Series of banks push deposit interest rates higher

NCB adds up to 2%/year when all individual customers deposit online savings through NCB's digital banking application. The condition is widely applied to deposits with terms from 6 months or more and is extended until January 31, 2026.

With the addition of an interest rate of 2%/year, the online deposit interest rate at NCB for terms of 6 - 8 months will be up to 8.2%/year; term of 9 - 11 months up to 8.25%/year; term of 12 - 36 months is 8.3%/year, this is the highest deposit interest rate on the market today.

Cake by VPBank also pushes interest rates above 8% through the policy of adding interest rates. The bank applies an additional interest rate for 6-month term deposits gradually increasing according to deposit balance, from 0.2% - 1%/year. After adding, the interest rate customers enjoy is up to 7.3% - 8.1%/year depending on the customer's deposit amount.

PVcombank is applying an additional program of up to 1.5%/year for customers who deposit online savings on Fridays every week. The application conditions are relatively broad, only need to deposit online, with a term of 12 months or more and a minimum deposit amount of 100 million VND.

With this additional level, the actual interest rate received by depositors is pushed up very high. Deposits of 100 million VND can enjoy an interest rate of 7.6%/year for a 12-month term, 7.8%/year for a 13-month term. In particular, if choosing a term from 15–36 months, the actual interest rate received is up to 8.3%/year, a rare level on the market today for deposits that are not large.

At BVBank, this bank is deploying online deposit certificate products with the highest interest rate of up to 7.8%/year.

Accordingly, customers can buy deposit certificates through digital channels with a minimum amount of 10 million VND, applicable to 4 terms including 6, 9, 12 and 15 months. The corresponding interest rates are 6.5%/year for terms of 6 and 9 months; 6.8%/year for terms of 12 months; and highest 7.8%/year for terms of 15 months.

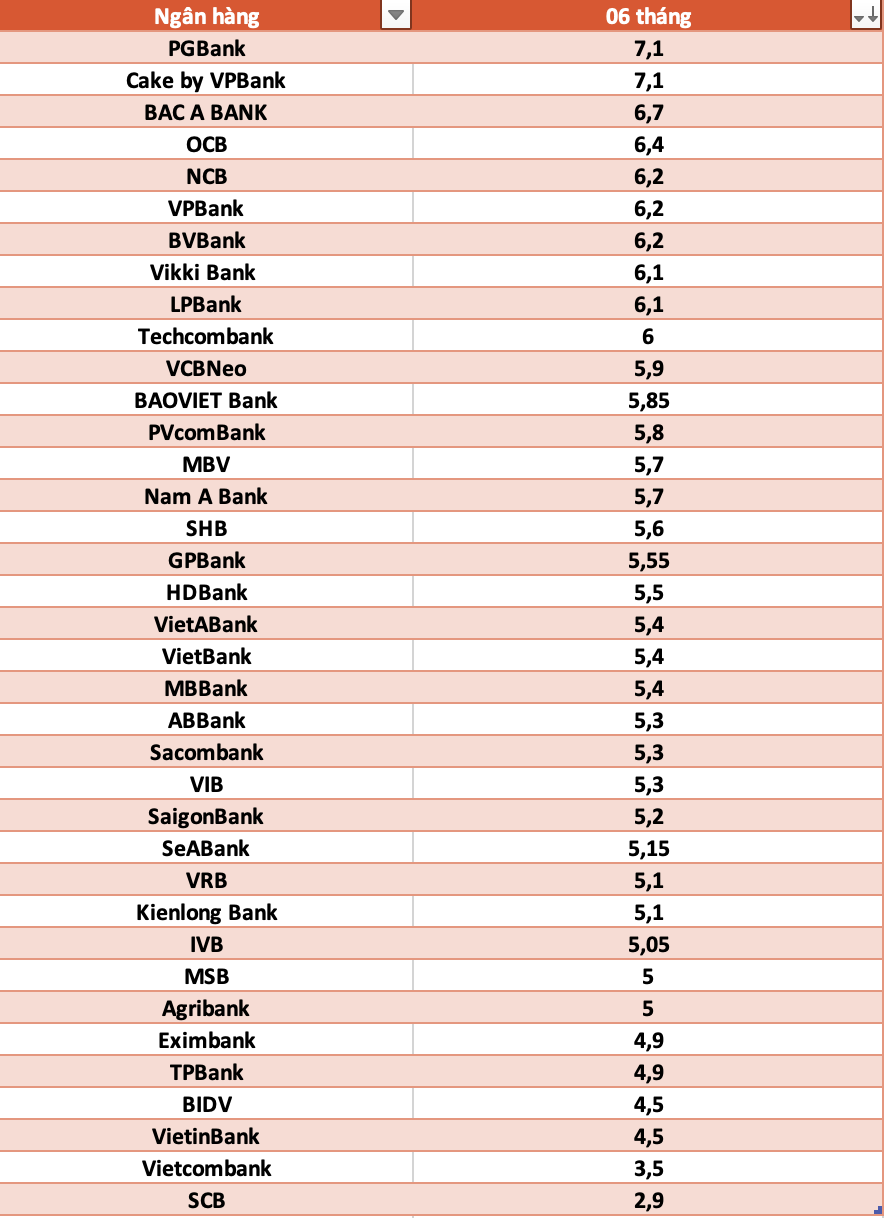

In addition, currently some banks have listed official savings interest rates exceeding the threshold of 7%/year, such as Cake by VPBank, PGBank and OCB. The highest 6-month term interest rate belongs to Cake by VPBank, PGBank, these two banks simultaneously listed 7.1%.

The highest special interest rate is 6.5–9%/year

The highest deposit interest rate at banks currently fluctuates in the range of 6.5–9%/year, but to enjoy this interest rate, customers must meet special conditions on deposit size.

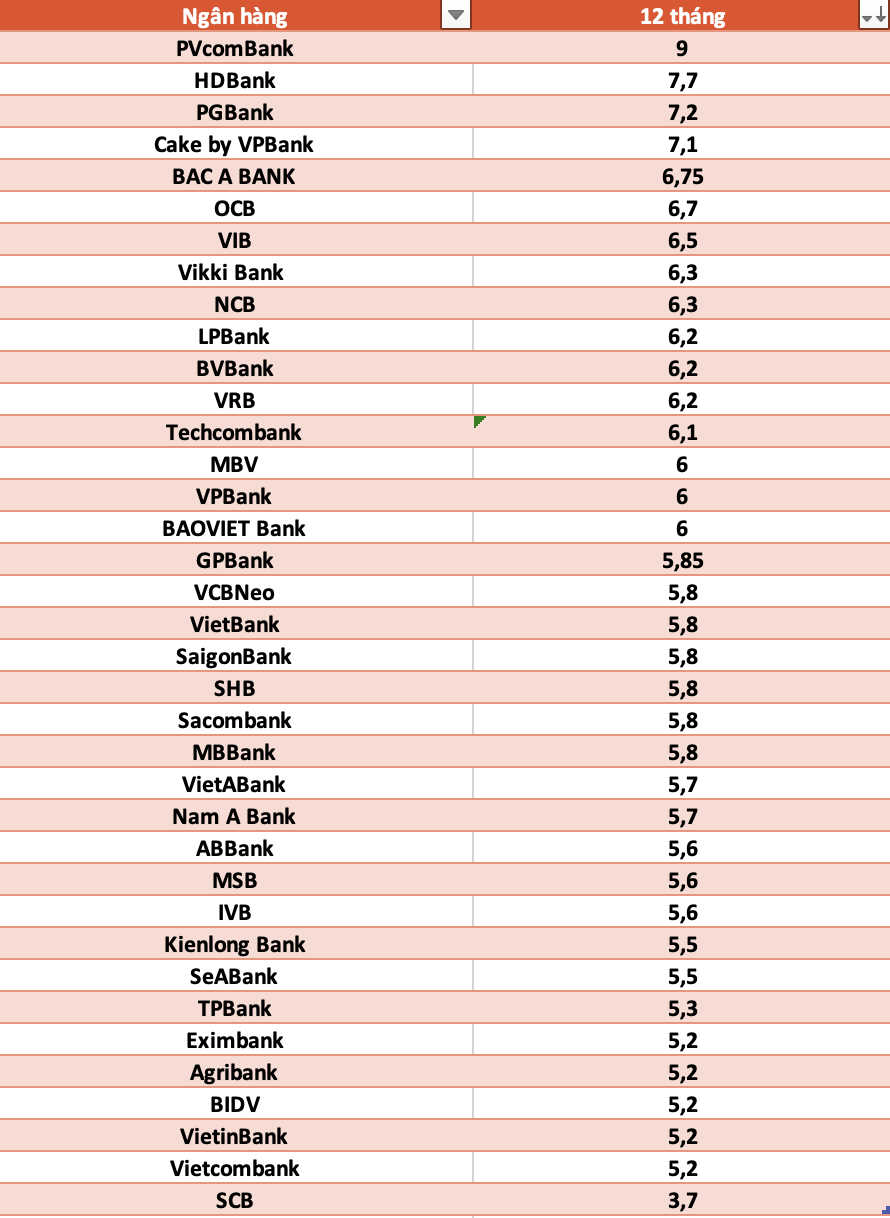

PVcomBank applies a special interest rate of 9%/year for terms of 12-13 months when depositing money at the counter, with the condition of maintaining a minimum balance of 2,000 billion VND.

HDBank applies an interest rate of 8.1%/year for the 13-month term and 7.7%/year for the 12-month term, with the condition that the minimum balance is 500 billion VND.

Vikki Bank applies an interest rate of 8.4%/year for deposits from 13 months or more, with a minimum deposit amount of VND 999 billion.

For deposits from 500 million VND at OCB, this bank lists interest rates of 6.7%/year for terms of 12-15 months; term of 18 months 6.9%/year; term of 21 months 7%/year; term of 24 months 7.1%/year; term of 36 months 7.3%/year.

Viet A Bank applies an interest rate of over 6%/year for Dak Tai Savings product, with an interest rate ranging from 6.0%/year for a 6-month term to 6.8%/year for an 18-month term. The application condition is a minimum deposit amount of 100 million VND, transactions at the counter and interest payment at the end of the term.

For deposits of over 1 billion VND at Bac A Bank, the interest rate is increased to 6.4%/year for terms of 6-8 months; 6.45%/year for terms of 9-11 months; 6.5%/year for terms of 12 months; 6.6%/year for terms of 13-15 months and 6.7%/year for terms of 18-36 months.

Nam A Bank applies an interest rate of 6.5%/year for a 24-month term and 6.3%/year for a 36-month term, with the condition that the deposit amount is from 500 billion VND or more.

Many banks list interest rates above 6.5%/year without conditions

In addition to special interest rate packages, many banks are currently listing interest rates above 6.5%/year for long terms without requiring a minimum deposit amount.

Vikki Bank applies an interest rate of 6.5%/year for 6-month terms; 6.6%/year and 6.7%/year respectively for 12-month and 13-month terms. Cake by VPBank maintains an interest rate of 7.1%/year for terms from 6–36 months.

Bac A Bank lists an interest rate of 6.5%/year for terms from 6-11 months; 6.5%/year for terms of 12 months; 6.6%/year for terms of 13-15 months and 6.7%/year for terms from 18-36 months.

OCB applies an interest rate of 6.5%/year for terms of 12-15 months; term of 18 months 6.7%/year; term of 21 months 6.8%/year; term of 24 months 6.9%/year; term of 36 months up to 7.1%/year.

VIB applies an interest rate of 6.5%/year for 12-month terms; PVcomBank applies an interest rate of 6.8%/year for terms from 15–36 months.

PGBank applies an interest rate of 7.1%/year for terms of 6-9 months; term of 12-13 months is 7.2%/year; term of 18-36 months up to 7.3%/year.

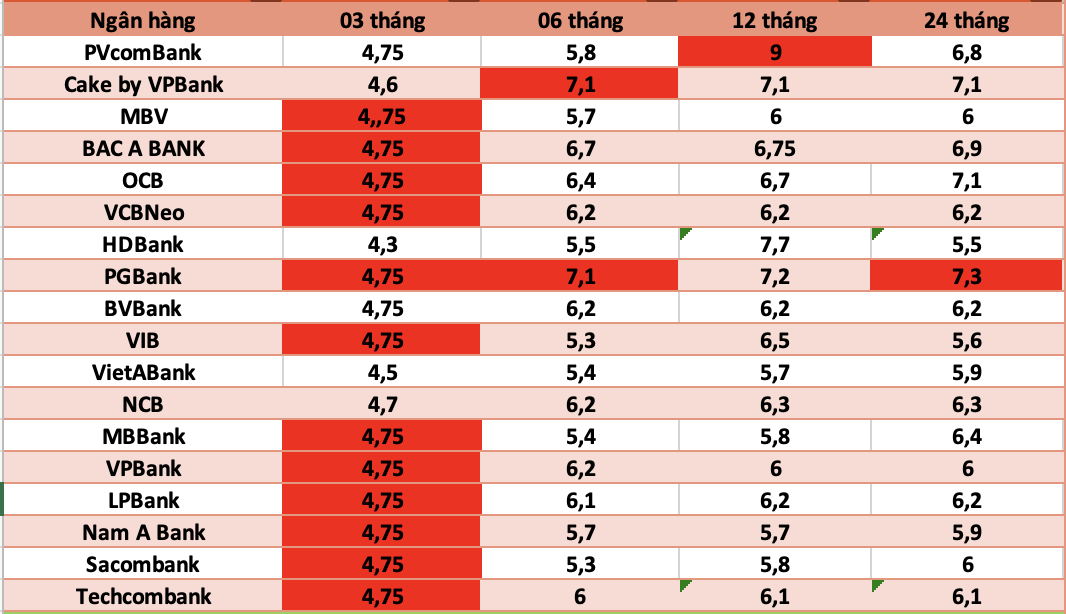

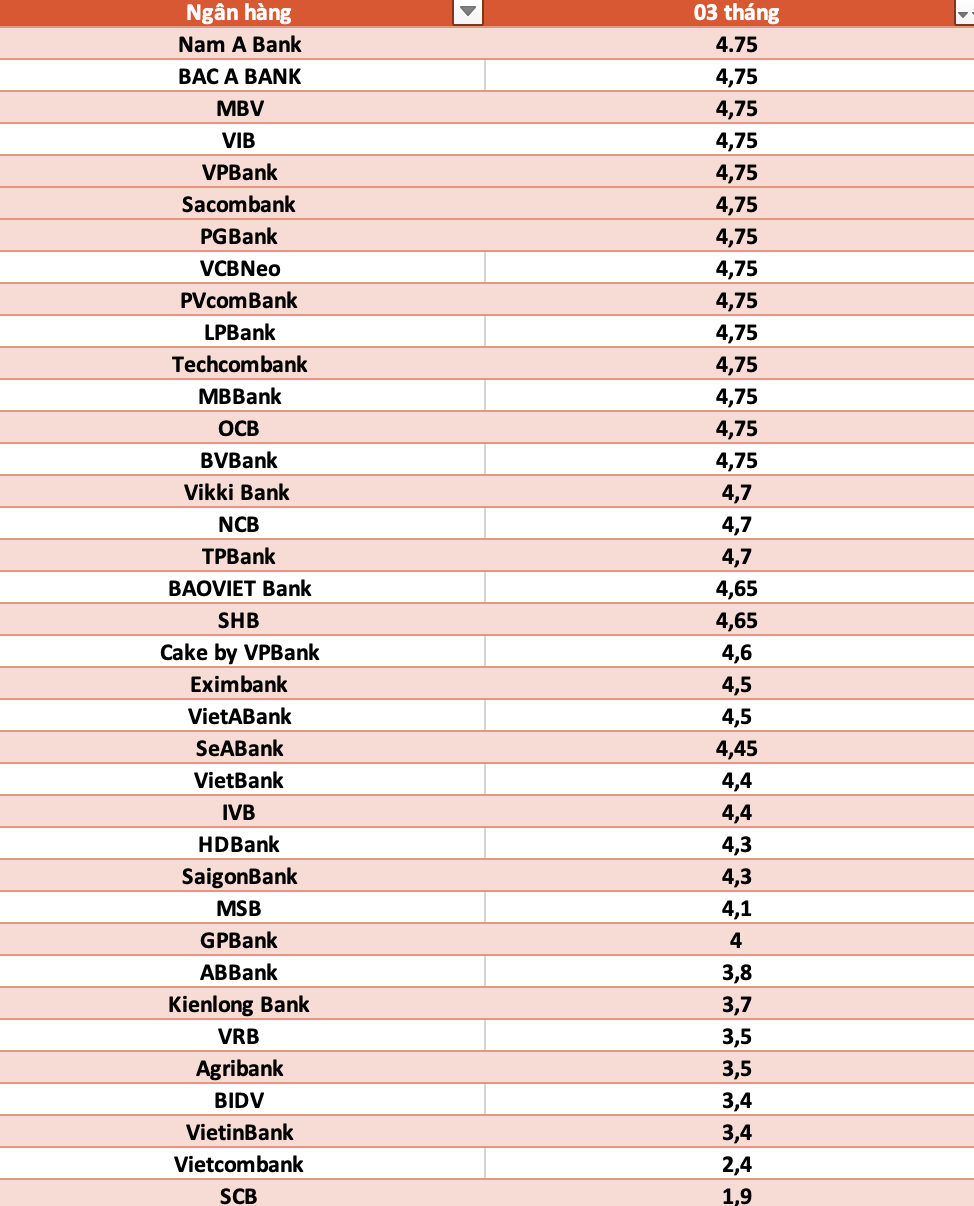

Statistics of banks with the highest savings deposit interest rates today:

Comparison of the highest bank interest rate for a 3-month term

Savings deposit interest rates at banks for a 6-month term

12-month savings deposit, which bank's interest rate is the highest?

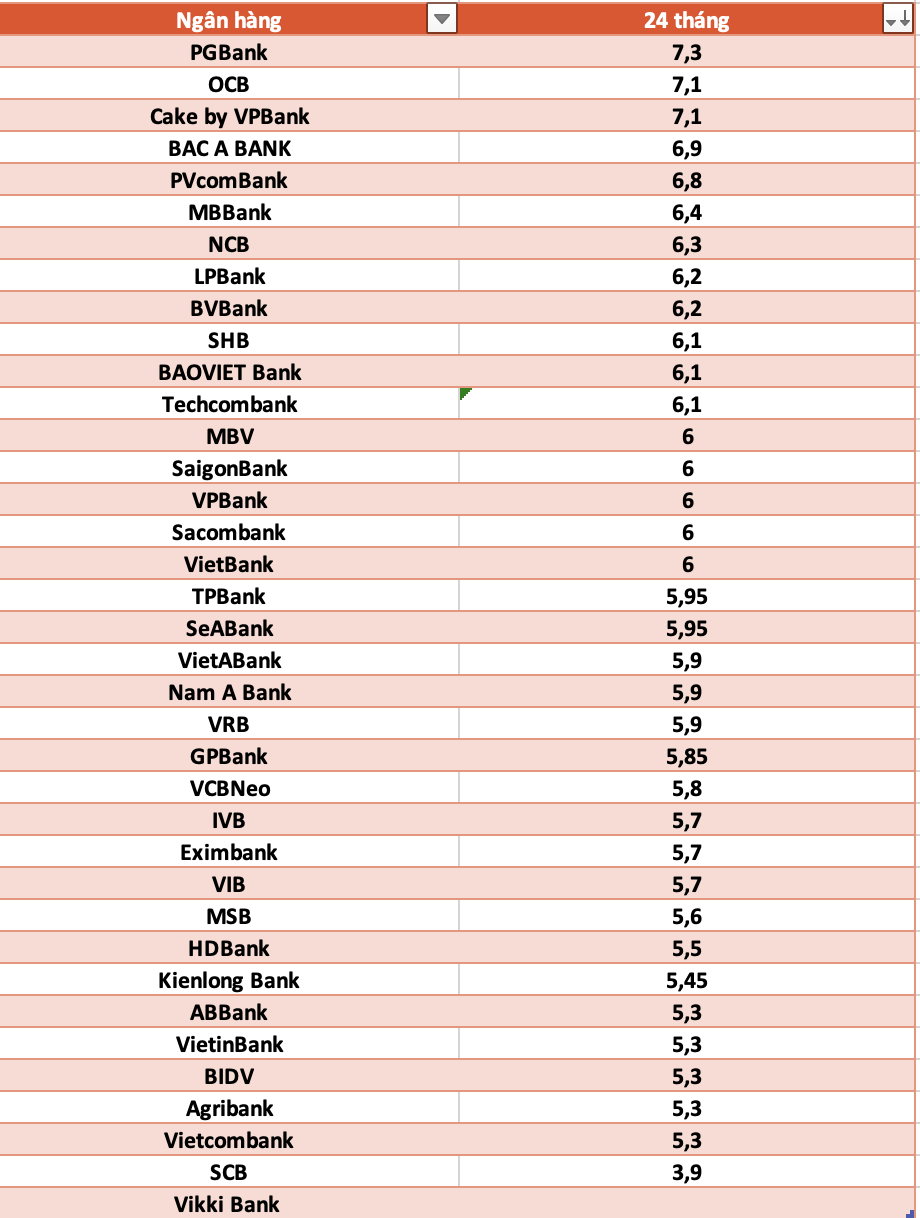

Agribank bank interest rates, Sacombank interest rates, SCB interest rates, Vietcombank interest rates... highest for the 24-month term

Interest rate information is for reference only and may change in each period. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles about interest rates HERE.