Northern employment tax rate from wages

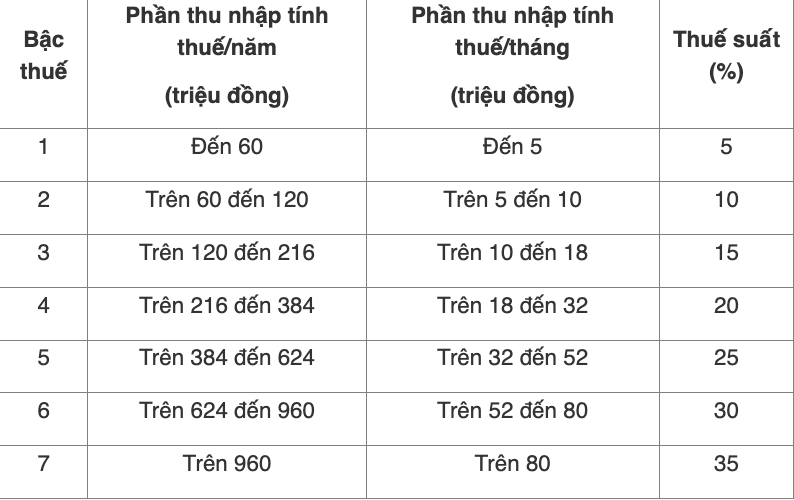

According to Article 22 of the Law on Personal Income Tax 2007 and Clause 2, Article 7 of Circular 111/2013/TT-BTC (amended and supplemented in Circular 92/2015/TT-BTC), the personal income tax rate on income from wages and wages is applied according to the Partial progressive tax rate, specifically as follows:

How to calculate personal income tax from wages in 2025

The basis for calculating tax on income from wages and wages is income for tax calculation and tax rate, specifically as follows:

personal income tax payable = Taxable income x Tax rate.

In which:

Taxable income = Taxable income - Reductions.

Taxable income = Total income - Exempted expenses.

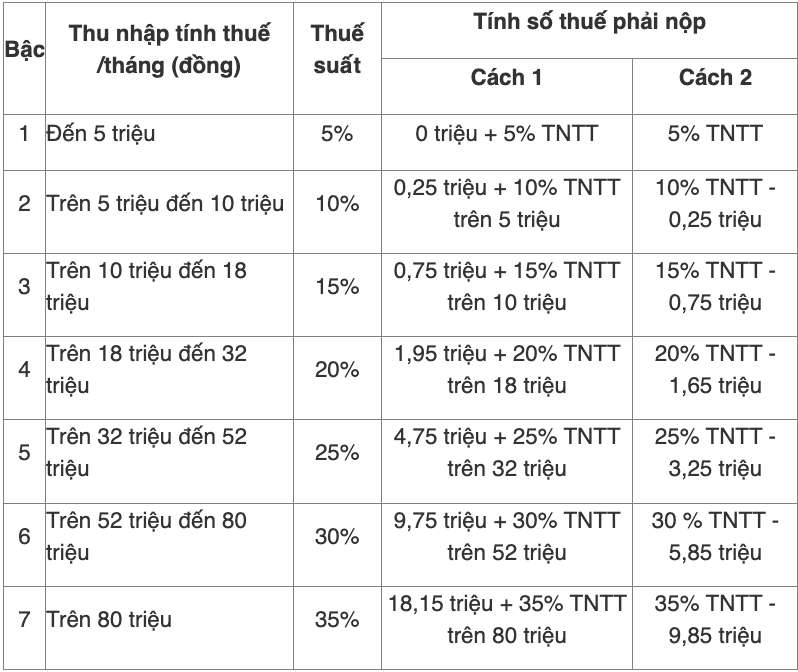

For individuals residing, the shortened method according to Appendix: 01/PL-TNCN issued with Circular 111/2013/TT-BTC can be applied as follows:

For example: Ms. C has income from salary and wages for the month of 40 million VND and pays the following insurance: 7% social insurance, 1.5% health insurance on salary. Ms. C raised 2 children under 18 years old, during the month Ms. C did not contribute to charity, humanitarianism, or encourage education. Personal income tax temporarily paid in the month of Ms. C is calculated as follows:

Ms. C's taxable income is 40 million VND. Ms. C is entitled to the following deductions:

- Reduced family deduction for yourself: 9 million VND

- family deduction for 02 dependents (2 children): 3.6 million VND × 2 = 7.2 million VND

- Social insurance, health insurance: 40 million VND × (7% + 1.5%) = 3.4 million VND

In total, the amounts deducted are:

9 million VND + 7.2 million VND + 3.4 million VND = 19.6 million VND

- Ms. C's taxable income is: 40 million VND - 19.6 million VND = 20.4 million VND

Tax payable:

Method 1: The amount of tax payable is calculated according to each level of the Southern Steering Committee

- Level 1: taxable income up to 5 million VND, tax rate of 5%: 5 million VND × 5% = 0.25 million VND.

- Level 2: taxable income over VND 5 million to VND 10 million, tax rate of 10%:

(10 million VND - 5 million VND) × 10% = 0.5 million VND.

- Level 3: taxable income over VND 10 million to VND 18 million, tax rate of 15%:

(18 million VND - 10 million VND) × 15% = 1.2 million VND

- Level 4: taxable income over VND 18 million to VND 32 million, tax rate of 20%:

(20.4 million VND - 18 million VND) × 20% = 0.48 million VND

The total amount of tax that Ms. C must temporarily pay in the month is:

0.25 million VND + 0.5 million VND + 1.2 million VND + 0.48 million VND = 2.43 million VND

Method 2: The amount of tax payable is calculated according to the concise method

Taxable income in the month of 20.4 million VND is taxable income of level 4. The personal income tax payable is as follows: 20.4 million VND × 20% - 1.65 million VND = 2.43 million VND.