There is still a situation where invoices are not issued at the time of sale.

According to the Lao Dong Newspaper, at some retail petrol stations in Hanoi, the stores can issue electronic invoices when customers request them or issue automatic invoices when customers do not need to receive invoices. However, there are also cases where invoices are not provided at the time of purchase.

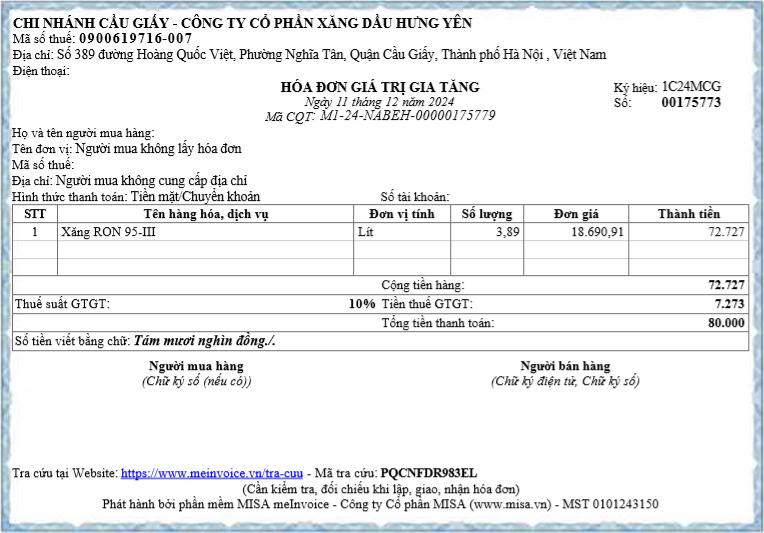

At around 4:40 p.m. on December 10, the reporter bought gasoline at the Hung Yen gas station on Hoang Quoc Viet Street (Cau Giay, Hanoi), but the sales staff did not provide an invoice at that time, but instructed the customer to leave information such as phone number, email and said they would contact to send an electronic invoice later.

At 10:29 p.m. the same day, an employee of this store contacted the reporter to ask for more information about writing the electronic invoice, and at 9:15 a.m. the next day (December 11), the sales invoice was sent to the customer.

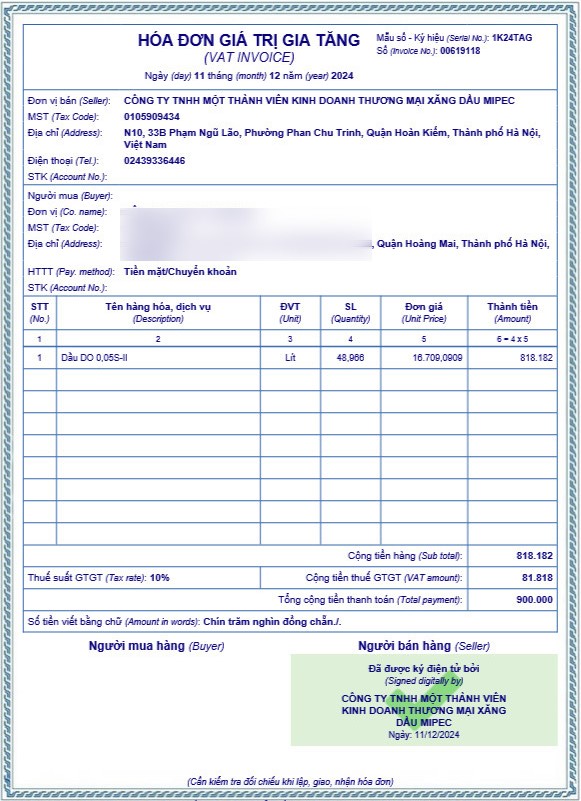

At gas station No. 6 - Mipec Gas Station, Nam Cuong Urban Area (Bac Tu Liem, Hanoi), the electronic invoice issuance is done quite quickly. When we request an invoice, the sales staff transfers it to the store accountant, then the accountant is the one who receives it, gets the customer information and immediately issues the electronic invoice to the customer.

Similar to some other petrol retail stores such as Petrolimex, PVOIL, Thuy Duong petrol, issuing electronic invoices to customers is done immediately upon request. However, the number of customers requesting invoices is quite small.

In fact, many people do not have the habit of getting an electronic invoice after each time buying gas. “Most gas stations have a lot of people waiting in line, each time filling up a motorbike costs about 80,000 - 100,000 VND, getting an invoice is useless. If everyone waits for an invoice, it will be very time-consuming, so I never get an invoice when I go to fill up gas,” said Ms. Minh Thu (Tay Ho, Hanoi).

Businesses have been more active

Regarding the issuance of electronic invoices for each sale at retail gasoline stations, Mr. Nguyen Thanh Chung - Deputy Head of Sales Department of Mipec Petroleum Company - shared: "All of our gas stations have issued electronic invoices for each sale in the retail gasoline business according to the regulations of the Ministry of Finance. We have invested in a synchronized automatic connection system to issue electronic invoices for each sale. Each time the trigger (gas pump nozzle - PV) is lifted, ending a pump, if the customer requests, we will issue an invoice according to the customer's request".

“In case the customer does not have a need, our system will automatically issue retail invoices, these activities are directly connected to the management system of the Hanoi Tax Department. The tax authority has very strict management, so most gas stations must strictly issue electronic invoices for each sale,” Mr. Chung added.

However, Mr. Chung also pointed out some shortcomings such as automatic management software sometimes having problems during the invoice issuance process such as software errors, or possibly incorrect data such as unit price, quantity, total amount, etc.: "We also have to both implement and train the company's accounting staff to grasp, transfer new technology and gradually overcome the shortcomings."

“Another thing is that to do this, we have to invest in a synchronous system to integrate the devices together with a not small initial investment cost, the number of electronic invoices increases dramatically, affecting the company's production and business costs,” said Mr. Chung.

On December 10, the Government Office announced that Prime Minister Pham Minh Chinh had just signed Official Dispatch No. 129/CD-TTg requesting ministries, branches and localities to strengthen the management and use of electronic invoices, and improve the efficiency of tax collection for e-commerce.

In particular, the Prime Minister requested to strengthen inspection and examination of the issuance and use of electronic invoices, especially in the creation of electronic invoices at retail gasoline stores for customers for each sale, ensuring compliance with legal regulations, and strictly handle those who do not comply or intentionally do not comply.

According to Decree No. 123/2020 of the Government, effective from July 1, 2022, regulating invoices and documents, all retail gasoline stores must issue electronic invoices with tax codes for each sale.

The time for issuing electronic invoices for the sale of gasoline at retail stores to customers is the time when the sale of gasoline is completed for each sale. The seller must ensure that all electronic invoices for the sale of gasoline to non-business individuals and business individuals are fully stored and can be looked up when requested by competent authorities.