Coffee price today

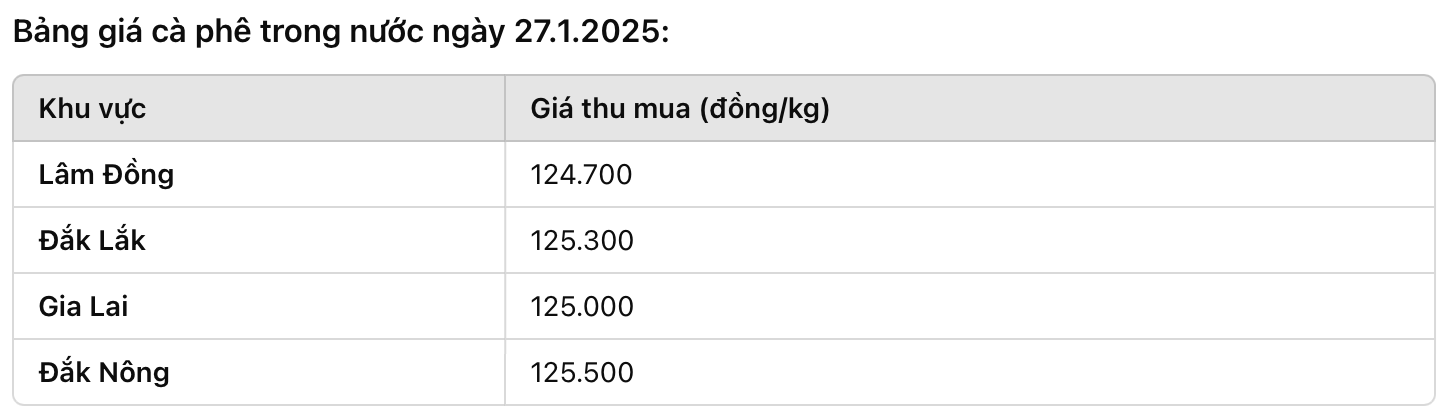

Today (January 27), domestic coffee prices remained stable compared to yesterday, fluctuating between 124,700 - 125,500 VND/kg. Over the past week, coffee prices have increased sharply from 5,200 - 5,500 VND/kg, bringing great joy to farmers during the Lunar New Year.

In the Central Highlands, Dak Nong continued to hold the leading position with the highest purchase price of VND125,500/kg. Dak Lak followed with a price of VND125,300/kg. Meanwhile, Gia Lai and Lam Dong reached VND125,000/kg and VND124,700/kg, respectively.

In the world market, Robusta and Arabica coffee prices continue to remain high. On the London exchange, Robusta coffee futures for March 2025 reached $5,544/ton, approaching the historical peak of $5,565/ton reached at the end of November last year. Contracts for May 2025 delivery increased to $5,499/ton.

In New York, the price of Arabica coffee futures for March 2025 delivery reached 347.55 cents/lb, a record high. The price of May 2025 futures recorded 343.05 cents/lb.

Coffee price forecast

Limited supplies are expected to continue to support coffee prices this week, as Vietnam, the world’s largest producer and exporter of Robusta coffee, enters the Lunar New Year holiday.

Meanwhile, according to Reuters, consulting firm Safras & Mercado said that Brazil's 2025-2026 coffee forward sales are slower than the annual average, as farmers are closely monitoring global prices and the size of the upcoming harvest.

Accordingly, pre-sales of coffee in the 2025-2026 crop year are estimated to reach 12% of expected output, lower than the 19% of the same period last year and the average of 21% of previous years.

Farmers in the world's largest coffee producer and exporter have been more cautious about selling due to low supplies from the previous crop, uncertainty about the upcoming crop, and expectations that coffee prices will continue to rise.

Arabica coffee futures on the Intercontinental Exchange (ICE) have hit a record high, supported by strong demand and supply concerns from Brazil.

“In addition to concerns about the size of Brazil’s next crop, which has caused producers to avoid placing orders in advance, rising prices have also delayed these deals,” said Safras analyst Gil Barabach.

Brazil suffered its worst drought on record in 2024, leaving coffee fields starved of moisture. Rains have been delayed later in the year, but most analysts expect a smaller crop in 2025 after an already low output in 2024.

Barabach said producers would not significantly change their stance on pre-selling until there is more clarity on the size of Brazil's next crop, which is likely to be determined in the coming months.

Arabica coffee sales in 2025-2026 are recorded at 19% of the expected output.

Safras also said coffee sales for the 2024-25 crop have reached 85% of production, up from 74% last year and the five-year average of 77%, as producers lock in profits amid high global coffee prices and a recent weakening of the Brazilian currency.

Coffee prices are expected to continue to fluctuate in the near future due to factors such as weather, production in major exporting countries and exchange rate fluctuations. However, given the current trend, coffee prices are likely to remain high in the short term.