By 0:00, there were dozens of people queuing in front

Recorded by Lao Dong Newspaper reporters from 11 pm on January 29 to dawn on January 30, at many silver business stores on Tran Nhan Tong street and Cau Giay street (Hanoi), hundreds of people flocked to queue to get numbers to buy silver for storage. The atmosphere heated up every hour, many people came from midnight but still "stay behind" a few dozen people.

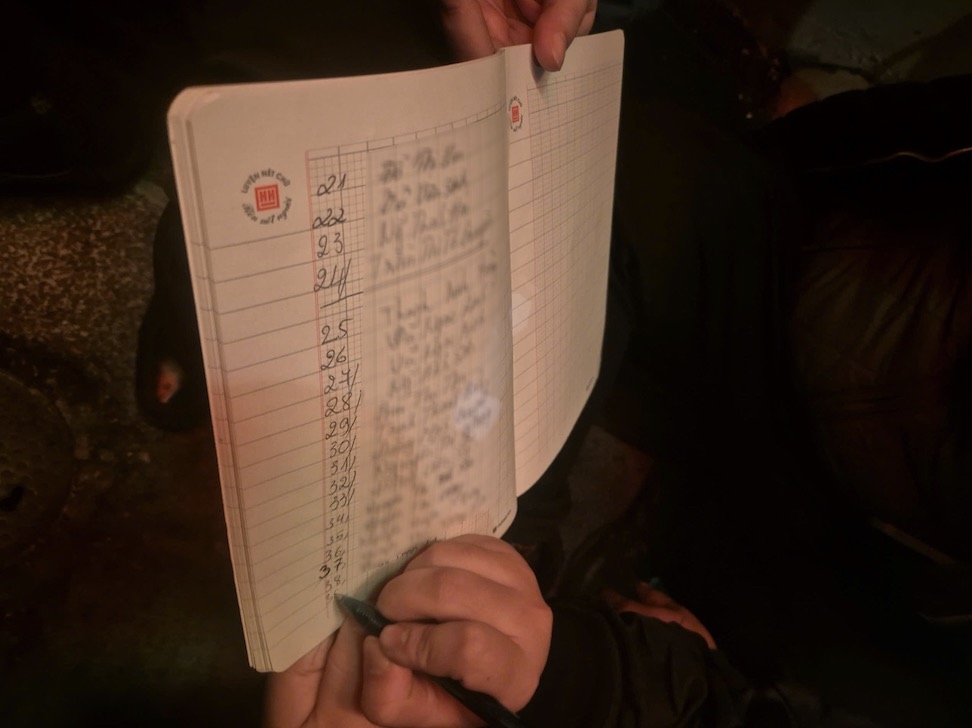

In the Tran Nhan Tong street area, the crowd gathered very early. Notably, to avoid arguments, some people who arrived earlier actively prepared notebooks and pens, wrote their names in order to arrive, considering them as "self-managed lists" in the night.

Mr. D.M.Q (Vinh Tuy - Hanoi) said that he had waited many times at Tran Nhan Tong facility to buy silver: "I usually wait from 3:00 am, but today the market is hot, I arrived at 12:00 pm and more than 30 people arrived first. I borrowed from the bank to buy, interest rate 8.7%".

Nearby, Ms. V.N.L (Pho Hue ward - Hanoi) shared about having to temporarily put aside work to run to get numbers: "I close the store and run out to get numbers. I just occasionally buy a little fortune, not doing business or anything.

Despite the large number of people, the majority still tried to maintain order. Many people reminded each other to talk quietly, stand neatly to avoid affecting the surrounding residential area. "Noise is when people report to the ward to clear it" - a woman queuing reminded everyone while waiting.

Meanwhile, on Cau Giay street, the number of people gathering was recorded to be particularly large, with rows stretching hundreds of meters. Many people stood close to each other in the late night, continuously exchanging information about prices, opening times and serial numbers.

Silver prices rise sharply but should not "rush in" because of FOMO

The high increase in silver prices is creating great attraction and may help some investors earn significant profits. However, flocking to buy according to crowd psychology (FOMO) is potentially risky.

Buyers need to pay special attention to the large buying-selling price difference, making "interest on the board" not necessarily real profit. In addition, using financial/borrowing leverage to chase price waves can push risks very high if the market reverses or prices adjust, buyers are prone to loan interest pressure and unexpected losses.