Surveyed on February 3, 2025, the interest rate applied to individual customers depositing money at the counter at the Bank for Investment and Development of Vietnam (BIDV) ranges from 1.7 - 4.7%/year. Meanwhile, the interest rate for corporate customers is lower, only from 1.6 - 4.2%/year.

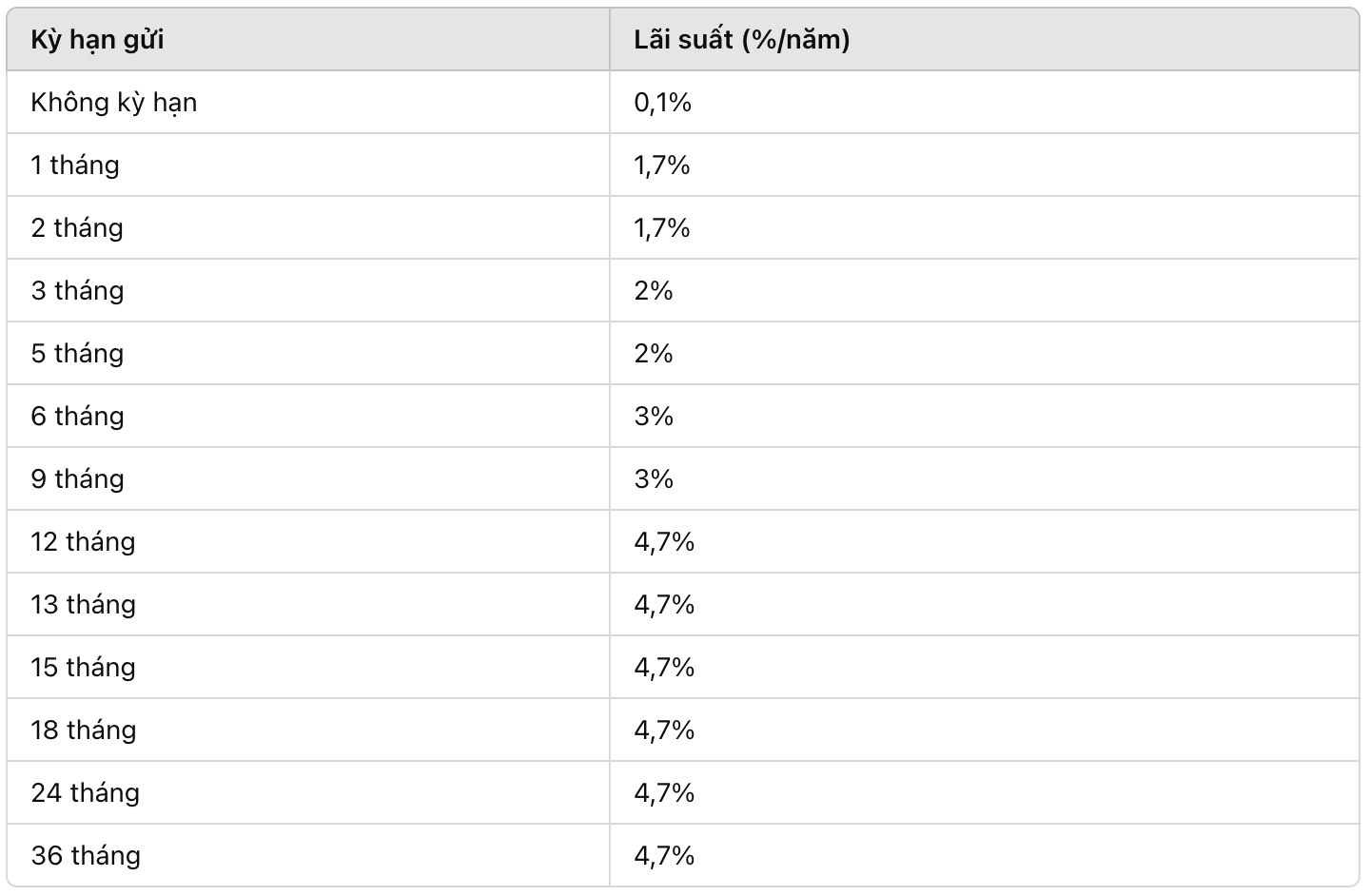

BIDV deposit interest rates for individual customers

Individual customers depositing money at BIDV in February 2025 will be applied the following specific interest rates:

For example: If you deposit 100 million VND at BIDV

6-month term, interest rate 3%/year. Interest received after 6 months: 1.5 million VND.

12-month term, interest rate 4.7%/year. Interest after 1 year: 4.7 million VND.

24-month term, interest rate 4.7%/year. Total interest after 2 years: 9.4 million VND.

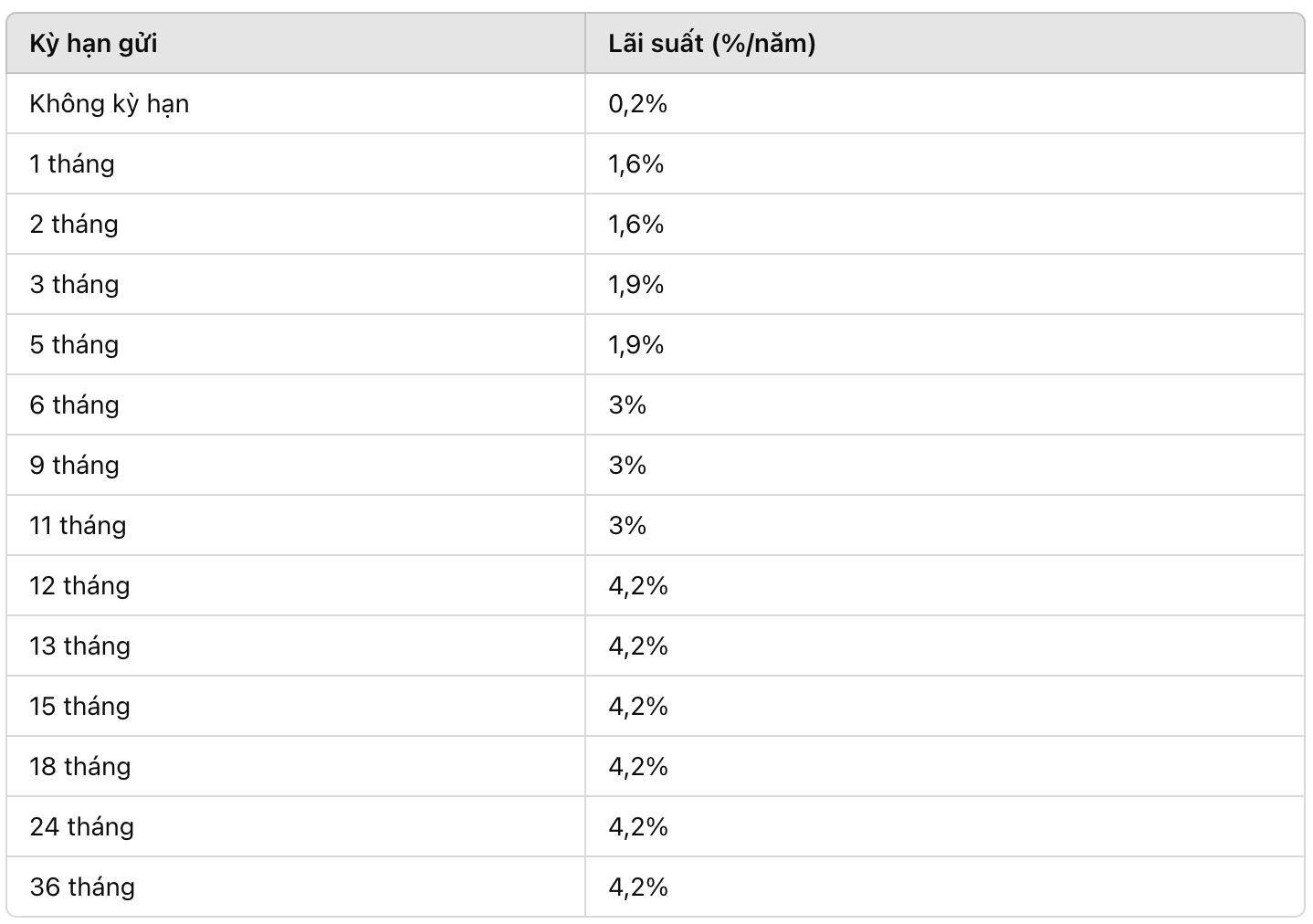

BIDV interest rates for corporate customers

BIDV's deposit interest rates for businesses in February 2025 are somewhat lower than those for individual customers:

For example: If a business deposits 500 million VND at BIDV

6-month term, interest rate 3%/year. Interest received after 6 months: 7.5 million VND.

12-month term, interest rate 4.2%/year. Interest received after 1 year: 21 million VND.

Term 36 months, interest rate 4.2%/year. Total interest after 3 years: 63 million VND.

The above interest rates are for reference only and may change from time to time. Customers should contact the nearest BIDV branch or transaction office directly for more details.