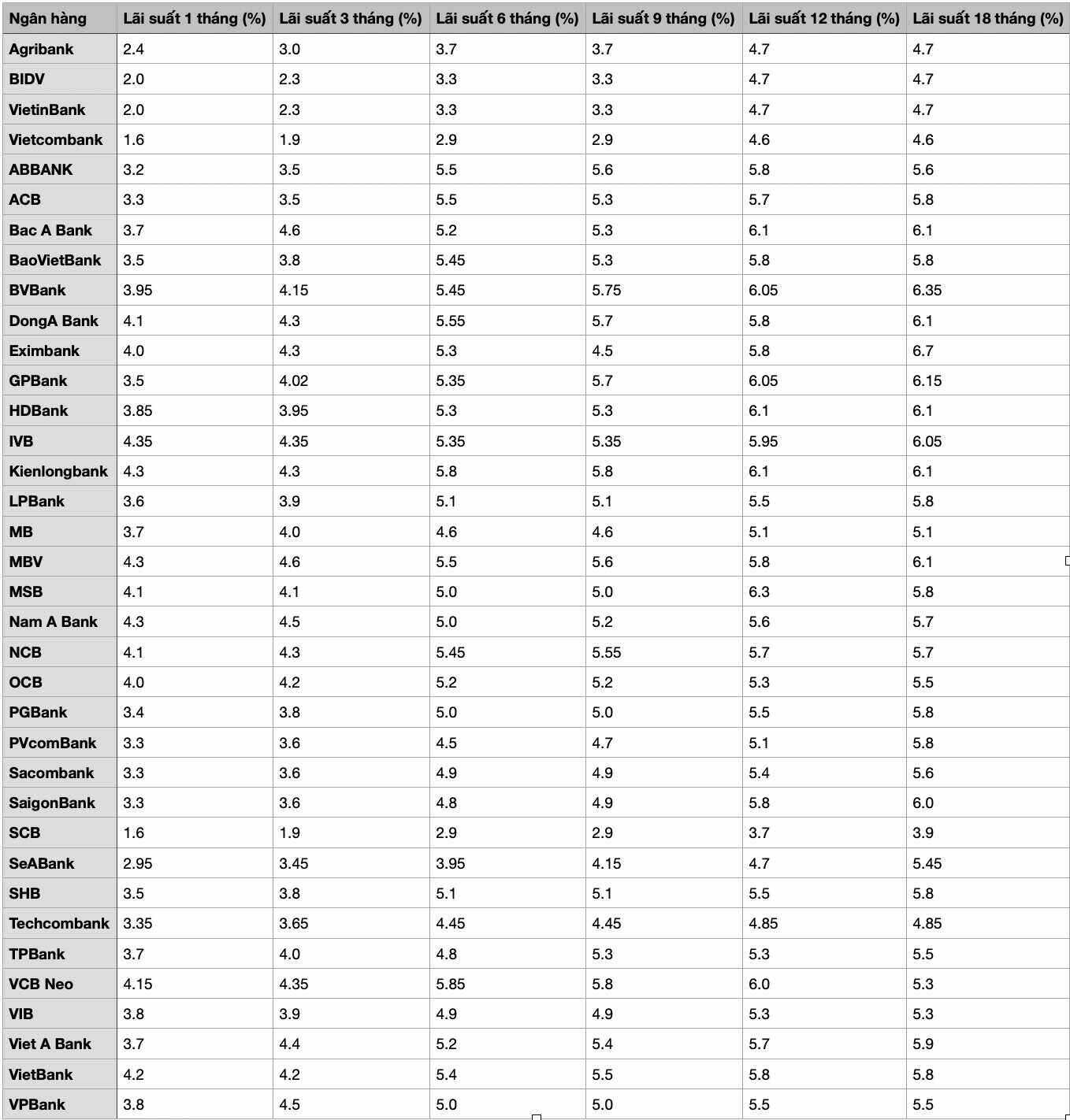

Which bank has the highest interest rate?

According to the updated interest rate table, Eximbank is the bank listing the highest interest rate for the 18-month term, reaching 6.7%/year. Meanwhile, for the 12-month term, many banks also list rates above 6%/year, notably:

Bao Viet Bank: 6.05%/year

BVBank: 6.05%/year

GPBank: 6.05%/year

IVB: 6.05%/year

Kienlongbank: 6.1%/year

DongA Bank: 6.1%/year

Bac A Bank: 6.1%/year

SCB: 6.1%/year

MSB: 6.3%/year

VCB Neo: 6%/year

If you choose a shorter term, the interest rate is significantly lower. For a 6-month term, most banks list interest rates around 5.0 - 5.85%/year, with VCB Neo offering the highest at 5.85%/year.

How much interest do you get for sending lucky money?

Suppose you have 10 million VND in lucky money and want to save it:

If you deposit for 12 months at MSB (6.3%/year), after 1 year, you will receive:

Interest = 10,000,000 x 6.3% = 630,000 VND

Total amount at the end of the period: 10,630,000 VND

If you deposit for 18 months at Eximbank (6.7%/year), after 1.5 years, you will receive:

Interest = 10,000,000 x 6.7% x 1.5 = 1,005,000 VND

Total amount at the end of the period: 11,005,000 VND

If you have a larger amount, such as 50 million VND, the interest received will also increase accordingly:

Deposit for 12 months at MSB (6.3%/year): Interest of 3.15 million VND, total amount at the end of the term of 53.15 million VND.

Deposit for 18 months at Eximbank (6.7%/year): Interest of 5,025 million VND, total amount at the end of the term of 55,025 million VND.

How to send lucky money effectively?

If you only have a small amount of money and do not have immediate plans to use it, a 6- to 12-month term deposit will be the optimal choice to take advantage of high interest rates while still being flexible in withdrawing money when needed.

For larger amounts that can be kept for a long time, an 18-month term at Eximbank with an interest rate of 6.7%/year is the best choice.

For those who do not want to risk interest rate reduction, they can choose banks with rates above 6%/year for 12-month term such as Kienlongbank, DongA Bank, SCB, BVBank...

So, if you have lucky money at the beginning of the year, instead of leaving it idle, you can take advantage of it to save, both preserving capital and generating effective profits.

Details of the latest savings interest rate comparison table of banks