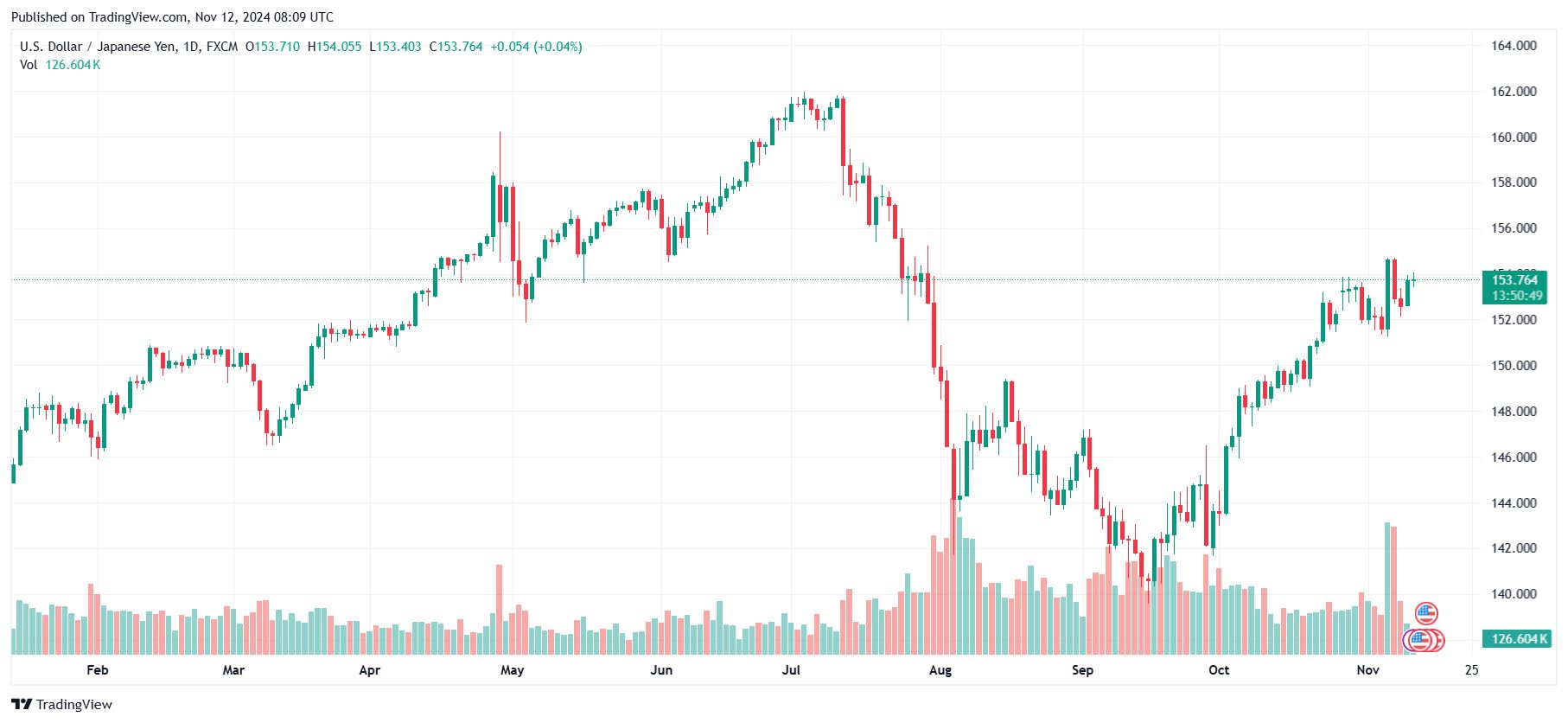

According to FXStreet, on November 12, the Japanese Yen struggled to gain a significant increase against the USD and fluctuated between a slight increase and a slight decrease.

Investors believe that Japan's political situation may make it difficult for the Bank of Japan (BoJ) to tighten monetary policy further. In addition, at its October meeting, BoJ policymakers were divided on whether to continue raising interest rates.

According to Kyodo News, Japanese Prime Minister Shigeru Ishiba is preparing for his first meeting with Chinese President Xi Jinping on the sidelines of the APEC summit in mid-November. In addition, Mr. Ishiba said the Japanese government will meet with representatives of businesses and unions later this month to discuss next year's wage negotiations.

The tariffs that Mr. Trump has pledged could hurt Japanese businesses, which export heavily to the United States, and hurt Japan’s economic growth, creating another obstacle for the BoJ’s plan to raise interest rates.

Meanwhile, expectations that US President-elect Donald Trump’s policies could push up inflation and force the Federal Reserve to refrain from cutting interest rates are keeping US bond yields high, reducing the appeal of the low-yielding yen and lifting the value of the dollar to its highest level since early July. However, concerns that the Japanese government might intervene to protect the yen have partly kept the currency from falling further.

Minneapolis Fed President Neel Kashkari said the Fed needs more evidence that inflation will reach its 2% target before deciding to cut interest rates further.

Investors now believe that Mr Trump's policies could boost growth and raise inflation, which would limit the Fed from cutting interest rates too much.

US bond yields remain high and the USD remains near its peak since early July, supporting the USD/JPY pair.

Several senior Fed officials, including Chairman Jerome Powell, will speak this week, and together with US consumer inflation data, they could hint at the next direction for Fed interest rates.

Notably, this week will also see Japan's preliminary Q3 GDP growth report and US retail sales figures on Friday, which could have a fresh impact on the USD/JPY pair.