Need to consider raising the threshold for applying the highest tax rate

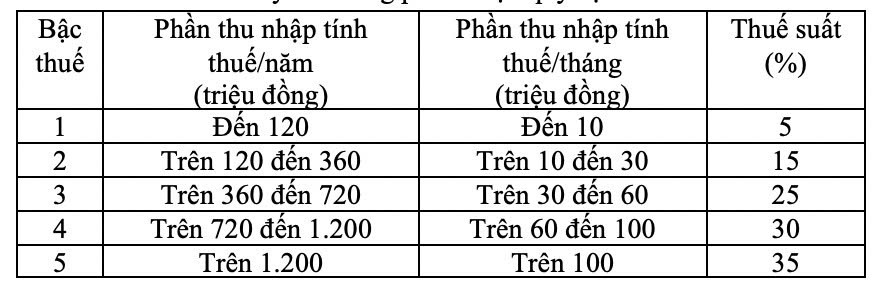

According to the submission on the draft Law on Personal Income Tax (PIT) (amended) being discussed at the 10th session of the 15th National Assembly, it is expected to gradually adjust the tax table in part to apply to residential individuals with income from salaries and wages in the direction of reducing the tax rate from 7 levels to 5 levels and expanding the gap between levels.

The plan is submitted to the National Assembly as follows:

Speaking to Lao Dong Newspaper, Delegate Trinh Thi Tu Anh (Lam Dong delegation) said that the development of a progressive tax table in sections with 5 levels as proposed in the draft is a reasonable step forward, helping to simplify the current tax system (from 7 levels to 5 levels).

According to the Delegate, the highest tax rate of 35% applied to taxable income over VND 100 million/month (the gap between levels is VND 10 - 40 million) is designed to hit the high-income group, thereby narrowing the rich - poor gap and increasing budget revenue to serve social security policies.

"However, I think this tax rate should still be further assessed for suitability with the 35% taxable group, because the 100 million VND/month threshold may not fully reflect the impact of inflation and actual living expenses in large cities such as Hanoi or Ho Chi Minh City, where high-income people often come with the burden of housing, education and health care costs" - delegate Trinh Thi Tu Anh commented.

The delegate pointed out that Vietnam's new tax rate with a maximum of 35% applied from 100 million VND/month (equivalent to 1.2 billion VND/year, about 50,000 USD) is still low compared to other countries in the region.

Specifically, Thailand only applies a rate of 35% when earning over 5,000,000 baht/year (equivalent to VND 3.36 billion, about 140,000 USD), while the Philippines applies a similar rate for income from 8,000,000 peso/year (equivalent to VND 3.45 billion, about 144,000 USD).

"Low taxes in Vietnam cause people with good incomes but not yet "super-rich" to suffer high tax rates early, which can reduce labor motivation, savings and spending, affecting economic growth," the delegate analyzed.

On the contrary, she cited that Singapore applies a maximum personal income tax of only 24%, thereby increasing the ability to accumulate, invest and attract high-quality human resources, while still ensuring a stable source of budget revenue.

Therefore, I think it is necessary to consider raising the threshold of the highest tax rate, while adjusting the way of calculating tax on bonuses, to ensure fairness, promote spending, investment and sustainable economic growth - the Delegate said.

From the above analysis, delegate Trinh Tu Anh proposed to adjust the principle of family deduction to be more flexible.

"Instead of waiting for the CPI to fluctuate above 20% as at present, we should switch to an annual adjustment mechanism based on the consumer price index (CPI) and GDP growth, to protect taxpayers against inflation" - the delegate said.

Income only needs to increase slightly, personal income tax has increased sharply

Also contributing opinions on this content, delegate Hoang Van Cuong (Hanoi delegation) said that reducing the number of tax rates may make the tax calculation method simpler for management agencies, but it is unreasonable in some points.

According to the draft, the income level of up to 10 million VND/month is subject to a tax rate of 5%; from over 10 million to 30 million VND/month is subject to a tax rate of 15%, which is an unusual increase of 10 percentage points.

This leads to unreasonableness: People with an income of 10 million VND are subject to a tax of 5%, but only need to increase to 11 million VND, so they are subject to a tax of 15%. After that, from 30 to 60 million VND/month, the tax rate increased to 25%. Thus, people with an income of VND31 million and VND59 million are both subject to a tax of 25%.

The delegate said that such a design does not encourage workers to strive for increased income, because if they just try to increase their income slightly, the tax will increase a lot.

"If income increases to 30 million VND/month, then pay 15% of tax, if it increases to 31 million VND, then pay 25% of tax, then people do not try to strive anymore" - the delegate expressed his opinion.

From the above shortcomings, delegate Hoang Van Cuong proposed to maintain seven tax levels, with a gap between levels of 5%. Specifically, the income taxable/month (million VND) is 10; 20. 40; 60; 80; 100; 150 corresponding to personal income tax of 5%; 10%; 15%; 20%; 25%; 30%; 35%.

The delegate added that the regulation of applying a 35% tax on income of VND100 million/month or more is unreasonable, because people with a slightly higher income due to work efforts have to pay a very high tax rate. Therefore, the 35% tax rate he proposes to apply to taxable income of over 150 million VND/month.