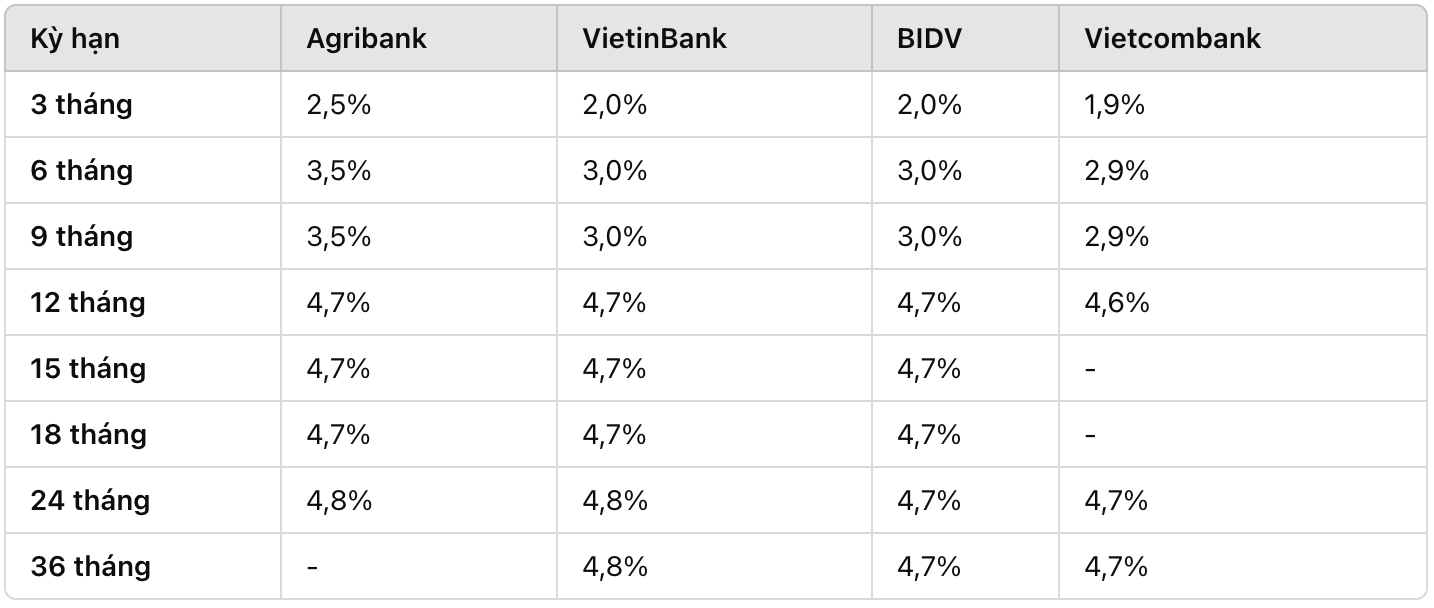

Latest interest rates at Agribank, VietinBank, Vietcombank and BIDV

According to Lao Dong reporter's records with 4 banks Vietcombank, Agribank, VietinBank and BIDV on February 2, 2025, the mobilization interest rate table is being listed around the threshold of 1.9-4.8%/year.

Of these, Agribank and VietinBank have the highest interest rates, at 4.8%/year for terms over 24 months. Interest rates at BIDV range from 2-4.7%/year, while Vietcombank applies interest rates from 1.9-4.7%/year.

Below are the latest Big 4 interest rate details for each term:

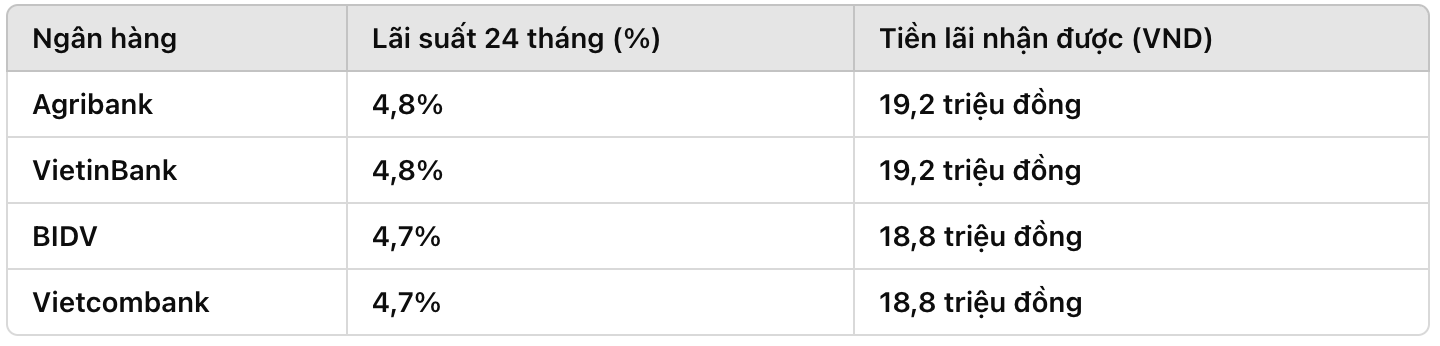

Deposit 200 million VND at Big 4, how much interest will I receive?

Customers depositing 200 million VND for a 24-month term at Big 4 banks will receive the following corresponding interest rates:

Accordingly, if depositing 200 million VND at Agribank or VietinBank, customers will receive the highest interest, up to 19.2 million VND after 24 months. Meanwhile, depositing at BIDV or Vietcombank, the interest received will be slightly lower, reaching 18.8 million VND.

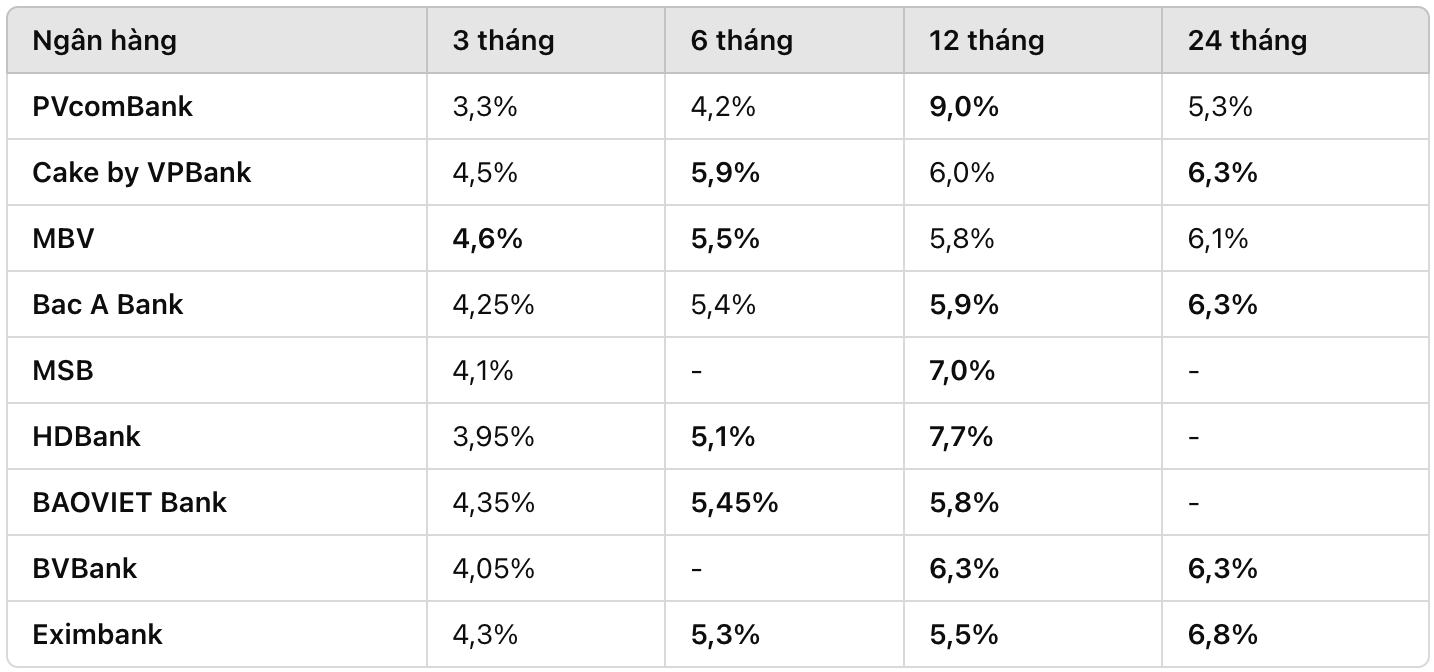

Compare with other banks

In addition to the Big 4 group, many other banks are applying higher interest rates, up to 6-9%/year. However, these interest rates often come with certain conditions such as large deposits or long terms.

For example:

PVcomBank is applying an interest rate of 9%/year for a 12-month term but requires a large minimum deposit amount.

HDBank offers 7.7%/year for 12-month term, significantly higher than the Big 4 group.

Eximbank listed an interest rate of 6.8%/year for a 24-month term, higher than that of state-owned banks.

Below is the interest rate table of some other banks:

Note when saving

High interest rates often come with conditions: Some banks list attractive interest rates but only apply to large deposits, usually from 500 million VND or more.

Check the terms carefully: Before making a deposit, customers need to learn about the regulations on early withdrawal, savings book renewal, and interest rate policy changes.

Prioritize reputable banks: For large deposits, you should choose a bank with a stable financial situation, avoiding risks from banks with high bad debt ratios.

Interest rates may change from time to time. For details, customers should contact the bank directly or visit the official website to update the latest interest rates.