1. People with income from salaries and wages not yet equal to the payable level

According to Clause 1, Article 7 of Circular 111/2013/TT-BTC, Clauses 1, 2, 3, Article 9 of Circular 111/2013/TT-BTC and Resolution 954/2020/UBTVQH14, individuals without dependents will not need to pay income tax when their total income from wages and salaries is under 11 million VND after deducting the following deductions:

- Insurance contributions, voluntary pension funds, charitable contributions, humanitarian contributions, and study incentives.

- Income exempt from personal income tax.

- Payments not subject to personal income tax.

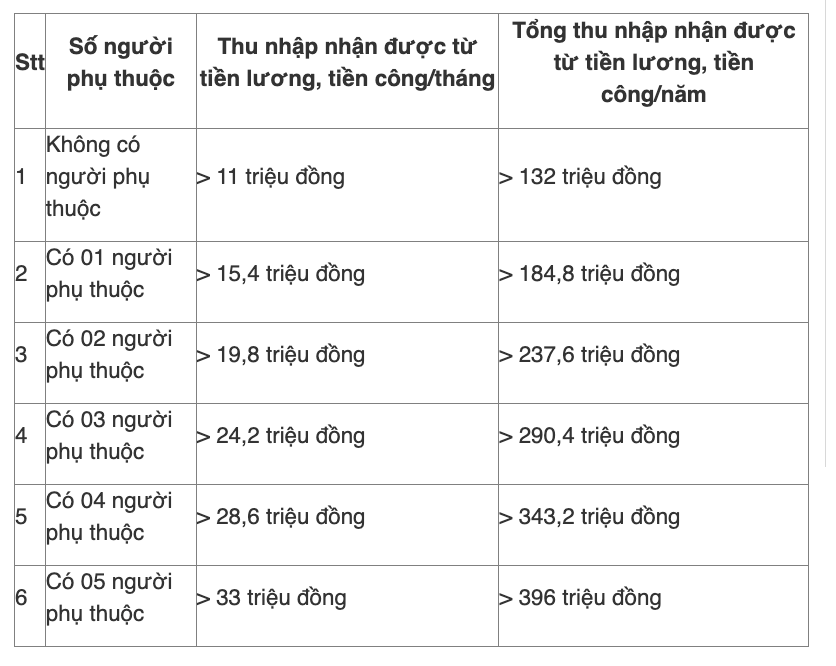

Accordingly, individuals who do not meet the following taxable income threshold will not have to pay personal income tax:

2. People who have made a contract for less than 3 months or do not sign a labor contract

According to the provisions of Point i, Clause 1, Article 25 of Circular 111/2013/TT-BTC, for individuals residing in the country who have signed labor contracts for less than 03 months or have not signed labor contracts, income is not subject to personal income tax in the following cases:

- Total income from salaries and wages under VND 2,000,000/payment.

- Total income from salary and wages over VND 2,000,000/payment, as the only source of income, and at the same time, total taxable income after deducting deductions not to the extent of tax payment and individuals have a commitment according to Form No. 08/CK-TNCN issued with Circular 80/2021/TT-BTC.

3. Individuals with income from sources exempt from personal income tax

According to the provisions of Article 4 of the Law on Personal Income Tax 2007 (amended and supplemented in 2012, 2014 and the Law on Science, Technology and Innovation 2025) on cases of personal income tax exemption in 2025 as follows:

(1) Income from real estate transfer between husband and wife; biological father, biological mother and biological child; adoptive father, adoptive mother and adopted child; father-in-law, mother-in-law and daughter-in-law; father-in-law, mother-in-law and son-in-law; paternal grandfather, paternal grandmother and grandchild; maternal grandfather, maternal grandmother and grandchild; brothers, sisters, brothers together.

(2) Income from transfer of housing, land use rights and assets attached to residential land of individuals in cases where the individual has only one house or residential land.

(3) Income from the value of land use rights of individuals allocated by the State.

(4) Income from inheritance or gifts is real estate between husband and wife; biological father, biological mother and biological child; adoptive father, adoptive mother and adopted child; father-in-law, mother-in-law and daughter-in-law; father-in-law, mother-in-law and son-in-law; paternal grandfather, paternal grandmother and grandchild; maternal grandfather, maternal grandmother and grandchild; brothers, sisters and siblings together.

(5) Income of households and individuals directly engaged in agricultural, forestry, salt-making, aquaculture, and fisheries that have not been processed into other products or have only been processed through conventional processing.

(6) Income from conversion of agricultural land of households and individuals allocated by the State for production.

(7) Income from interest on deposits at credit institutions, interest from life insurance contracts.

8. Income from remittances.

9. The salary for working at night and working overtime is paid higher than the salary for working during the day and working within the hours prescribed by law.

10. Pension paid by the Social Insurance Fund; pension paid monthly by the voluntary pension fund.

11. Income from scholarships, including:

- Scholarships received from the state budget;

- Scholarships received from domestic and foreign organizations under the education support program of that organization.

(12) Income from compensation for life insurance contracts, non-life insurance, compensation for work-related accidents, state compensation and other compensation according to the provisions of law.

(33) Income received from charitable funds is allowed to be established or recognized by competent state agencies, operating for charitable and humanitarian purposes, not for profit.

(14) Income received from foreign aid sources for charitable and humanitarian purposes in the form of government and non-government approved by competent state agencies.

15. Income from salary and wages of Vietnamese crew members working for foreign shipping lines or Vietnamese shipping lines for international transport.

16. Income of individuals who are ship owners, individuals with the right to use ships and individuals working on ships from the activities of providing goods and services directly serving offshore fishing activities.

(17) Income from salaries and wages from performing scientific, technological and innovation tasks.

(18) Income from copyright of science, technology and innovation tasks when the results of the tasks are commercialized according to the provisions of the law on science, technology and innovation, the law on intellectual property.

(19) Income of individual investors, experts working for creative startup projects, founders of creative startup enterprises, individual investors contributing capital to the risk investment fund.

4. Business households and individuals with revenue under 100 million VND/year

Pursuant to Article 4 of Circular 40/2021/TT-BTC, the principles for calculating personal income tax for business households are as follows:

- The principle of tax calculation for business households and individuals is implemented in accordance with the provisions of current law on VAT, personal income tax and related legal documents.

- Business households and individuals with revenue from production and business activities in the calendar year of VND 100 million or less are not required to pay VAT and are not required to pay personal income tax according to the provisions of law on VAT and personal income tax. Business households and individuals are responsible for declaring taxes accurately, honestly, fully and submitting tax documents on time; responsible before the law for the accuracy, honesty and completeness of tax documents according to regulations.

- Business households and individuals doing business in the form of groups of individuals and households, the revenue level of VND 100 million/year or less to determine that individuals are not required to pay VAT, not required to pay personal income tax is determined for one (01) representative of the group of individuals and households in the tax calculation year.