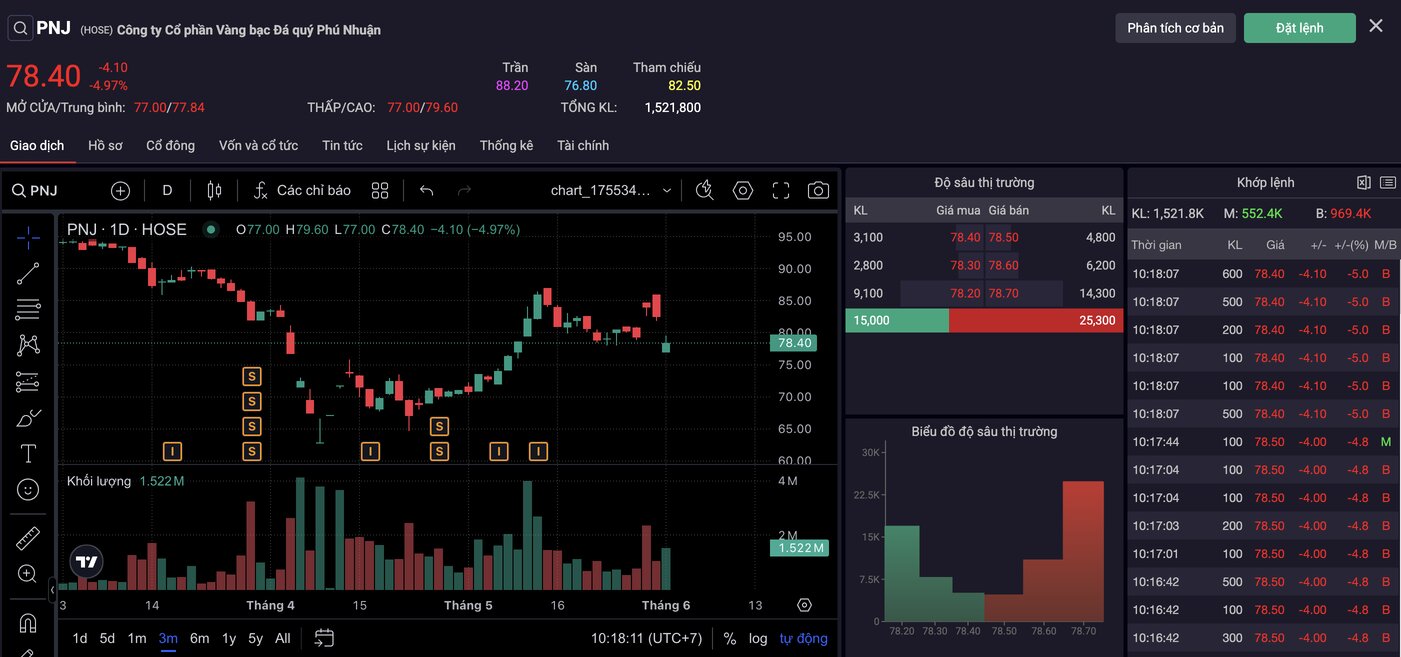

As of 10:13 a.m., PNJ stock (HOSE), of Phu Nhuan Jewelry and Gold Joint Stock Company, was trading at 78.6 thousand VND/share, down sharply by 3.9 thousand VND (-4.73%) compared to the reference level of 82.5 thousand VND. During the session, the stock price fluctuated within the range of 77,000 VND - 79.6 thousand VND, with a total trading volume reaching 1,494,400 shares, higher than the average of the last 10 sessions (992,450 shares).

Order book data recorded that selling pressure continued to dominate, with the number of stocks waiting to be sold at 78.6 thousand VND; 78.7 thousand VND and 78.8 thousand VND up to more than 31,000 stocks, while buyers were cautious, the buying volume at significantly lower prices.

Negative short-term trends

On the technical chart, PNJ prices are currently below the two moving averages of MA10 (80.55) and MA50 (77.53) - a signal that the downtrend is still dominant in the short term. The long decline in candle trees and increased volumes shows increased selling pressure, especially in the context of unstable market sentiment.

The nearest support zone around 77,000 VND is being tested, and if it is broken, PNJ can continue to decrease sharply to the 75 thousand VND - 76,000 VND zone in the short term.

Market sentiment affected by inspection conclusions

One of the main reasons for PNJ's sharp decline is the concern after the inspection conclusion of the State Bank announced on May 30, 2025. Accordingly, PNJ, along with Bao Tin Minh Chau, SJC... were discovered to have committed a number of violations related to reporting procedures, gold transactions, taxes and money laundering prevention.

Although the company has taken remedial measures, this information still negatively affects the psychology of individual investors - the group that accounts for a large proportion of PNJ's liquidity.

The gold market and international factors also put pressure

The global financial market is fluctuating after US President Donald Trump's strong statement that China violated the trade agreement (May 30, 2025) raised concerns about the possibility of a trade war returning. This causes strong fluctuations in international gold prices - indirectly affecting gold enterprises such as PNJ.

In Vietnam, the State Bank has just conducted a large-scale inspection of gold trading activities, in which many organizations have been required to adjust their operations and tighten procedures. The gap between domestic and world gold prices remains high, continuing to be a barrier for businesses.

Despite the decline in market prices, PNJ's financial indicators are still at a positive level:

EPS: 6,080 VND

P/E: 12.96 (reasonable valuation)

Beta: 1.22 (higher fluctuations than the general market)

Market capitalization: VND 26,626.9 billion

The main reason for PNJ's sharp decline is the negative impact of the inspection conclusion - increasing legal concerns among investors. However, the current price range is also approaching the strong support level, and stocks are being traded at a reasonable valuation range.

Long-term investors can consider disbursing a portion if they believe in PNJ's ability to overcome immediate difficulties.

Short-term investors should wait for clear signs of recovery, especially when there is confirmation from organizational cash flow or positive information from management agencies.

According to the financial report for the first quarter of 2025, the company's net revenue reached VND 9,635 billion (down 24% yoy) and profit after tax reached VND 678 billion (-8% yoy).

Revenue structure changed in the first quarter with the jewelry retail segment accounting for 69%, the jewelry wholesale segment accounting for 12% and the 24K gold segment falling by 18%. This change in structure is in line with the company's orientation to become a jewelry retail enterprise.