On the afternoon of February 1st, Kim Seon Ho's management company - Fantagio - said: "Currently, Kim Seon Ho is operating under an exclusive contract signed under a personal name with Fantagio, and within the framework of contract relations as well as current activities, we always fully and seriously comply with legal procedures and tax obligations.

Fantagio explained clearly about Kim Seon Ho's private company: "Kim Seon Ho's one-person legal entity is mentioned in articles established to serve production and activities related to stage drama, not created for the purpose of intentionally saving taxes or evading taxes.

However, since Kim Seon Ho moved to Fantagio, the actual business operations of this legal entity have been suspended for more than a year, and are currently undergoing dissolution procedures in accordance with legal regulations and related procedures.

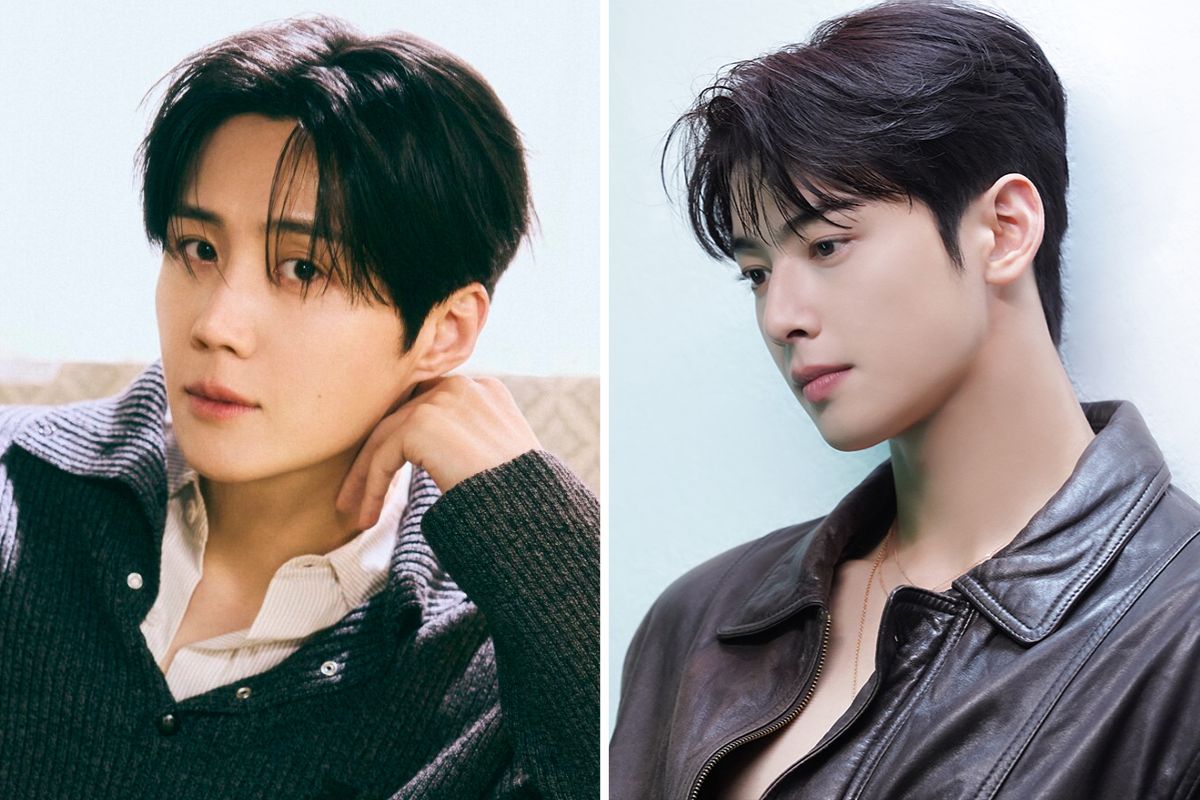

Earlier the same day, Sports Kyunghyang questioned whether Kim Seon Ho showed signs of tax evasion, with the establishment of a family company similar to the case of Cha Eun Woo (Astro).

According to the newspaper, this legal entity was established in January 2024, with Kim Seon Ho and family members holding executive positions. The company is said to have unusual signs such as addresses matching Kim Seon Ho's home address; paying fake labor wages; abusing company credit cards for personal purposes.

Meanwhile, Cha Eun Woo - a singer and actor also under Fantagio - has recently also been involved in tax evasion allegations.

The tax authorities believe that Cha Eun Woo used the legal entity of the company in his mother's name to evade personal income tax, and have announced the recovery of about 20 billion won. In particular, the fact that the registered address of this legal entity is a restaurant on Ganghwa Island operated by his parents further intensifies the controversy.

Về vụ việc của Cha Eun Woo, công ty quản lý Fantagio phản hồi rằng: “Các vấn đề hiện đang trong giai đoạn xác minh sự thật theo quy trình của cơ quan thuế. Công ty và nghệ sĩ đang hợp tác đầy đủ trong phạm vi cần thiết. Trong tương lai, khi có kết luận pháp lý hoặc hành chính rõ ràng, chúng tôi sẽ thực hiện các biện pháp cần thiết một cách có trách nhiệm theo kết quả đó”.

Bản thân Cha Eun Woo cũng lên tiếng tuyên bố “sẽ thành khẩn hợp tác trong các thủ tục liên quan đến thuế sắp tới, và sẽ khiêm tốn chấp nhận kết quả khi có phán quyết cuối cùng, thực hiện đầy đủ trách nhiệm tương ứng”.