Amending the personal income tax table for 5 more steps

On the morning of November 4, the Minister of Finance, authorized by the Prime Minister, presented a Report on the draft Law on Personal Income Tax (PIT) (amended).

The draft Law on personal income tax (amended) consists of 4 chapters and 29 Articles, regulating taxpayers, taxable income, tax-exempt income, tax reduction and the basis for calculating personal income tax.

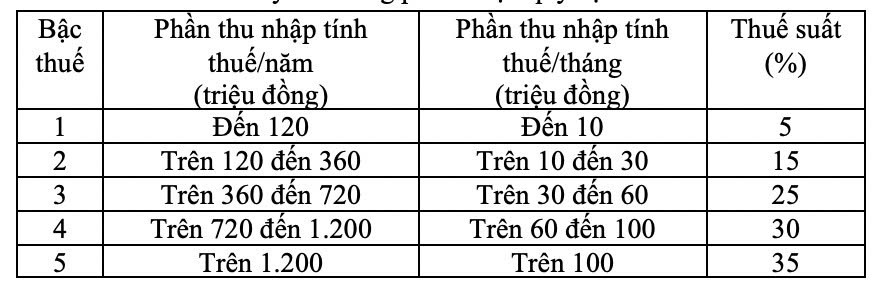

The draft law to adjust the progressive tax table in part applies to individuals residing with income from salaries and wages in the direction of reducing the tax rate from 7 to 5 levels and expanding the gap between levels.

The plan is submitted to the National Assembly as follows:

Amend the Tax Plan to 5 levels with the gap between gradually increasing levels of 10, 20, 30, 40 million VND and tax rates of 5%, 15%, 25%, 30%, 35%. The final tax rate is 35% applied to taxable income over VND 100 million/month.

According to calculations, along with adjusting the new family deduction level, this tax rate adjustment plan reduces revenue by about VND 27,400 billion/year.

According to this plan, most of the mobilization tax rates will be reduced compared to the current one. However, based on the review opinions and discussions in groups and halls of National Assembly deputies, the Government will study the whole and have additional thorough assessments to ensure reasonableness, and report to the National Assembly for consideration.

In addition, the draft Law also adjusts the income threshold to determine taxable income for some amounts of income such as income from winning prizes, from copyrights, from commercial franchises, from inheritance and gifts from 10 million VND to 20 million VND; Amending regulations on family deduction, deduction for charitable and humanitarian contributions; Rectifying some terms and times for determining income for tax calculation to ensure clarity in implementation, implementation, etc.

Continue to specify the family deduction level

Regarding the content of the revenue level of individuals doing business who are not subject to personal income tax (from 200 million VND/year or less, similar to the provisions of the Law on Value Added Tax), in the inspection report, Chairman of the National Assembly's Economic and Financial Committee Phan Van Mai said that this threshold of tax-free revenue is too low compared to business practice and does not ensure fairness when compared with the income level of salaried workers with family deductions.

Therefore, the inspection agency proposed that the Drafting Agency calculate and adjust the revenue level of non-taxable business individuals to be more equal and more consistent with the family deduction level (therefore, it is possible to simultaneously adjust this threshold of the Law on Value Added Tax).

In addition, this revenue threshold is directly related to the rights and obligations of taxpayers, and should be stipulated in the Law to ensure the authority of the National Assembly and the clarity and transparency for taxpayers, therefore it is proposed to remove the provisions in Clause 4, Article 7 of the draft Law.

Regarding the Partial Progressive Tax Plan (Article 9), many opinions are concerned about the reasonableness of the plan to adjust the corresponding income thresholds and tax rates in the Tax Plan because some taxable income ranges of the draft Law create a greater burden on personal income tax for taxpayers while most other taxable income ranges create lower tax obligations than the current Law. This does not ensure fairness for taxpayers among income groups.

The inspection agency also believes that the regulation on family deduction levels is an important content and one of the bases for taxpayers to determine their tax obligations, therefore, receiving special attention from the people and society.

The implementation of the past time and the experience of other countries show that the actual family deduction level has not been adjusted too regularly and continuously and is not an urgent content that needs to be regulated by the Government to ensure flexibility and timeliness.

Therefore, it is recommended to continue to specify the family deduction level in the draft Law, and at the same time assign the Government to submit to the Standing Committee for National Assembly for consideration and adjustment of the family deduction level if necessary, in accordance with the actual needs as expressed in the current Law on personal income tax; supplement specific family deduction levels and remove the regulation assigning the Government to regulate the family deduction level in Clause 1, Article 10, and at the same time remove the regulation in Clause 3, Article 29 accordingly.