The 3 sets of Electronic Handbooks include: Electronic tax handbook for business owners; Electronic tax handbook for chief accountants; and Electronic tax handbook for business households and individuals.

In particular, the electronic tax handbook for business households and individuals has provided detailed instructions on tax obligations for these subjects.

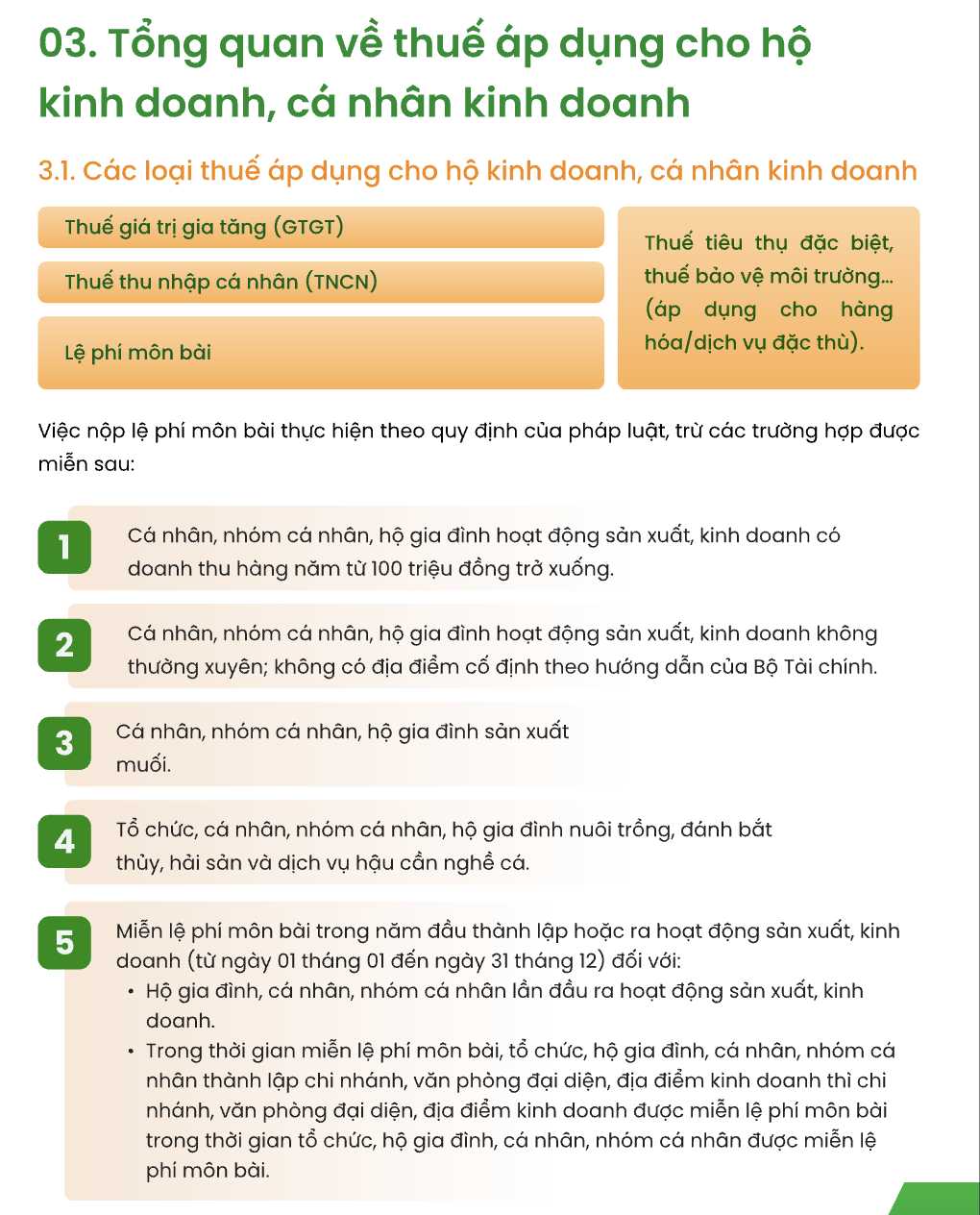

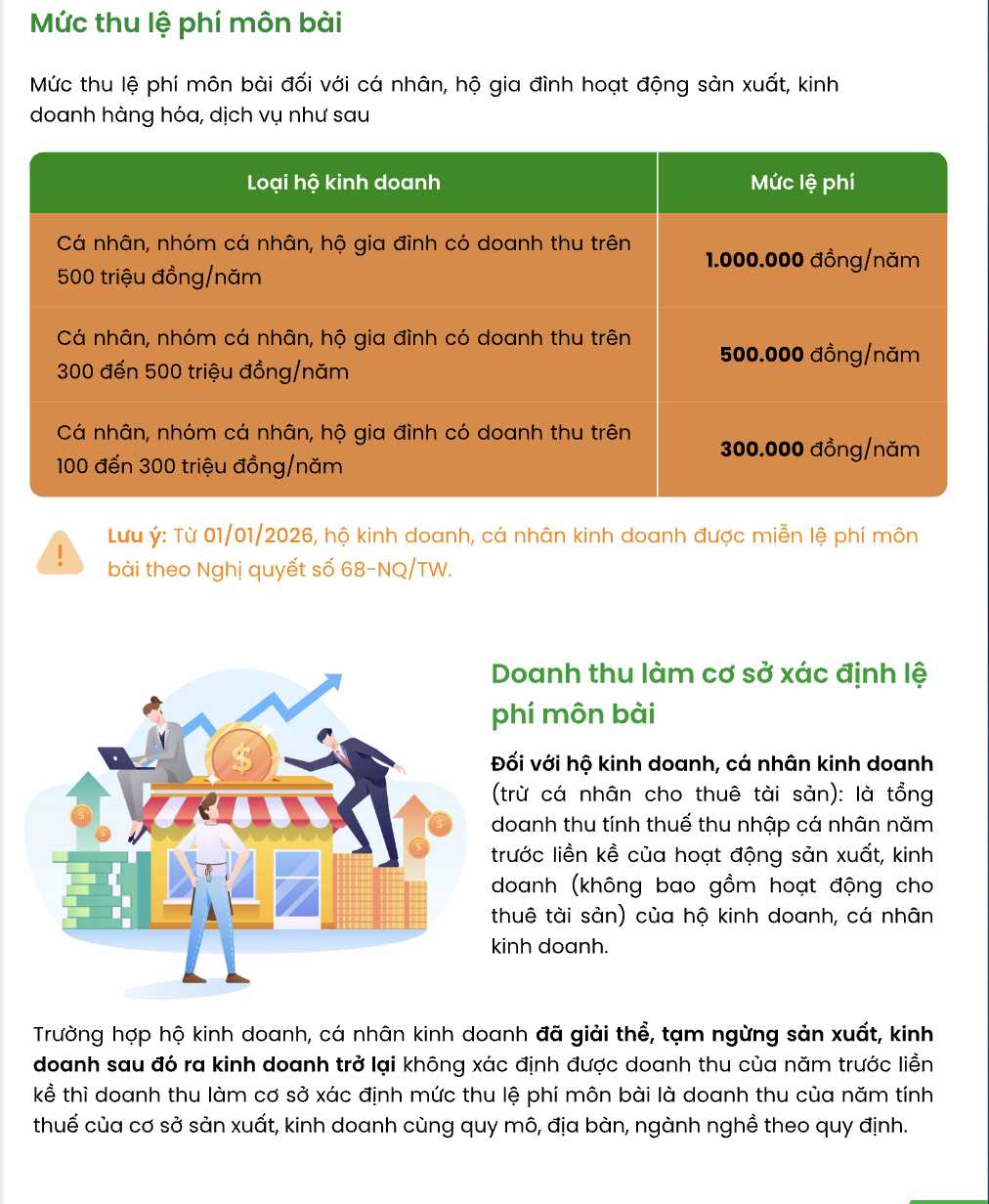

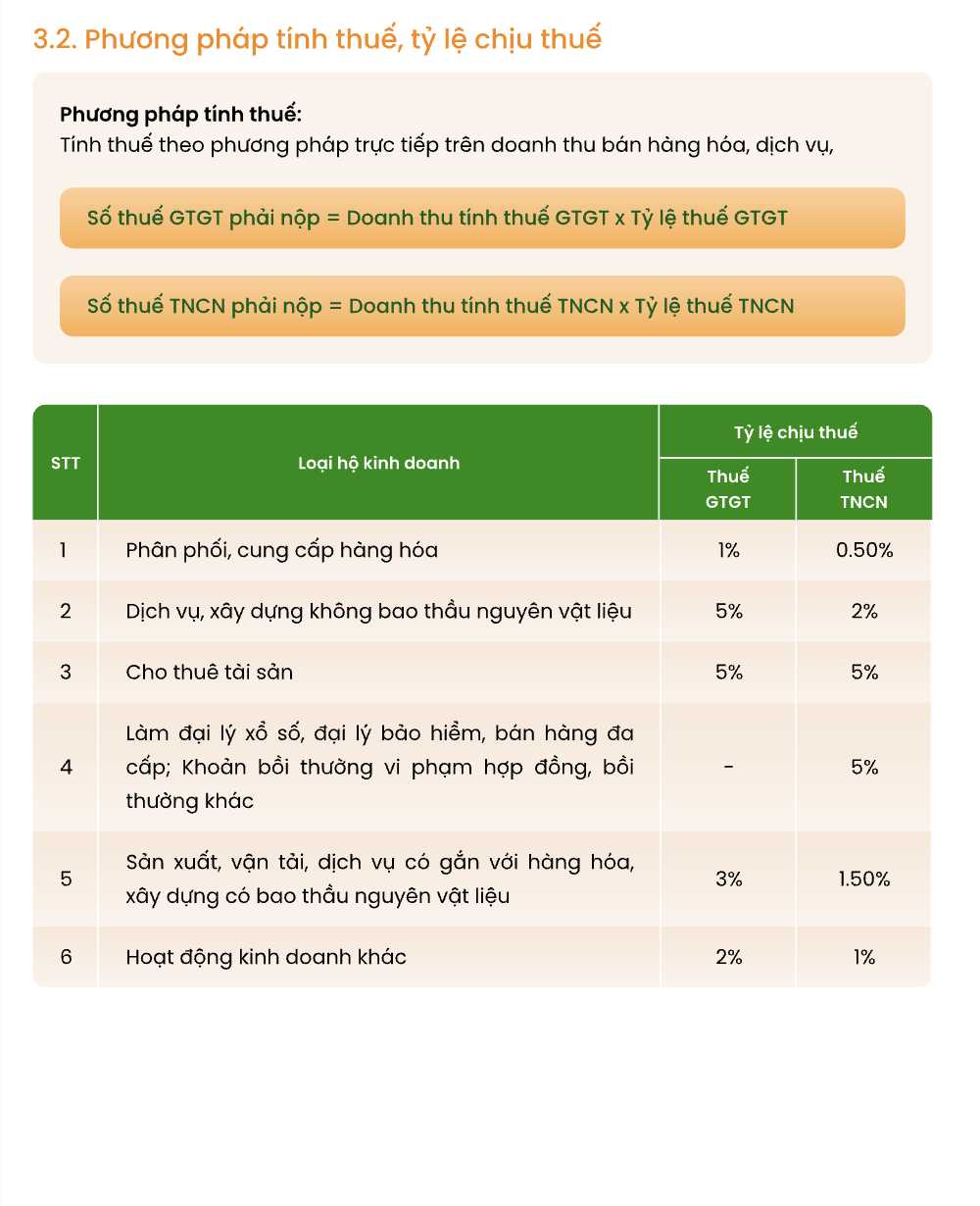

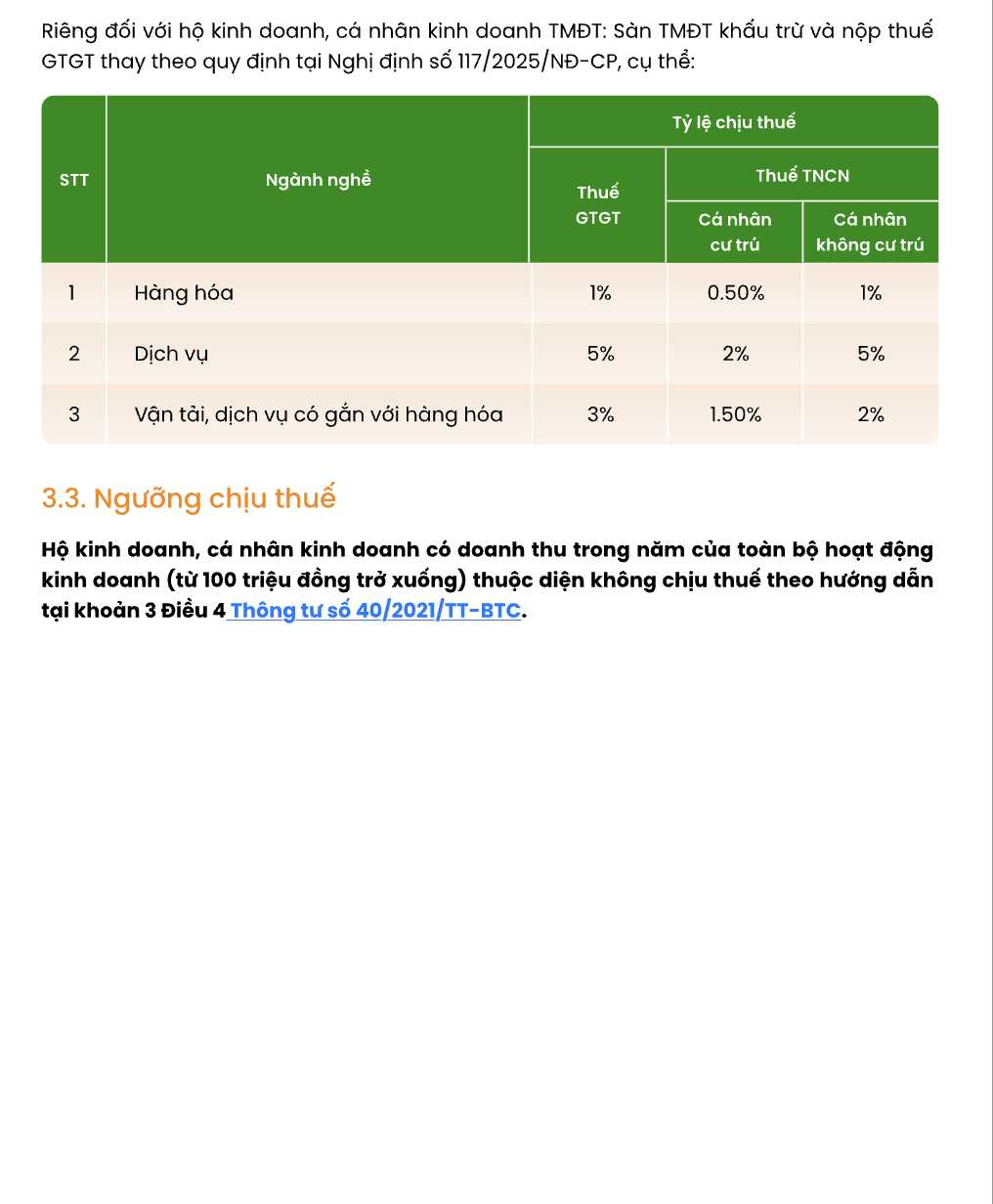

Accordingly, the overview of taxes applied to business households and individuals is as follows:

According to Ms. Nguyen Thi Lan Anh, Head of the Legal Department (Tax Department), the development of handbooks is an important step in the process of modernizing the Tax sector, demonstrating the determination to accompany, support, and facilitate taxpayers; at the same time, transparency and publicity help facilitate access to tax laws and policies, encourage voluntary compliance, and contribute to building a healthy and sustainable business environment.

The three notebooks were researched and developed by a team of tax officials and civil servants with the goal of creating a synchronous toolkit, practically supporting the business community, accountants and individuals in business. Notably, notebooks are integrated with AI to support Q&A, allowing users to easily look up and apply tax administrative policies and procedures quickly.

The launch of the notebook series is part of the roadmap for implementing Resolution No. 57-NQ/TW dated December 22, 2024 of the Politburo on breakthroughs in the development of science, technology, innovation and national digital transformation. Resolution 57 identifies the development of science, technology, innovation and digital transformation as the main driving force for socio-economic development, improving competitiveness, and bringing the country to rapid and sustainable development in the new era.

At the same time, this activity is also associated with the implementation of the Tax System Reform Strategy for the period 2021 - 2030, in which the Tax sector aims to perfect a synchronous, fair and effective policy; build a streamlined and professional apparatus; promote comprehensive digital transformation.

Recently, the Tax sector has synchronously deployed many technology applications such as electronic invoices completely replacing paper invoices, forming a real-time management big data warehouse; developing the eTax Mobile - iCanhan application; building electronic information portals for foreign suppliers, e-commerce, households and individuals doing business. These platforms contribute to increased transparency, anti-fraud, cost savings and facilitation for taxpayers.

According to the Tax Department, along with technological innovation, there is innovation in management methods. The Tax Authority aims to support taxpayers in a focused direction, while expanding the scope of support. This helps taxpayers quickly and accurately carry out procedures, while improving discipline, ensuring fairness and transparency in tax obligations.

The launch of the 3-book series of AI- integrated electronic handbooks is not only a practical support tool for businesses and individuals, but also affirms the determination of the Tax sector in reforming, innovating and integrating, towards building a tax system on par with international standards, nurturing sustainable revenue sources, accompanying the country's development.