Full BIDV interest rate set

According to Lao Dong, the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) issued a table of online savings interest rates currently fluctuating within the range of 2.0-4.9%/year.

Short term (1 week - 2 weeks): 0.3%/year.

Term 1 - 2 months: 2%/year.

Term 3 - 5 months: 2.3%/year.

Term 6 - 11 months: 3.3%/year.

Term 12 - 15 months: 4.7%/year.

18 month term: 4.7%/year.

Term 24 - 36 months: 4.9%/year (highest).

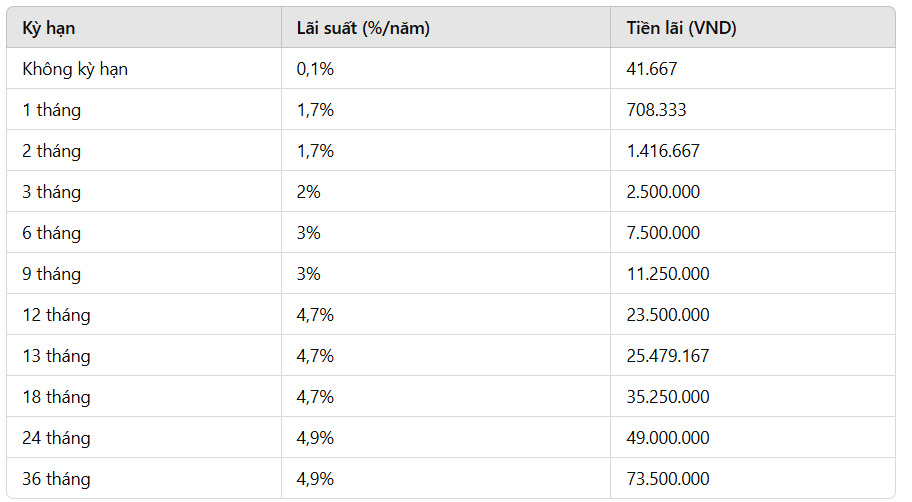

In addition, online deposit interest rates at BIDV are listed as follows:

No term: 0.1%/year.

Term 1 - 2 months: 1.7%/year.

Term 3 - 5 months: 2%/year.

Term 6 - 9 months: 3%/year.

Term 12 - 36 months: 4.7%/year (highest).

According to records, savings interest rates at Agribank, BIDV, Vietcombank and VietinBank vary depending on the deposit term. For short terms from 3 to 9 months, Agribank, BIDV and VietinBank apply interest rates ranging from 2% to 3% per year. Meanwhile, Vietcombank has lower interest rates, from 1.9% to 2.9% per year.

For long-term terms of 12 months or more, savings interest rates at BIDV and VietinBank are the highest, reaching 4.9% and 5%/year respectively for terms of 24-36 months. Agribank has a relatively competitive interest rate, around 4.8%/year, while Vietcombank keeps it lower, around 4.7%/year.

In summary, Agribank leads in short terms, VietinBank stands out in long terms, and Vietcombank has the lowest interest rate in the Big 4 group.

Deposit 500 million at BIDV, how much interest do you receive?

Readers can quickly calculate interest rates using the following formula:

Interest = Deposit Amount × Interest Rate × Actual Number of Days/360 (or /12 for monthly calculation).

See the highest interest rates at banks HERE.