In January 2025, 10 banks increased deposit interest rates, including Agribank, Bac A Bank, NCB, MBV, Eximbank (increased 2 times), KienlongBank (increased 2 times), VietBank, ABBank, BaoViet Bank, and BVBank.

However, according to Lao Dong, on February 3, Vietnam Technological and Commercial Joint Stock Bank (Techcombank) was the first bank to adjust its deposit interest rates down after the Lunar New Year holiday.

This is the third time since the beginning of 2025 that this bank has reduced interest rates, only applicable to terms from 1-5 months.

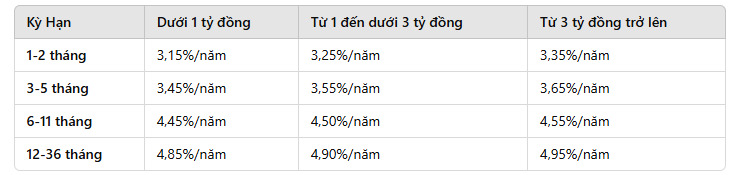

Specifically, the interest rate for 1-2 month terms decreased to 3.15%/year and for 3-5 month terms decreased to 3.45%/year. The remaining terms, from 6 months and up, remain unchanged.

Techcombank also adjusted interest rates for deposits over 1 billion VND, 0.1-0.2% higher than under 1 billion VND.

Which bank pays interest from 7.0%?

According to Lao Dong, with a special interest rate, the highest in the market is the interest rate of 9.0%/year listed at PVcomBank. PVcomBank customers will enjoy a special interest rate of 9.0%/year when having a new deposit balance of 2,000 billion VND or more.

HDBank currently has a particularly high interest rate, up to 8.1%/year for a 13-month term and 7.7% for a 12-month term, with a minimum balance of VND500 billion. This bank also applies a 6% interest rate for an 18-month term.

MSB applies interest rates for deposits at the counter up to 8.0%/year for a 13-month term and 7.0% for a 12-month term. The applicable conditions are that the savings book is newly opened or the savings book is opened from January 1, 2018, automatically renewed with a term of 12 months, 13 months and the deposit amount is from 500 billion VND.

Dong A Bank has deposit interest rates, terms of 13 months or more, end-of-term interest for deposits of 200 billion VND or more, applying an interest rate of 7.5%/year.

According to Lao Dong, the first month of 2025 recorded 7 banks increasing deposit interest rates, including: Agribank, Bac A Bank, NCB, MBV, Eximbank, KienlongBank, VietBank.

Where is the best place to deposit money right now?

1 month term:

Eximbank is currently leading with the highest interest rate, reaching 4.5%/year (weekend). Second place is MBV, KienLongBank with 4.3%/year. Bac A Bank and OCB are in third place, applying an interest rate of 4.0%/year.

3 month term:

Eximbank continues to lead with the highest interest rate of 4.75%/year (weekend). MBV ranks second with 4.6%/year. Bac A Bank and NCB rank third, with interest rates of 4.2%/year and 4.3%/year, respectively.

6 month term:

CBBank stands out with the highest interest rate, reaching 5.85%/year, followed by KienLongBank with an interest rate of 5.8%/year. Bac A Bank ranks third with 5.55%/year. MBV and NCB follow, both applying an interest rate of 5.5%/year.

9 month term:

CBBank continues to lead with an interest rate of 5.85%/year. MBV ranks second with 5.6%/year. Bac A Bank ranks third, with an interest rate of 5.45%/year.

12 month term:

MBV and Gpbank are in the lead with an interest rate of 6%/year. Bac A Bank is in second place with 5.8%/year. CBBank is in third place, also with 6.0%/year.

18 month term:

Eximbank leads the long-term with an interest rate of 6.6%/year. Bac A Bank follows with an interest rate of 6.2%/year. MBV, Oceanbank, and KienLongBank are ranked third, with an interest rate of 6.1%/year.