Rate hike expectations support the Yen

The yen was supported by expectations that the Bank of Japan (BoJ) will continue to raise interest rates this year. On January 30, Deputy Governor Ryozo Himino said the BoJ will continue to raise interest rates if economic activity and prices develop in line with the bank's forecasts.

Official data released on January 31 showed core inflation in Tokyo hit 2.5%, the fastest annual pace in nearly a year, reinforcing expectations for a further BoJ rate hike.

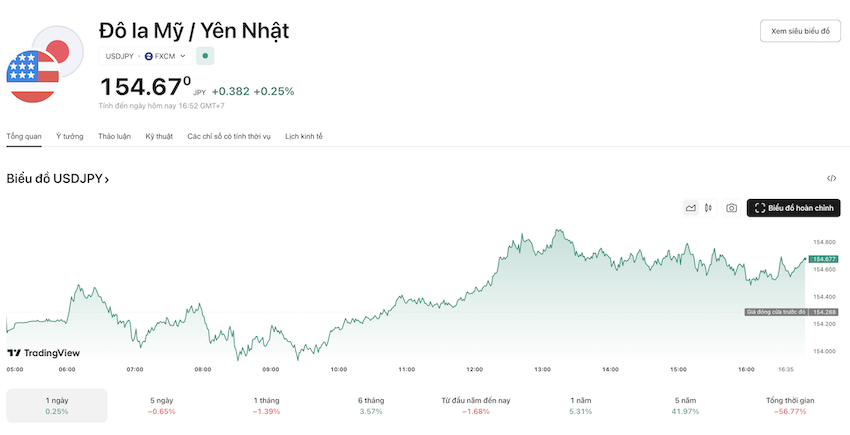

Jane Foley, senior FX strategist at Rabobank, predicts the USD/JPY exchange rate will reach 145 yen/USD by the end of this year. "After comments from BoJ Deputy Governor Himino, yen bulls seem more confident in policymakers' determination to raise interest rates by 2025," she said.

Japanese Yen exchange rate at domestic banks

In the Vietnamese market, the Japanese Yen exchange rate also recorded an upward trend. According to an update from the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank), the buying and selling rates are 155.23 VND/JPY and 165.49 VND/JPY, respectively.

Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) listed the buying rate at 156.59 VND/JPY and the selling rate at 166.29 VND/JPY.

Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) has a buying rate of 156.81 VND/JPY and a selling rate of 165.37 VND/JPY.

The appreciation of the Japanese Yen may affect trade and investment activities between Vietnam and Japan, especially in the fields of import-export and tourism.