Customers "give their wallets" to scammers without knowing it.

Recently, many authorities have received reports from people about being scammed and having their assets stolen on banking applications. The tricks of the criminals are very sophisticated, directly installing malware on customers' phones to take control or copy data in parallel, revealing information such as access accounts, passwords, OTPs, and even being granted permission to track customers' behavior and geographic location.

For example, Mr. D. (65 years old, Quy Nhon) was asked by a scammer impersonating a ward police officer to install a fake public service application. Because the application had the same interface and logo as the Ministry of Public Security, he trusted and followed it and lost 64.5 million VND after transferring 10,000 VND as a test.

Ms. V., an office worker in Hanoi, was also scammed when transferring a shipping fee of VND20,000 via QR code. The fake shipper called back to inform that the code had been sent incorrectly and instructed to cancel to avoid being deducted VND2 million/month. She shared: “Both annoyed and confused, I quickly followed the steps instructed by the shipper to cancel the registration, not knowing that I was authenticating a transaction to transfer VND23 million in my account.”

MBBank App proactively detects malicious code and applications that show signs of taking over users' phones.

Military Commercial Joint Stock Bank (MB) has announced the App Protection solution set on the MBBank App, designed as a leading advanced protection layer in the security system of today's banks.

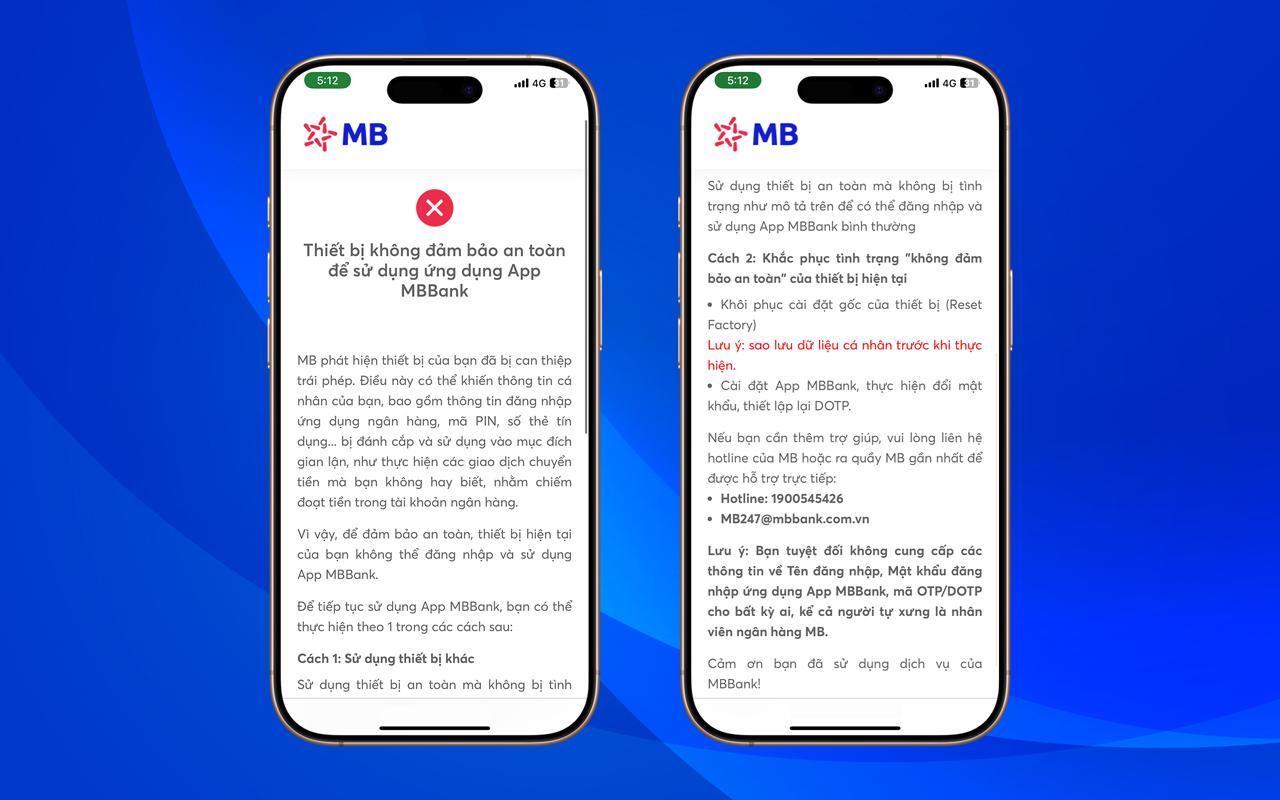

Accordingly, if the customer's phone is infected with malware or installed with malicious software, spyware, and is likely to be remotely controlled, when opening the Banking application, the MBBank App will identify, stop the transaction and immediately notify the customer. In case of detecting high risk, the App will automatically exit the application and notify the customer of the next steps to prevent the risk of losing money on the account.

In addition to App Protection, with the goal of putting customers' transaction safety first, MB also always improves solid defense layers for each transaction. In particular, to support customers to the maximum in completing biometric data, creating a solid defense layer, especially for large transactions, MB has deployed synchronously on channels, including from self-implementation on MBBank App, authentication via VNeID, biometric authentication for others with the "opportunistic biometrics" feature, to serving and supporting people to the maximum at the counter.